2026 ECONOMIC OUTLOOK

Predictions for the new year that definitely won't look bad in hindsight

2025 was, from an economic perspective, absolutely wild.

Longest federal government shutdown in U.S. history? Check. Trade policy we haven’t seen since the 1930s? That too. A massive spending and tax bill with the stranger-than-fiction name of One Big Beautiful Bill Act? Why not?

We’d settle for a less wild 2026.

In our 2025 Forecast—which held up decently well, all things considered—Zack wrote:

There are two huge question marks heading into the year. First, policy uncertainty is a pain regardless of how it resolves, but a quick resolution—one way or another—would help everyone.

Second, inflation. If it speeds up—oh no. If it falls back toward 2%, well, the opposite of oh no.

Those are still big, scary questions heading into 2026, though perhaps not the biggest nor the scariest.

But it’s not all doom and gloom. In some ways (we know, you’ve heard this before), 2026 has the potential to be better than 2025.

An Early 2026 Turbo Boost

Many households will get chunky tax refunds in 2026 due to OBBBA deduction changes. These refunds will function like stimulus checks, albeit ones that mostly go to higher income households.

Optimistically, this could give much needed warmth to a cooling economy.

Pessimistically, this will cook the economy into a microwaved Hot Pocket—parts of it scalding hot, others so frozen you could crack your teeth on it.

Sticking with the food analogies, this will likely cause a sugar rush. Expect lots of big ticket purchases: cars, travel, other durables, etc.

Will businesses expand to meet the elevated demand? If so, this rush will provide much needed stability to a flagging labor market, at least for a while.

If businesses instead respond to greater demand with higher prices (instead of more employees/production capacity), expect inflation to accelerate and growth-boosting effects to be minimal.

Policy Uncertainty

Despite concerns about tariffs and uncertainty, we were relatively optimistic about the second Trump administration’s economic policy. This was a pretty widely held sentiment in late 2024, and one that proved woefully overoptimistic.

Yes, the OBBBA has some nice tax provisions for businesses, but deregulation fell well short of expectations, specifically for construction.

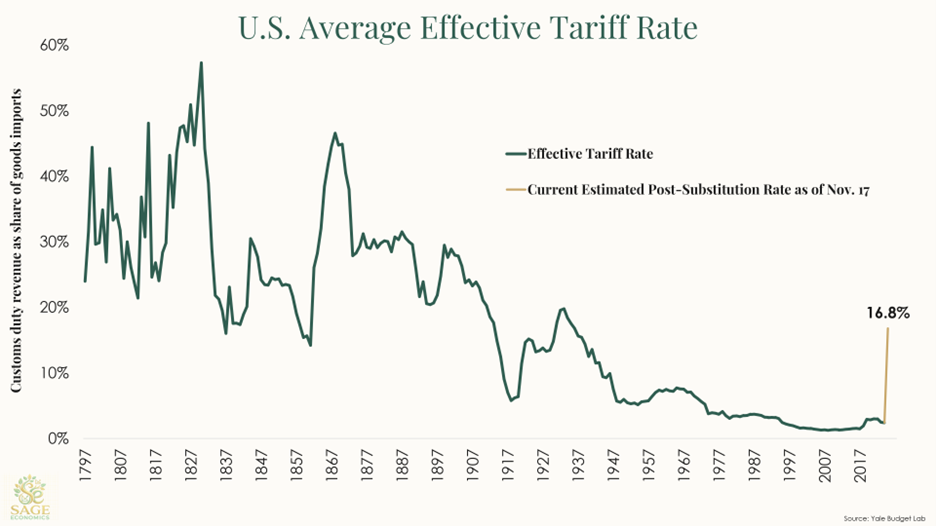

And then there were tariffs, larger and more volatile than virtually anyone thought possible. Our current effective tariff rate (16.8%) is the highest since the 1930s.

The Supreme Court is probably going to invalidate the tariffs authorized by IEEPA, which will drop the effective rate to an estimated 9.3%. That’s better but still the highest rate since the 1940s.

It’s impossible to tell when and to what degree tariffs will raise prices, and the economic effects of new immigration policies are just as difficult to interpret (we simply don’t have great data on undocumented workers).

What’s clearer is that trade policy has put the economy into a holding pattern, with certain industries like manufacturing (-63,000 jobs through the first 11 months of 2025) rapidly losing altitude.

And then there’s the fact that the U.S. government took a stake in fourteen different companies this year, ending a 60+ year streak during which the government didn’t take a stake in even a single healthy company. This is simply not capitalism.

Will 2026 bring more policy certainty? Hopefully, but who really knows? We’ll get a new Fed chair around June, and there are concerns about how that will affect Fed independence. Mid-term elections in November will also amp up the uncertainty.

Even so, the consensus view seems to be a calmer 2026 on the policy front. We’ll believe it when we see it.