A Bummer of a Dec. Jobs Report

Strong Headline Numbers, Weak Details

This post is sponsored by Pivot Workforce. I wouldn’t accept a sponsor for this newsletter unless they were 1) a company I know and trust and 2) tackling an important problem like the construction industry's skilled labor shortages. Pivot checks both those boxes. Their goal is to help construction companies get the high-quality talent they need, and they have over three decades of experience staffing difficult-to-fill positions for some of the most recognized names in the construction industry. I urge any contractors struggling to find workers to give Pivot a look.

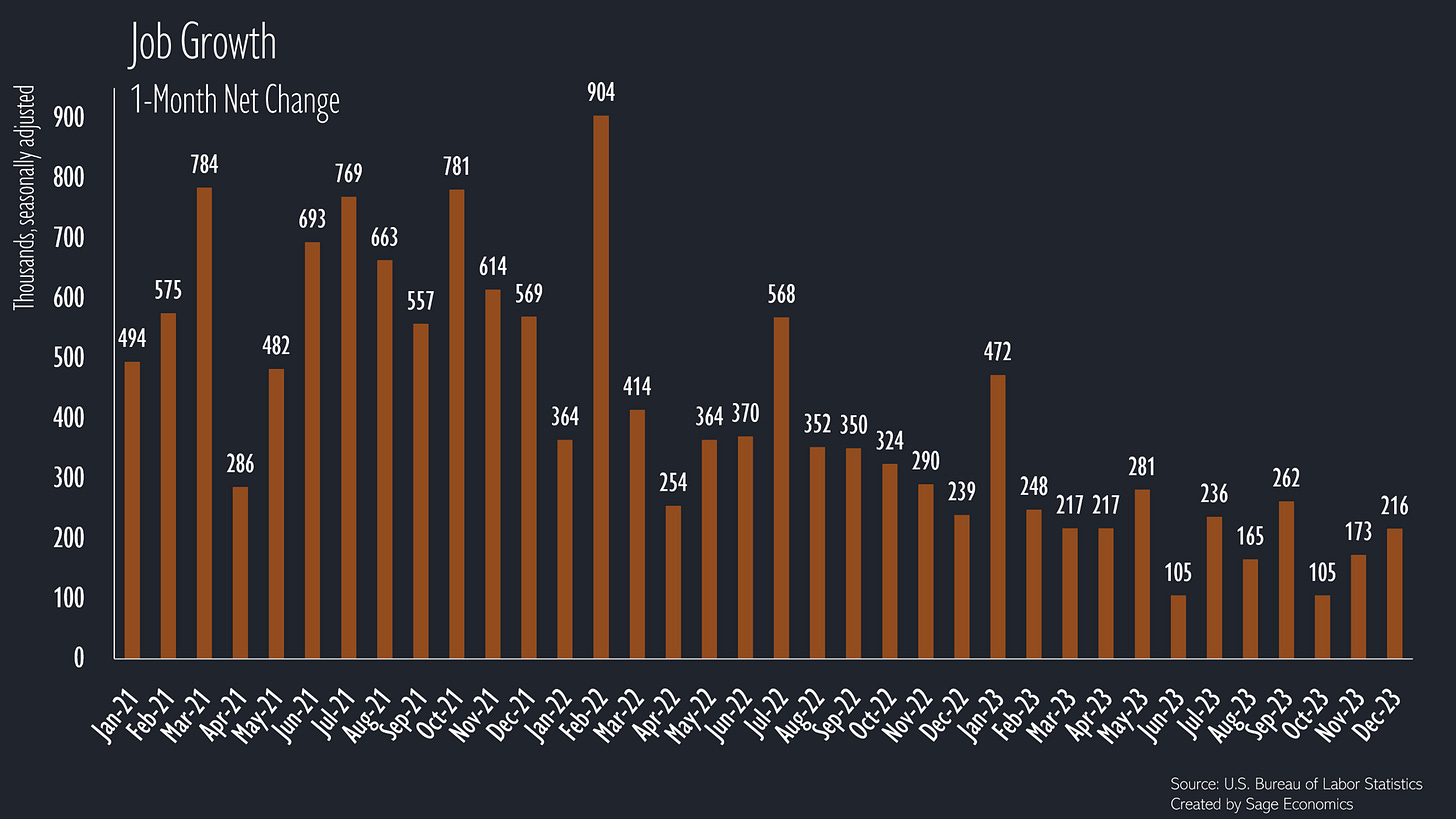

The consensus forecast had U.S. employers adding 170,000 jobs in December and the unemployment rate rising to 3.8%. As we’ve come to expect, the consensus forecast was wrong; employers added 216,000 jobs for the month, and the unemployment rate was unchanged at the extremely low level of 3.7%.

That’s the good news. The bad news is pretty much everything else:

The labor force shrank by 676,000 people, the largest monthly decline since January 2021.

Wage growth picked up to 4.1% year over year rate. That’s both faster than expected and faster than the Fed wants to see.

The prime age employment-population ratio fell to 80.4%, down from 80.7% in November and 80.9% at the peak in June and July.

The Household Survey, which asks people about their job status instead of looking at payroll data, shows employment declined by 683,000 in December.

Revisions to October and November job growth show that we added a combined 71,000 fewer jobs than initially thought in those months.

So despite the robust topline numbers, I’m a little disappointed. We want to see wage growth keep cooling toward a level more consistent with 2% inflation, and it didn’t. That’s at least partially due to labor shortages—employers raise wages when they struggle to find workers—and the sizable decline in the labor force was a bad development on that front.

But hey, this is just one month of data, and most of the bad news came from the far more volatile Household Survey. A report with strong headline numbers and some mixed signals under the hood is definitely better than the other way around.

And devilish details aside, December’s data puts a nice bow on what turned out to be one hell of a great year for the labor market. We added 2.7 million jobs in 2023, and the unemployment rate has now been under 4% for 23 straight months. That’s incredibly impressive for a year that was by most accounts (not saying names) supposed to feature a recession.

Industry Level Data

Job gains were, once again, concentrated in education and health services and government, though leisure and hospitality—the only sector yet to fully recover to pre-pandemic employment levels—added jobs at a good pace.

Two industries—other services and mining and logging—lost jobs in December, though the losses were pretty small. If you’re wondering what other services includes, it’s a grab bag with things like churches, nonprofits, repair and maintenance places, hairdressers, laundromats, and a whole lot more.

Odds and Ends

The transportation and warehousing sector lost 22,600 jobs in December, the third straight monthly decline, and 62,700 jobs over the past year. The freight industry has had a rough 2023.

Temporary help services (think staffing firms) lost another 33,300 jobs. This is typically thought to be a sign of job growth (or losses) a few months down the road, but my view remains that labor is so tight that nobody needs help getting a job.

Long term unemployment (15 weeks and over) increased pretty sharply, and the average duration of unemployment is up to 22.3 weeks, well above the 19.5 week average from December 2022.

What’s Next

Week in Review, which is only for paying subscribers, will be out later today. If that’s not you and you want it to be, just click the button below.