A Fools Gold Jobs Report

Strong headline numbers are pure pyrite

This post is sponsored by KODIAK – Proven Workforce Solutions. I wouldn’t accept a sponsor for this newsletter unless they were 1) a company I trust and 2) addressing critical issues like skilled labor shortages in construction. KODIAK, which recently merged with Pivot, checks both those boxes. Their mission is to help construction companies find experienced talent, including engineers and project managers for Direct Hire, as well as skilled craft professionals like welders and electricians for contingent staffing. With over three decades of experience, I encourage contractors struggling to find workers to consider KODIAK.

At a glance, today’s jobs report looks like pure gold. U.S. employers added 147,000 jobs in June, about 40,000 more than expected, and the unemployment rate fell to 4.1%, the lowest rate since February.

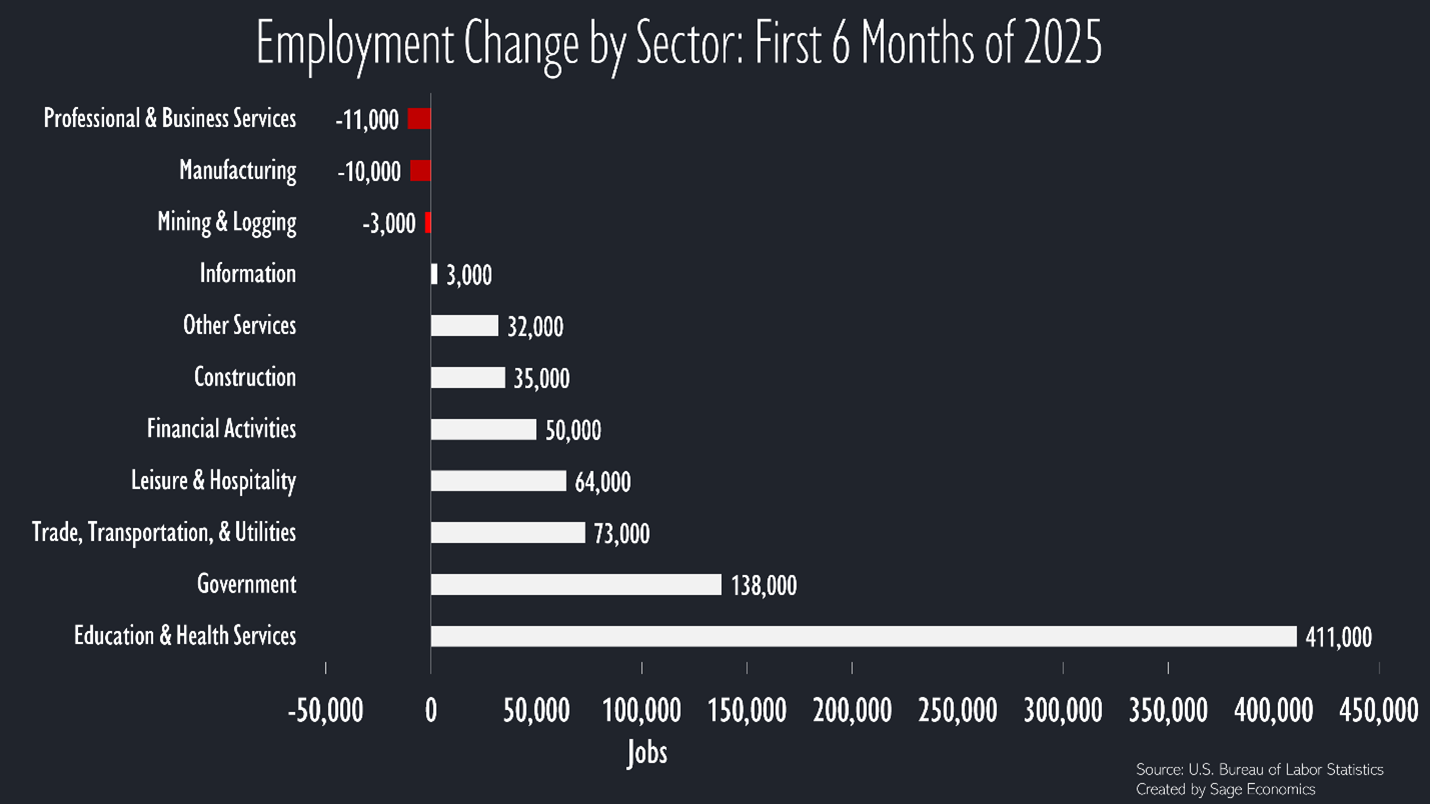

Look a bit closer, however, and you’ll see some pyrite mixed in with that shimmering bullion. Virtually all of June’s job growth occurred in noncyclical sectors (i.e., those less affected by macroeconomic dynamics), and roughly 65,000 of those jobs were state and local education jobs. That’s almost certainly a seasonal adjustment issue (June data, after all).

Healthcare, private schools, and government accounted for more than 70% of job growth through the first half of 2025. Put another way, cyclical private sectors are hardly adding jobs at all. Manufacturing has lost jobs.

You might say, “hey wait, what about construction?” I discuss that seeming exception below.

Wave Goodbye to July Rate Cuts

Despite the poor sectoral composition of job growth, today’s report is good enough that there almost certainly won’t be a rate cut at the Fed’s July meeting. Market-implied odds of a July rate cut fell from 24% yesterday to less than 5% as of this writing.

Labor Force Contraction a Cause for Concern

The labor force shrank by 130,000 in June and is down 755,000 over the past two months. Labor force data are volatile, so this could be statistical noise, or it could be a manifestation of shifting immigration policy. I think it’s more than noise. Speaking of immigration . . .

Another Note on Construction

Construction continues to add jobs at a healthy pace, but I fear that could be due to undocumented workers who weren’t being counted on payrolls being replaced by documented workers who are (we have no way of really knowing). If that’s the case, the construction industry could have far less momentum than today’s data suggest.

What this means is that the industry added more jobs than we thought over the last several years as undocumented workers became increasingly prevalent, but their growing departure from the labor market is not showing up in the form of current job losses.

The Upshot

This was actually a terrible jobs report because the headline numbers (+147,000 jobs; 4.1% unemployment) are good enough to forestall rate cuts. In other words, interest rates will stay higher for longer, but there is growing evidence that the business cycle has entered a period of economic deterioration.

What’s Next?

We’re currently working on Week in Review, our every Friday (well, Thursday, this week) post where we concisely cover everything you need to know about the economy, and we’ll have that out in the next few hours. That’s just for paying subscribers. If that’s not you and you want it to be, just click the button below:

In other words Zack was right that the Fed should cut? Do you think unemployment is now a bigger risk than inflation?