A Freudian Skip, Inflation, & More

Week in Review: June 12-16

Why does every week feel like a decade? This week had it all: new inflation data, an interest rate decision (or indecision), retail sales, consumer sentiment, and more.

Monday

Restocking the SPR

On Friday, the U.S. DOE bought 3.1 million barrels of crude oil at a price of $73/barrel to refill the strategic petroleum reserve. We’ve criticized the government a few times in this newsletter for not refilling the SPR earlier, so credit where credit is due: this is a good move and by waiting they are purchasing at a lower price. Of course, the price of oil could fall further given global growth dynamics, but that is a matter of speculation.

Back in 2022, the government released 180 million barrels from the SPR to keep oil prices under control during the early months of Russia invading Ukraine. They sold those barrels at an average price of $95/barrel.

So there’s still work to be done refilling the SPR. They intend to keep buying more through 2023 —but selling at $95 and buying at $73 is pretty solid business, especially by government standards.

Gas Prices

Gas prices rose by about $0.06/gallon during the week ending June 12th. This is the highest price since the first week of May and is likely due to Saudi and OPEC+ cuts. Gas is still $1.40 cheaper per gallon than it was one year ago and I'm quite sure the Saudi's are frustrated by the lack of strong upward movement in oil prices.

TSA Checkpoint Travel Numbers

The number of people passing through TSA security during the week ending June 12th was slightly lower than 2019 levels. It seems likely that travel numbers jump above 2019 levels during the summer months. Lots of bookings, though there is also some evidence that consumers have diminished their consumption of discretionary items recently (see retail sales below). Time will tell. On Tuesday, Tampa's airport was really rather empty, which I found surprising given what I've been observing over the past two years, even on weekdays.

Tuesday

Consumer Price Index

CPI is the most popular measure of inflation. The May reading indicates that economywide prices inched 0.1% higher in May and are up 4.0% over the past year (2.0% is the target). That’s the smallest annual increase since March 2021. Eleven months ago (June 2022), inflation was running at a 9.1% annual rate. It’s incredible, bordering on miraculous, that inflation has come down this far without a meaningful increase in unemployment. The economy has proven incredibly resilient in the face of war and the fastest interest rate increases in four decades.

But getting down to that 2.0% target might be tough. Oil prices were in the stratosphere during the Summer of 2022 (thanks Putin). Accordingly, much of the decline in overall inflation is due to the 20% decline in energy prices over the past year.

Core CPI, which excludes food and energy prices and is considered a more stable inflation gauge, increased 0.4% in May and has now increased by 0.4% or 0.5% during each of the past six months. That equates to a roughly 5.0% annual increase in prices.

So core prices are still rising way too quickly. Still, there are two reasons for optimism.

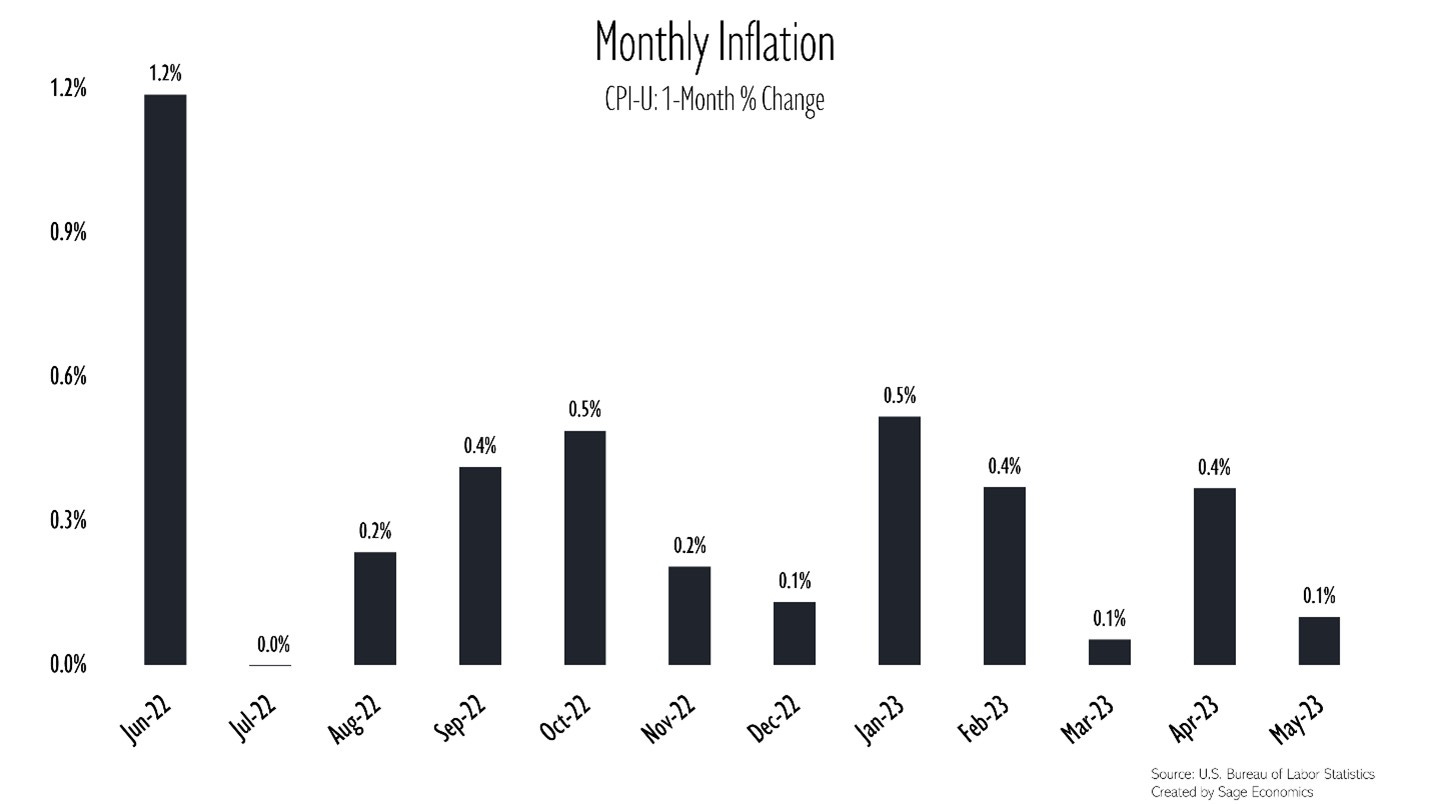

First, inflation is likely going to slow again on a year-ago basis in June due to base effects. As you can see below, prices surged during June 2022, but that chunky increase will fall out of the annual calculation next month. Barring a big surprise, the annual rate of inflation will fall below 4.0%.

Second: excluding shelter (i.e. housing), inflation is up just 2.2% over the past year. Measuring shelter prices is difficult. The way the BLS does it results in a lag. Because of that lag, the shelter component of CPI will decline in coming months resulting in a significant decline in overall inflation.

I know. We’ve been saying that for like a year (really just Zack, not me, Anirban Basu, otherwise known as Economist X or the Economist formerly known as Anirban Basu), but this time we both mean it. The WSJ graphed out six rent indicators from real estate companies and they consistently indicate that the rate of rent increases has plunged over the past year.

To recap what you should take from this CPI report:

Price increases are slowing but remain too fast to keep the Fed at bay.

That’s especially true for core prices, which exclude food and energy because they’re too volatile and often influenced by non-economic factors like Vladimir Putin, otherwise known as the soon to be former leader of Russia.

The shelter component of CPI should decline in coming months, and that will help bring this measurement of inflation meaningfully lower.

It’s miraculous that inflation has fallen so much over the past year without a large increase in unemployment. March 2022 (3.6%); now 3.7%.

NFIB Small Business Optimism Index

Small business owner optimism improved in May but is still low by historical standards. Hiring remains difficult. Owners are still raising prices (though at a slightly slower pace). This all makes sense with other recent data releases, but as we wrote a few weeks ago, it’s increasingly difficult to trust sentiment.

Gallup State of the Global Workplace Report

Gallup released this report on workplace trends (the U.S. section starts on page 19). There are a few interesting findings here. For instance, 47% of workers are actively searching for a new job, and 18% of workers feel “anger” for a lot of the workday (among my employees, that anger is largely directed toward me, Economist X).