A Long and Discouraging Week

Week in Review: March 3-7

Vladimir Lenin said, “there are decades where nothing happens; and there are weeks when decades happen.” Lenin, a fan of tariffs in his own right, might have appreciated how long the on-again, off-again tariffs made this week feel.

This week had a lot of economic data releases, capped off by today’s BLS Jobs Report. You can read Zack’s longer post on that, which is free for all subscribers, here.

Monday

Construction Spending

Construction spending fell in January. Blame the residential segment; spending on new single family (-0.9%) and multifamily (-12.0%) units is down over the past year, although repair and renovation work is holding up pretty well.

Nonresidential construction is being held up by data centers, which accounted for more than 75% of the monthly increase in nonresidential spending. High interest rates are taking their toll on many other nonresidential construction segments, however.

One interesting note: construction spending on religious structures, which fell sharply over the past few decades, has rebounded sharply, rising 64% over the past 3.5 years. Are we becoming more religious, or is it just Joel Osteen?

ISM Manufacturing PMI

Manufacturing activity expanded in February, according to this survey of industry managers, though at a slightly slower pace than in January. That’s the good news.

The bad news is that the prices component surged higher, and some manufacturers are starting to feel the effects of tariffs (survey comments here). As one manager in machinery manufacturing noted:

The incoming tariffs are causing our products to increase in price. Sweeping price increases are incoming from suppliers. Most are noting increases in labor costs. Vendors are indicating open capacity. Inflationary pressures are a concern. Our company is working diligently to see how the new tariffs will affect our business.

The ISM report hinted at emerging stagflation, with prices rising and hiring intentions fading.

Tuesday

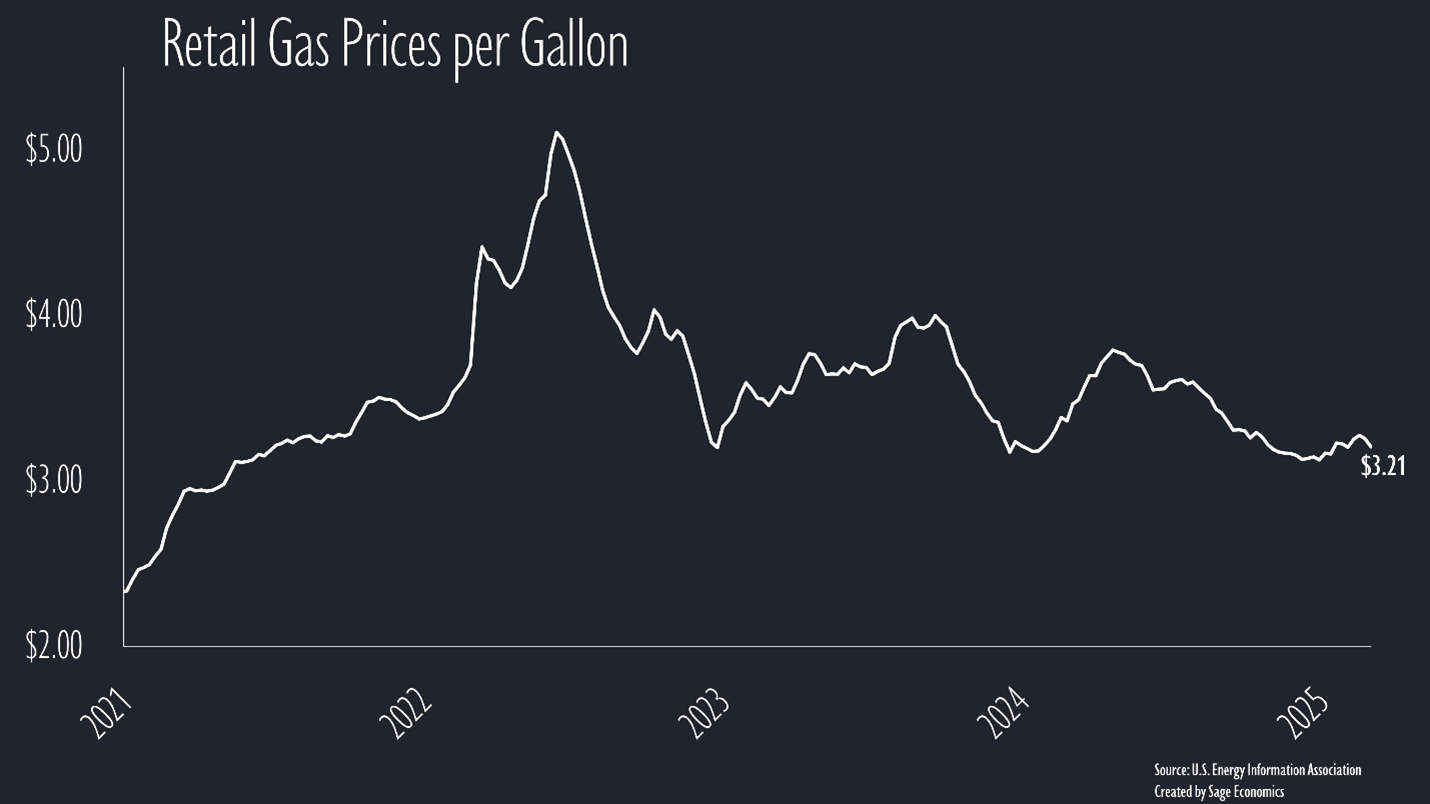

Gas Prices & Diesel Prices

Gas prices fell to $3.20/gallon this week. I’ve been saying that gas prices will start rising as gas stations switch over to summer-blend gasoline, but now I’m not so sure. OPEC+ is going to raise its output starting in April. That, along with elevated U.S. oil stockpiles and concerns about growth have put serious downward pressure on oil prices. Which is to say, it’s possible that gas prices remain tamer-than-usual through spring. By Friday afternoon, oil prices had sunk to around $67/barrel in North America.