A Rate Cut, Retail Spending, & More

Week in Review: Sept. 16-20

The Fed started cutting rates this week, just 30 short—or interminably long, if you were trying to buy a house—months after it started raising rates to fight inflation. There’s more on this under Wednesday, and Anirban is writing up a longer piece about his thoughts on rates and the economy. That will go out sometime in the next week.

If you need a crash course (or refresher) on why and how the Fed moves rates, check out our Very Basic Primer on Interest Rates.

Other than rate cuts, this week gave us updates on retail spending, new home construction, existing home sales, and a lot more.

Monday

TSA Checkpoint Travel Numbers

Travel volumes have fallen back to just barely above 2023 levels, according to TSA data. It’s possible that demand for leisure travel increased relative to 2023 but that demand for business travel didn’t, and far fewer people travel for leisure during September. It’s also possible (and more likely) that the demand side of the economy is losing steam.

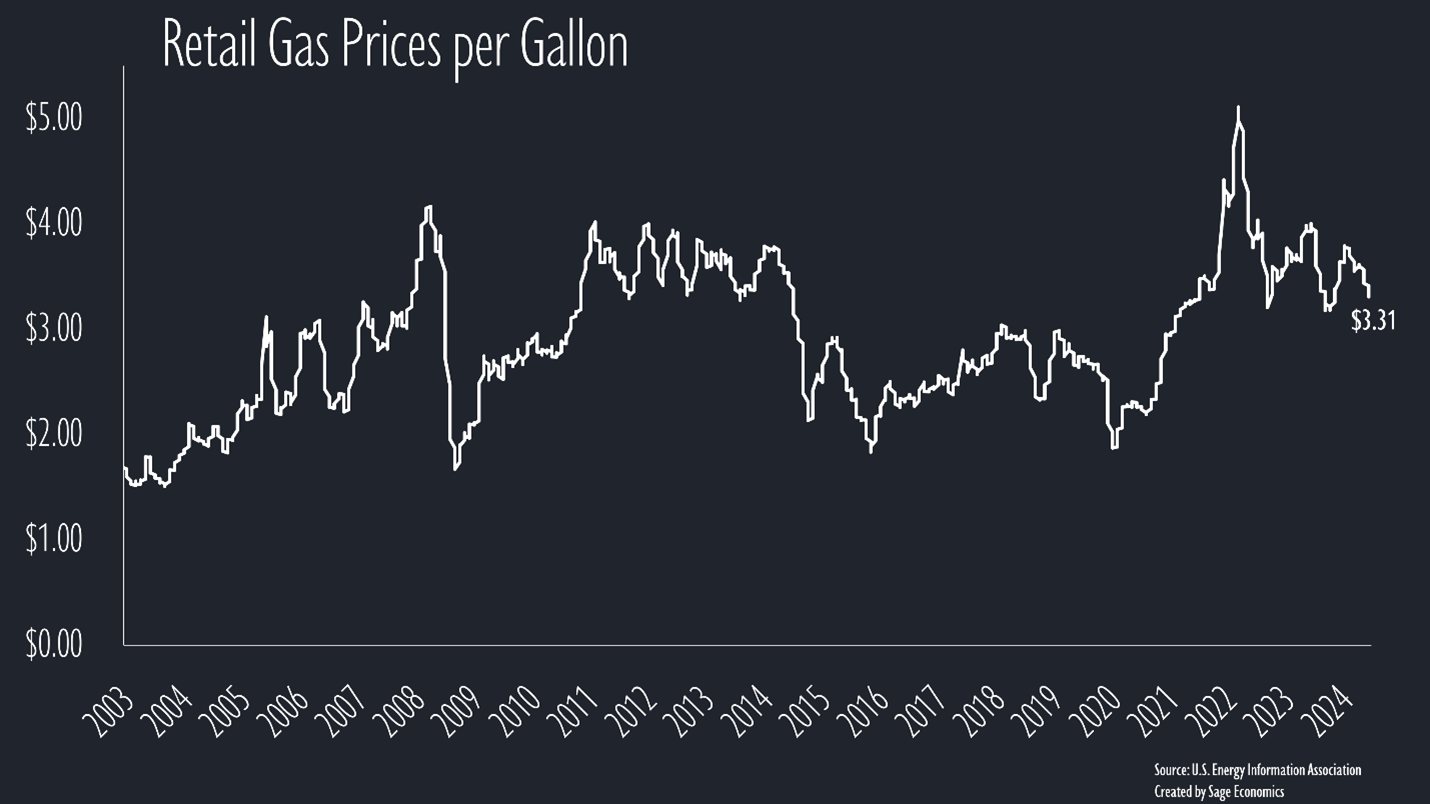

Gas Prices & Diesel Prices

Gas prices fell to an average of $3.31/gallon, the lowest price since the first week of February. Diesel prices fell again and, at $3.53/gallon, are close to a three-year low.

Tuesday

Retail Sales

Retail spending rose 0.1% in August. While that’s not a particularly large increase, the consensus forecast had spending falling in August, so this is an encouraging figure. At some point, we’ll stop doubting the American consumer.

E-commerce continues to kick ass, with sales up a whopping 1.4% in August and 7.8% year over year.

Furniture and home furnishing stores continue to struggle, and that makes sense given the direct relationship to homebuying activity.

NAHB Wells Fargo Housing Market Index

This measure of homebuilder confidence increased in September but remains low. This should improve as rates come down over the next couple of quarters.