We’re getting out the August Q&A only 7 days into September. Not bad! As always, thanks for your questions. We’ll send out a question request for this month in a week or two, but feel free to comment on or respond to this with any asks.

What does the strength of the U.S. Dollar relative the Euro and other currencies say about the strength of our economy?

The strength of the U.S. dollar against the euro, yen, Canadian dollar, and a host of developing country currencies tells us that America remains strong in relative terms. Oh, I know we have major issues like our national debt, declining productivity, and elevated inflation, but inflation is even worse in much of the world and our growth is tepid largely by our own standards (see jobs, retail sales, etc.). We are the best house in a really bad neighborhood, and the growing strength of the dollar reflects our ability to raise interest rates rapidly without falling into recession (yet, anyway; hold onto your hats for next year).

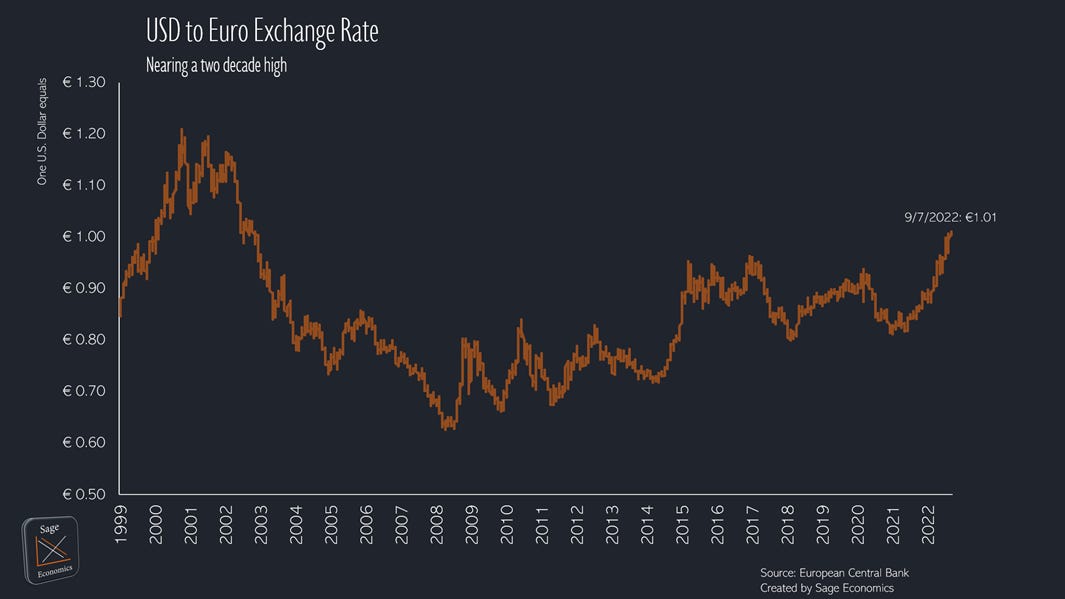

As you can see below, $1.00 now gets you €1.01, the highest exchange rate since the early 2000s.

The PPI inputs to construction series shows higher inflation than other measures (Mortensen, Turner, Rider-Levett-Bucknall, Construction Analytics). What is the best source for forecasting non-residential construction escalation?

Many of the escalation indices mentioned in the question are backward looking. The best sources for forecasting are commodity price futures. The savviest investors in the world are literally telling you (collectively) what they think will happen with oil, steel, natural gas, and other key prices. Compensation growth tends to be steadier, so that's easier to predict. And of course, geopolitical events, natural disaster, man-made disaster (see Vlad the Destroyer), and other Black Swans—a global pandemic, for instance—can junk any forecast.

Why are bank deposit interest rates staying low and not tracking general market interest rates?

Banks have plenty of deposits. They're not in the mood to compete for more. Given rising interest rates, banks are likely to suffer even greater difficulty making loans (e.g., residential mortgages), so there is little reason for them to attract additional liquidity by raising the rates we receive on our deposits.

As a side note, rates have inched ever-so-slightly higher for savings accounts and CDs. According to this WSJ piece, Goldman Sachs (through their online bank Marcus) “recently offered 1.7% annually on its savings account, up from 0.5% in April.”

If Jerome Powell and Janet Yellen are two of the top economic minds in the U.S., how could they be so wrong and clueless about dumping massive amounts of money into the economy without causing inflation and bringing levels of new debt that make us look like a third-world dictatorship?

Janet Yellen is a tremendous economist, who served as Federal Reserve Chairperson from 2014 to 2018. Admittedly, as Treasury Secretary, she has overseen an incredible amount of federal spending, but she answers to a boss.

Jerome Powell is not a top economic mind. He is an attorney and represents a great argument for why Federal Reserve Chairmen and Chairwomen should be economists (like my hero Ben Bernanke). I view many of our current inflation problems as Powell's fault. And he will also lead us into recession.

One economist (Steve Hanke of JHU) predicts a major recession because the money supply has stagnated. But in the same article, he says inflation is going to remain high because of "unprecedented growth" in the money supply. He also states that Powell is "still going on about supply-side glitches" and "he has failed to tell us that inflation is always caused by excess growth in the money supply, turning the printing presses on." Does any of this make sense to you? Is recession a foregone conclusion because of money supply growth? And is the M2 now stagnant or still growing?

Ah, this is a matter of timing. Dr. Hanke is really smart, but like many economists, it's not always obvious what he's saying. There is a lag between money supply growth and inflation. Hence, the inflation of today is a result of prior increases in money supply (which were ridiculously massive), while the recession of tomorrow will be the result of squeezing money supply in a belated response to elevated inflation.

Are home prices expected to fall in the next year?

Find a city in which home prices boomed during the pandemic, and you're likely to see price declines over the year ahead. The process has already begun on the West Coast, where prices have been falling in recent weeks in many cities (see Seattle, San Francisco, San Jose). Sellers in many communities are racing to slash prices as pessimistic buyers face higher mortgage rates (which are up nearly 2.5 pp since the start of the year). For now, year-over-year sale prices are up significantly. They won’t be this time next year.

What consumer spending and ballot box effect may result from those "anticipating" student loan forgiveness, without actual forgiveness prior to November election?

Wealth effects. About 43 million people know that their net worth is about to increase. They'll start spending some of that enhanced wealth now, which is why this is inflationary.

What affect, if any, will student loan forgiveness have on the unemployment rate and the labor force participation rate? If there is an affect, when will this occur?

I don't think there will be much impact. I suspect that even $10k or $20k won't alter decisions with respect to how much to work and how much income to generate. I suspect that the impact will largely be spending oriented.

Why do some politicians keep trying Trickle Down Economics? Is there something here that the world is missing?

Trickle Down Economics doesn't work because it largely skips the middle class. Don't get me wrong, taxes can be too high (and were too high before Reagan took office), but when taxes are merely cut and the primary beneficiaries are the already wealthy, they will tend to expand spending on luxury goods, including goods made in Italy, France, England, Switzerland, and Germany. That doesn't strike me as expanding America's middle class.

Beyond that, they have a much lower marginal propensity to spend (i.e., their spending increases less when they’re given money). Think about it. If you get $10,000, you’ll probably spend more than you otherwise would have. If Bezos gets $10,000, he might shrug.

On the other hand, when we reduce tax burdens on doers (manufacturers, real estate developers, etc.), that can have major, positive impacts on middle class formation and prosperity. That's why I love the direction in which North Carolina is heading. That may be America's most competitive economy.

Why are US healthcare costs so much higher than the rest of the industrialized world? What could be done to fix it?

Our high costs are driven by many factors, but let's focus on three. First, we don't take great care of ourselves. Obesity is a major issue. Too much McDonald's and Coca-Cola, though I, as an American, love both.

Second, there is far too much intermediation between patient and caregiver—insurers, prescription benefit managers, etc.—which drive up transaction costs, often without sufficient countervailing benefit.

Third, lobbying. We end up paying far higher prices for medications because of the pharmaceutical lobby and other lobbies. There is some value to high prices because it expands the motivation to innovate, but those newer drugs are often the most expensive of all.

Week in Review post on Friday. Paid subscribers get the full post, free subscribers get a free preview.

I am not sure if your made your opinion on Jerome Powell clear.. 😂😂🤣

[He is not a top economic mind, he is a lawyer.. ]😂😂🤣