A Wartime Week in Review: March 10-14

Tariffs, Consumer Sentiment, & More

The trade war escalated again this week, with skirmishes with our northern neighbor on Monday and Tuesday and our first salvo against Europe—resulting in a proposed 200% tax on European champagne and wine—on Thursday.

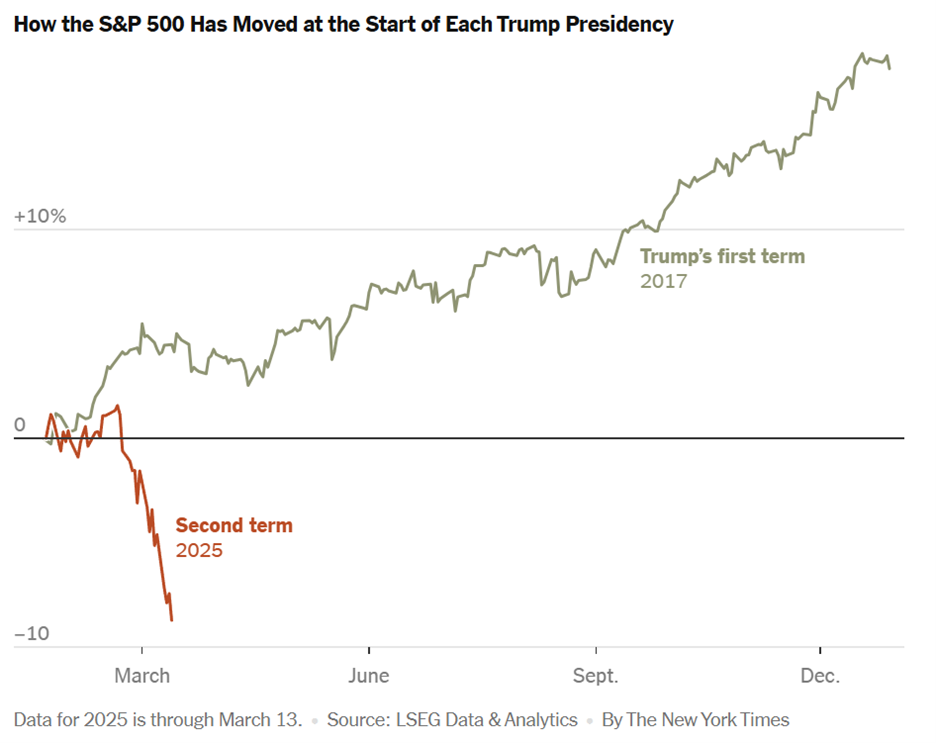

A big part of the pro-business argument for reelecting Trump was that 1) he wouldn’t go through with the tariffs and 2) if he did go through with the tariffs, he’d pull back if markets started to tank. That was, after all, how he approached policy in his first term.

Safe to say, this is not his first term.

It sure looks like the tariffs will continue until morale improves, and morale, as measured by consumer sentiment surveys, is in desperate need of improvement.

Beyond sentiment readings and equity markets, it was actually a pretty okay week of economic data featuring updates on inflation, labor market churn, and more.

Monday

Gas Prices & Diesel Prices

Gas prices inched down to $3.20/gallon this week. While prices typically rise in the spring as gas stations switch over to summer-blend gasoline, demand concerns and rising OPEC+ production may dampen that trend this year.

Diesel prices fell to $3.58/gallon, the lowest price since early January.

TSA Checkpoint Travel Numbers

Air travel fell off pretty sharply over the past week, according to TSA data, and is back below 2023 levels. Related: domestic airlines have slashed their earnings estimates for this year due to softening demand.