A Wonderfully Boring Jobs Report

Employers add 139,000 jobs in May, Unemployment flat at 4.2%

This post is sponsored by KODIAK – Proven Workforce Solutions. I wouldn’t accept a sponsor for this newsletter unless they were 1) a company I trust and 2) addressing critical issues like skilled labor shortages in construction. KODIAK, which recently merged with Pivot, checks both those boxes. Their mission is to help construction companies find experienced talent, including engineers and project managers for Direct Hire, as well as skilled craft professionals like welders and electricians for contingent staffing. With over three decades of experience, I encourage contractors struggling to find workers to consider KODIAK.

Another month, another perfectly fine jobs report. U.S. payroll employment grew by 139,000 jobs in May, slightly beating expectations, and the unemployment rate remained unchanged at 4.2%.

This jobs report was boring—almost always a good thing for economic data—and markets responded accordingly, with major stock indexes ripping higher this morning. That said, there were still a few devils hiding in this details of this data.

Let’s start with revisions: job growth for the previous two months was revised down by a combined 95,000 jobs. That’s not a huge deal. Job growth was still at a healthy-enough level over the past few months, but the labor market was weaker than we thought in March and April.

Then there’s the unemployment rate. While it didn’t change with rounding, it actually rose from 4.187% in April to 4.244% in May. That’s the highest rate since October 2021 and is dangerously close to rounding to 4.3%.

The rising unemployment rate had a lot to do with the labor force, which shrank by 625,000 people in May. That’s the largest monthly contraction since 2023. This is obviously not great, but labor force data can be volatile from month to month, and even with May’s decline the labor force has grown at a healthy pace through the first five months of the year.

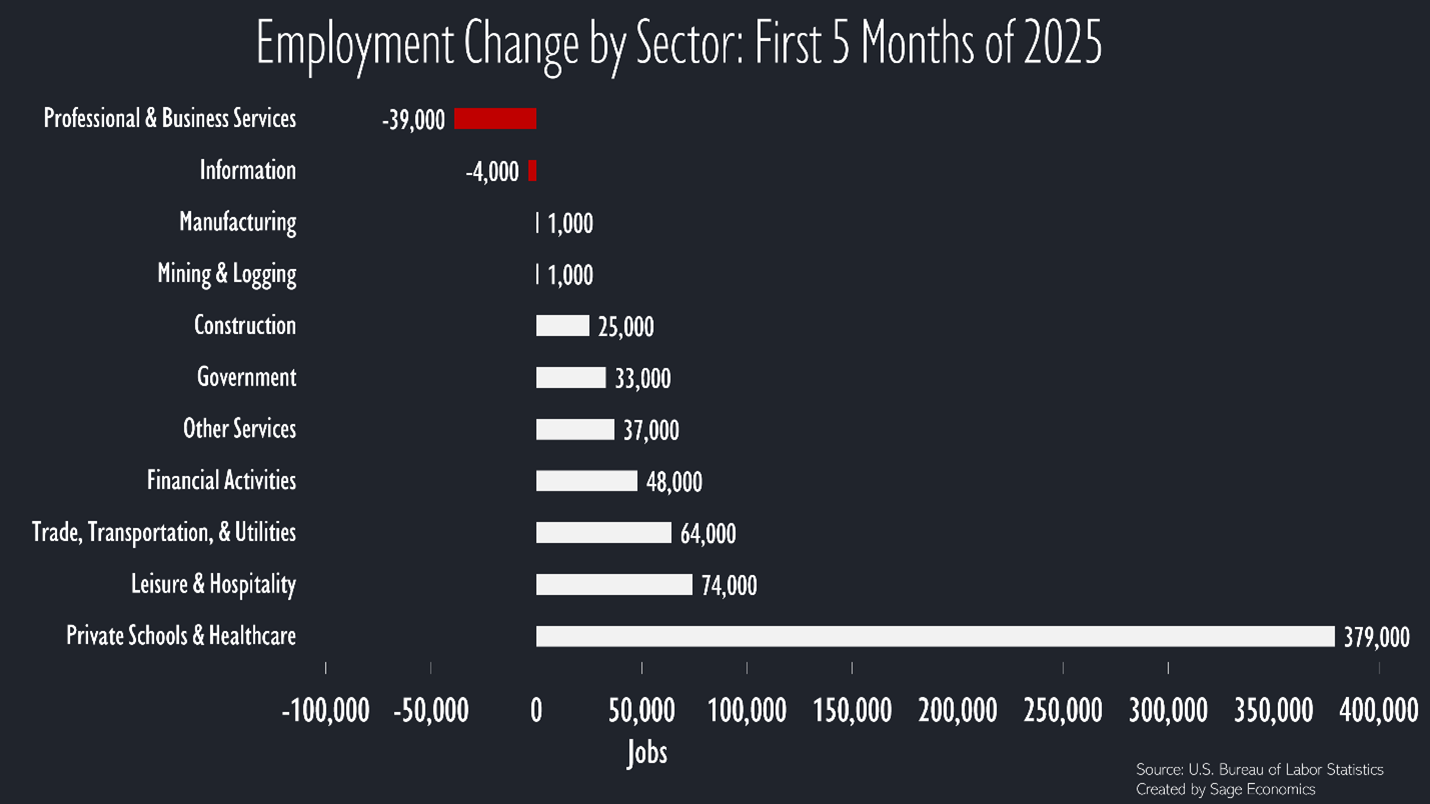

Job Growth by Sector

The composition of employment gains is pretty worrying. Healthcare continues to dominate job growth. That’s a noncyclical segment (not sensitive to broader economic conditions) and will likely continue to grow over the remainder of the year.

Leisure and hospitality also added a lot of jobs for the month, largely due to fast hiring at restaurants. While that signals that people are still eating out (or getting carryout), which is a good sign for consumer health, these aren’t the highest paying or most durable positions.

Manufacturing employment shrank in May and has grown by just 1,000 positions through the first five months of 2025. Metal manufacturing added jobs for the month, while most other manufacturing segments lost jobs. That’s about what you’d expect with large (and even larger now) tariffs on steel and aluminum.

Professional business services has lost almost 40,000 jobs in 2025, but that’s not really due to a decline in white collar jobs. This segment also covers staffing firms and waste management services, both of which have struggled over the past few quarters.

The Upshot

Yes, the details aren’t as good as the headline number, but there’s no real cause for concern here. Growth is gradually slowing, but we’d have to see more deceleration for that to be a problem. Overall, this is a wonderfully boring jobs report.

What’s Next?

We’re currently working on Week in Review, our every Friday post where we cover everything you need to know about the economy in a breezy, five-minute read, and we’ll have that out in the next few hours. That’s just for paying subscribers. If that’s not you and you want it to be, just click the button below: