Why Anirban Might Be Right

Another thing to worry about

Right now, the economy is 1) looking good but 2) facing an abnormally high number of threats, including:

Student loan payments resuming

The UAW strike

A potential government shutdown next month

Inflation

Oil prices

Commercial real estate debt & the banking sector

Labor shortages

Credit card debt

High interest rates

All of those might slow growth at the margins, but at least in the short term, I’m not too worried about them tipping the economy into recession (others, including Anirban, are more concerned).

I am, however, worried about a recent data release from the Federal Housing Finance Agency.

Why the economy has been stronger than expected

There are a few reasons the economy has surprised to the upside: Americans saved a lot of money during the early months of the pandemic, padding household finances, infrastructure and industrial policy have stimulated certain sectors, and supply chains healed pretty quickly during late 2022/ early 2023 (among others).

For me, though, the biggest factor is the lack of impact that higher rates have had on the American consumer, and that has everything to do with low rates during 2020 and 2021.

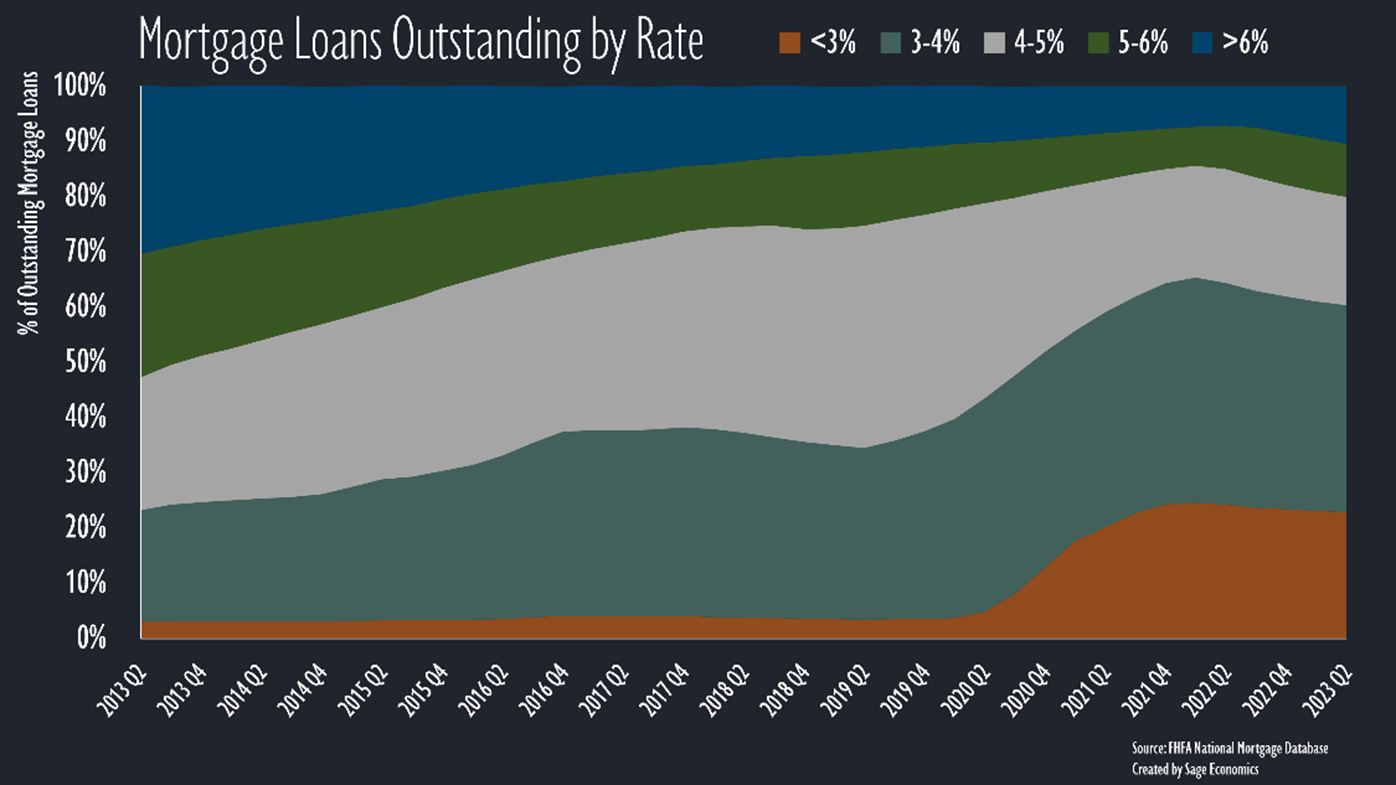

During the pandemic, a lot of households either bought or refinanced into historically low fixed rate mortgages; at the start of 2022, 65% of outstanding mortgages were locked into a rate of 4% or lower, by far the highest share on record.

Then interest rates shot up, mortgage rates surged to 7%+, and people stopped moving/refinancing. This paralyzed both the housing market and the rates people were paying on their homes. Which is to say, mortgage rates were higher, but that didn’t really matter because no one was getting a new mortgage.

With household finances unaffected by higher rates, consumer kept spending, the economy kept growing, and forecasts of recession crashed and burned.

But life happens

Despite those extremely high mortgage rates, a small segment of people still moved over the past 18 months. You get married (or divorced), you have kids (or become an empty nester), you get a new job in a new city (or start working from home and move to Boise). Whatever the reason, there’s been a trickle of home sales, and even a trickle piles up over time.

In the third quarter of 2021, just 8% of outstanding mortgage debt had an interest rate of 5% or higher. That share more than doubled by Q2 2023, rising to nearly 18%, the highest level since the middle of 2019.

As life keeps happening, more people will move. Smaller mortgages with lower interest rates will continue to be replaced by the exact opposite; median home prices are at an all-time record, and the average 30-year fixed rate set a new two-decade high at 7.31% last week. Debt service payments as a share of income (still low at the moment) will keep rising, and that will eventually eat away at consumer momentum.

The upshot

To be clear, I’m not particularly worried about a housing bubble or households falling behind on their mortgages. Just 2.6% of mortgage loans were delinquent in Q2, lower than in any quarter from 2003 to 2020, and a historically high share of new mortgages are being taken by borrowers with credit scores over 760.

I am concerned that as a higher share of household budgets get tied up in mortgage payments, consumers will pull back. Average mortgage payments have increased more than 10% over the past year and, with interest rates set to stay higher for longer, will keep rising.

This is exactly what economist mean when they talk about long and variable lags—the idea that there’s a delay of uncertain length between when interest rates rise and the economy feels the effects.

Big picture: this data makes me more concerned that the economy will slow next year. That raises the chances of 1) a recession in 2024 (I still put the odds at <50%), which would be bad, and 2) Anirban being right and me being wrong, which would be even worse.

What’s Next

Lots of new economic data this week, including construction spending, jobs and unemployment, and a few PMI readings. We’ll cover all that and more in Week in Review on Friday. That’s just for paying subscribers. If that’s not you and you want it to be, just press the button below.

Look for more homes to get listed as people get comfortable with the new mortgage levels (boiling the frog) and find that next house (bigger, smaller, better, blue) - but they are in a house now - and need to sell first. Little do they know, their neighbor saw the same next house - wants to buy it too- and lists their house. I am watching for a pop in listings as this chase begins (happening in our Atlanta suburb right now).

Technically, Anirban is wrong because he said the recession would start on September 5th.