April 2022 Jobs Report

Mostly good news, and we'll certainly take that

This post is sponsored by Pivot Workforce. I wouldn’t accept a sponsor for this newsletter unless they were 1) a company I know and trust and 2) tackling an important problem like the construction industry's skilled labor shortages. Pivot checks both those boxes. Their goal is to help construction companies get the high-quality talent they need, and they have over three decades of experience staffing difficult-to-fill positions for some of the most recognized names in the construction industry. I urge any contractors struggling to find workers to give Pivot a look.

U.S. payroll employment expanded by 428,000 in April, about 30,000 more than expected. The unemployment rate remained unchanged at an exceptionally low 3.6%. The economy is now just 1.19 million jobs below pre-pandemic levels. At April’s rate of hiring we’ll reach full recovery just in time for July 4th. America’s back baby!

Ok, ok, I know the stock market has been crashing (stock prices are frequently deemed leading indicators) and the risk of recession is rising. I also know that the labor market tends to be a lagging indicator. Nonetheless, adding jobs is a very fine thing, and it means that some Americans made the decision to accept a job offer. That’s a very fine thing and something not to be taken for granted given the times in which we live.

There was good and bad news in the April jobs report, but on balance I’d say it was positive. We’ll take what we can get after the first four days of this week included record high job openings (11.5 million), slowing growth reflected in a number of industry-specific diffusion indices, all-time high diesel prices, historically low diesel supplies, the first 50-basis point rate hike since 2000, and an ensuing stock market buying frenzy followed by an even larger selloff.

You can read more about all that in our Week in Review coming out later today. Week in Review is only for paid subscribers. If that’s not you, it can be! Simply click the button below.

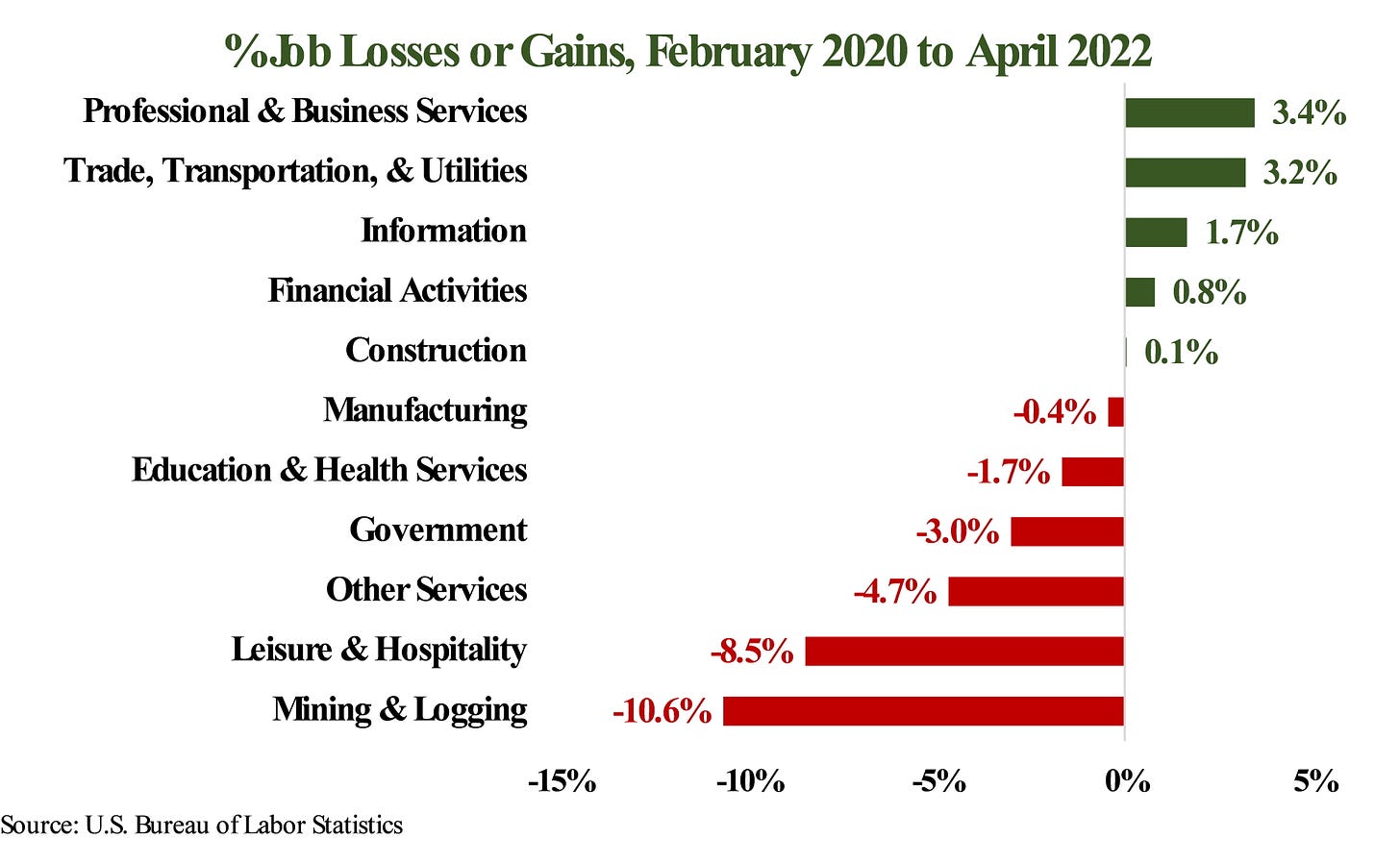

Let’s start with the good news. Job gains were widespread across industries in April. Five major industries have recovered all the jobs lost during the pandemic’s early months, and manufacturing employment will likely reach full recovery in the next month or two. Mining and logging is now the least recovered industry, but that’s mainly because the industry didn’t start regaining jobs until March 2021. If oil and gas companies would use their profits to expand capacity instead of paying dividends and buying back stocks, both industry employment and the national macro situation would be a lot better.

Average hourly earnings increased by just $0.10 in April, and the fact that a 0.3% increase in wages qualifies for the word just says a lot about inflation over the past year. Yes, this is high by historic standards, but after averaging a $0.14 monthly increase over the previous year, April’s number represents slowing wage growth. This is hopefully an indication that inflation is starting to slow, or at least is no longer accelerating. I understand that some people view slowing wage growth as a negative, but you can’t please all of the people most of the time.

Now the (universally) bad news: the labor force shrank by 363,000 in April, the first monthly decrease since September. As you know, we currently have 11.5 million open, unfilled jobs, and if the labor supply doesn’t increase, job growth will slow and inflation will accelerate. Hopefully this is just a blip. The labor force has still grown by nearly 1.8 million people during the first four months of 2022 and has expanded by about 3.1 million people over the past year.

The number of people marginally attached to the labor force (not in the labor force but who want a job and are available for work, though haven’t looked in the past 4 weeks) increased by about 262,000 in April. That explains some, but not all, of the labor force decline, and because we don’t know why those people are marginally attached, it’s not a particularly compelling explanation. The only other thing that stands out in the data is that the number of White people in the labor force declined by about 700,000, while the number of Black and Asian labor force participants increased. Again, this is more of an observation than an explanation and for a variety of reasons, including fear, I choose not to dwell on these issues any further.

My staff and I really dug into the household numbers on why the labor force shrank in April and didn’t come up with much of an explanation. There’s some odd fluctuations in the population figures for the month, and that leads me to believe that this is statistical noise. Hopefully labor force growth resumes next month. I suspect it will.

As always, you can read my in-depth thoughts regarding the construction industry’s labor market at Associated Builders and Contractors.

Three (somewhat) Key Takeaways

The number of Americans with disabilities in the labor force is up 22.2% over the past year, well above the 1.1% increase observed for Americans without disabilities. Remote work has substantially improved access to jobs for many Americans. That’s a big win for both inclusivity and the economy at large.

The number of foreign-born people in the labor force is up by about 1.8 million over the past year, and the participation rate for this population is up by more than a percentage point (native born lfpr is up just 0.4 pp over the past year). More foreign-born workers could really help our labor shortage problem at the moment. Can Congress please do something about immigration? Forget it, who am I kidding?

Employment at nursing and residential care facilities hasn’t recovered at all. The industry lost 410,000 jobs between February 2020 and October 2021 and has since regained just 7,600 jobs. More Americans would rather age at home. That would be fine, except that’s it’s also true for many young people.

What to Watch

How long will the stock selloff last? New Consumer Price Index data come out next week; did inflation peak in March? If we get a good inflation number, that could spark the next rally.

Want to Hear me Speak Live? (rhetorical question, of course you do)

My 2022 presentation is called No Time to Buy, and yes, the theme is James Bond. If you want to book a presentation (in person or virtual), please contact my assistant Julia, one of the nicest people I’ve ever met named Julia (jcomer@sagepolicy.com).