April 2023 Jobs Report

Labor Market Stays Strong

This post is sponsored by Pivot Workforce. We wouldn’t accept a sponsor for this newsletter unless they were 1) a company we know and trust and 2) tackling an important problem like the construction industry's skilled labor shortages. Pivot checks both those boxes. Their goal is to help construction companies get the high-quality talent they need, and they have over three decades of experience staffing difficult-to-fill positions for some of the most recognized names in the construction industry. We urge any contractors struggling to find workers to give Pivot a look.

Another month, another hotter than expected jobs report. U.S. employers added 253,000 jobs in April, and the unemployment rate ticked back down to 3.4%, matching the lowest rate since 1969. But the job growth estimates for February and March were revised lower by a combined 149,000 jobs, so hiring in the first quarter was a little slower than we initially thought.

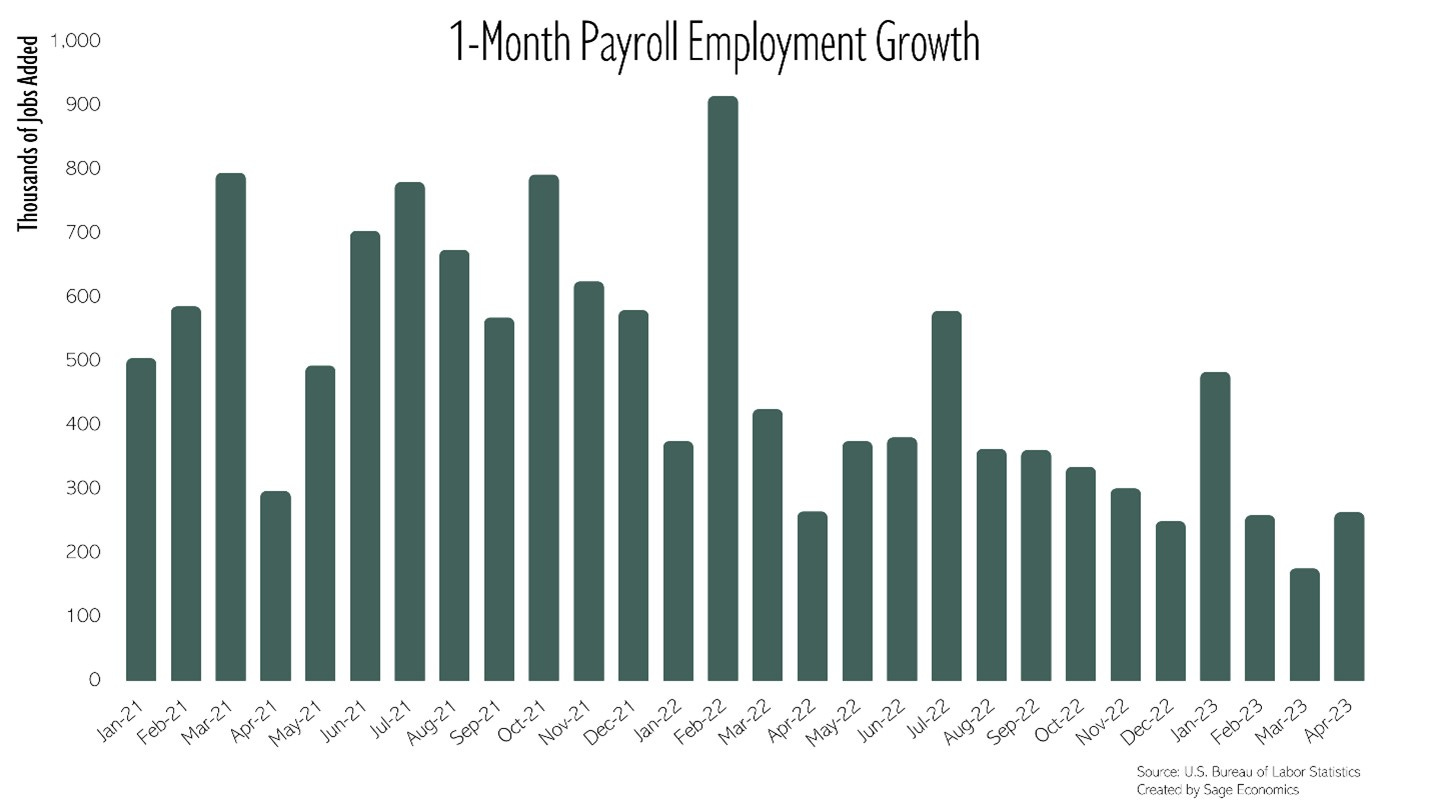

You can see below that job growth is slowing, just not as quickly as the Fed would like. Average hourly wages increased at the fastest pace since July and are up 4.4% year over year, and that’s also a bad sign on the inflation front.

The labor force shrank by 43,000 people in April, which is not great, but has added more than 1.7 million persons through the first four months of 2023, which is great. That’s the second largest labor force increase ever through the first third of a year (only 2000 was better).

The labor force participation rate held steady at 62.6%, still 0.7 percentage points below the pre-pandemic level. But the prime age (25-54) employment to population ratio inched up to 80.8%. That’s the highest level since 2001, so we can probably do away with the nobody wants to work anymore trope.

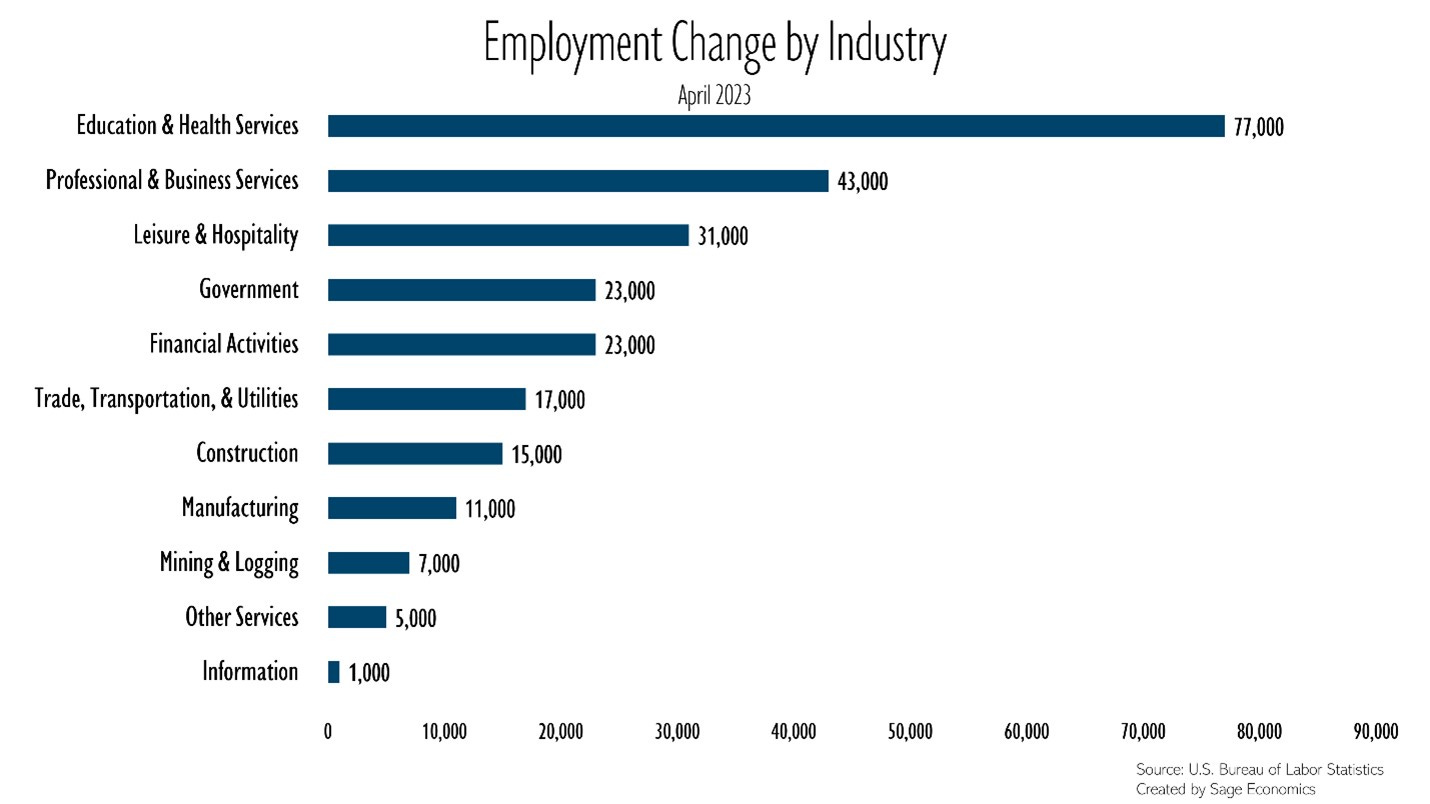

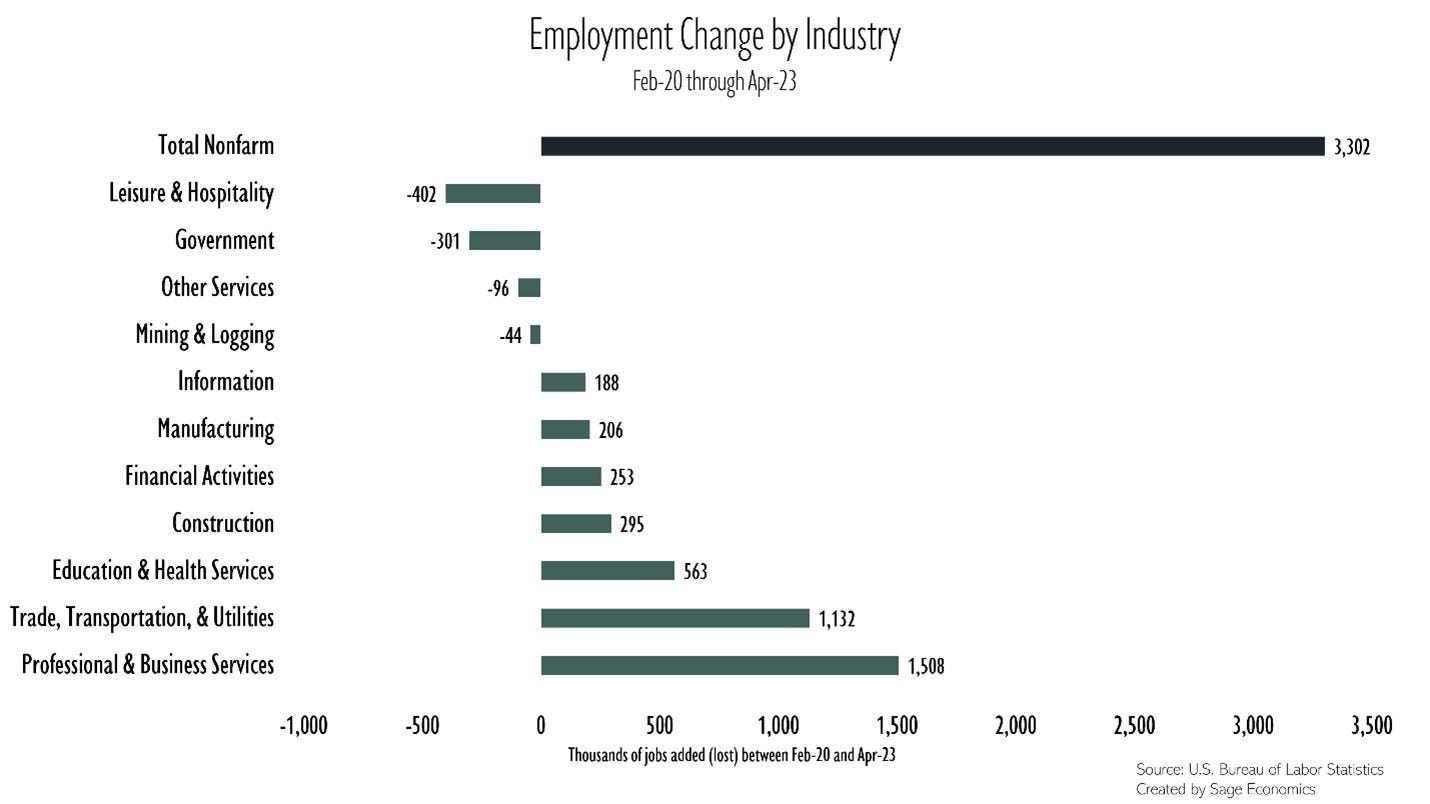

Job gains were concentrated in service providing industries, with education and healthcare leading the way and professional and business services close behind. Information, which includes tech, continues to add jobs at a really slow pace.

Both construction and manufacturing lost jobs in March. That was seen as a sign of emerging weakness, but those two industries bounced back in April (you can read Anirban’s thoughts on the construction industry’s labor market at Associated Builders and Contractors).

The 31,000 jobs added by leisure and hospitality were the fewest in any month since December 2020. At this pace, leisure and hospitality won’t return to the pre-pandemic level of employment until May 2024.

This week had a ton of other economic data releases (plus a rate hike), and you can read all about that in Anirban’s Week in Review later today (only for paying subscribers).

Three (somewhat) Key Takeaways

Temporary help services lost 23,300 jobs in April. This is normally seen as a forward-looking indicator of hiring, but I’m not sure that’s true when the labor market is this tight.

The unemployment rate for workers with a bachelor’s degree or higher fell to an absurd 1.9%. I would have guessed that was impossible due to frictional unemployment.

Forecasters have now missed low on payroll employment growth in each of the past 13 months. Forecasting is hard, but at least at the consensus level, this is bad.

What to Watch

Next week is all about the new inflation data.