Back at It Week in Review

Jobs, housing, rate cut odds, & more

The federal government reopened, data releases are flowing, and Lamar is back at practice. Sometimes life comes up aces.

This week brought us important updates regarding construction spending, the labor market, the prospect of a December rate cut, and a whole lot more.

Monday

Construction Spending

Construction spending increased in August, but that was due to a large (0.8%) increase in residential spending. Residential spending is still down 1.8% year over year, but it has risen for three consecutive months and stands at its highest level of 2025.

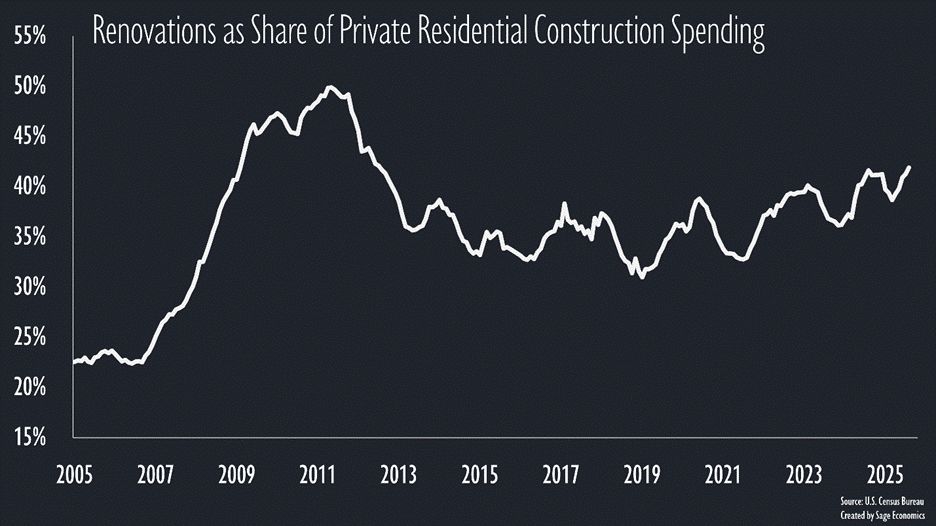

The recent rebound has been entirely due to repair/renovation work. New single and multifamily construction continues to contract. It’s reasonable to assume that high stock prices have at least partially funded big-ticket renovations among households with portfolios.

Nonresidential spending fell for the month and is now down 1.5% year over year, with private nonresidential activity particularly weak over the past 12 months.

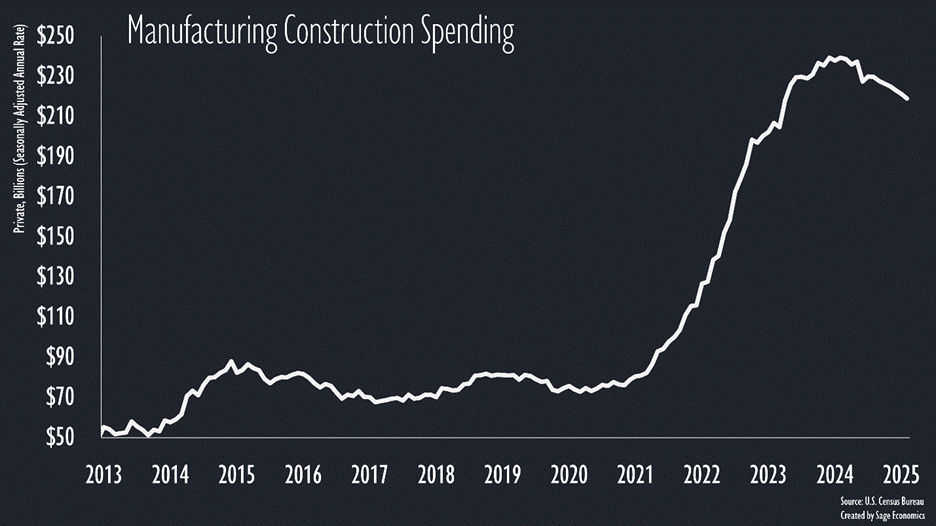

A big story here is the ongoing decline in manufacturing-related construction. While still high relative to the pre-CHIPS Act boom, it’s falling fast, down 8.2% over the past year. With tariffs and uncertainty weighing on manufacturing activity and CHIPS megaprojects wrapping up, this trend might stick around for a while. That’s not a good sign for those who crave American reindustrialization.

TSA Checkpoint Travel Numbers

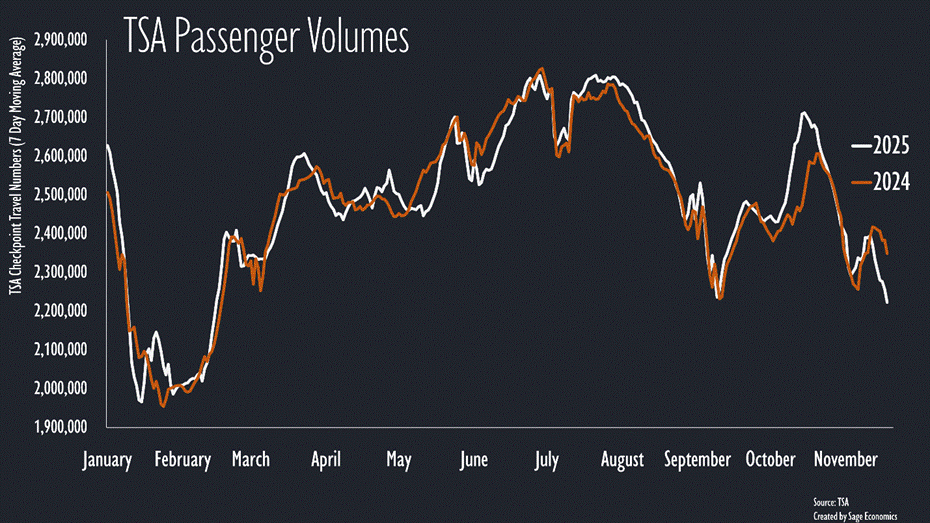

Air travel volumes have nosedived and are, according to TSA data, down more than 5% from 2024 levels during the week ending November 18th. Could this be due to the effects of the government shutdown and reduction in permissible flight activity? Definitely. But it’s still pretty concerning for those in leisure and hospitality since vacation plans may have changed during the shutdown, with more Americans opting for less expensive drive-to destinations as opposed to more expensive fly-to leisure hotspots.

Please know that we’ll be keeping a close eye on how Thanksgiving travel matches up with year-ago levels for those of our readers who hail from the leisure and hospitality sector.

Oil Stuff

Gas prices stayed at an average of $3.19/gallon this week. It’s hard to over-emphasize how boring gas prices have been lately, hovering between $3.15 and $3.19/gallon for over a month. Not that there’s anything wrong with boring gas prices. The trajectory of gas prices has helped moderate inflation.

Diesel prices—altogether less boring— rose for a fourth straight week and are up $0.20/gallon over the past month. Among other things, that implies higher shipping costs during the holiday shopping season. That’s inflationary.

Tuesday

NAHB/Wells Fargo Housing Market Index

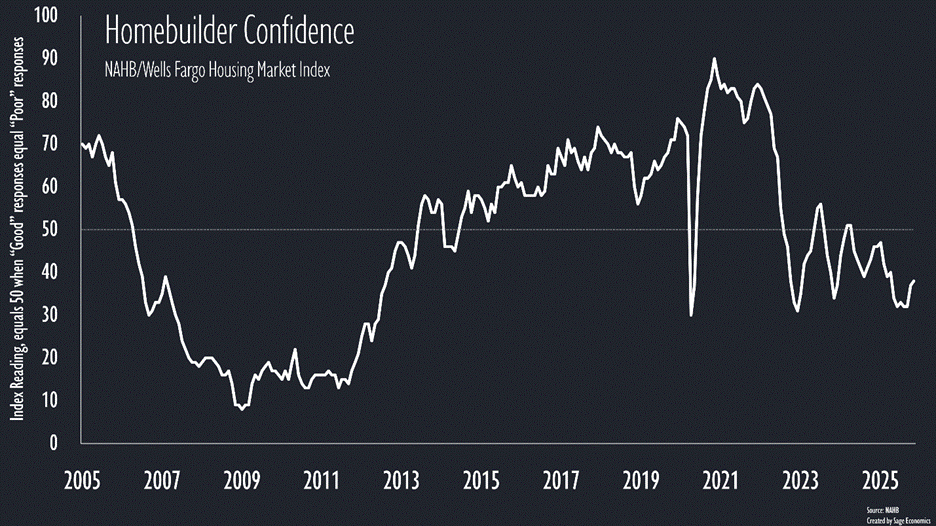

This measure of homebuilder confidence increased for a second consecutive month in November but remains well below its early-2025 level. Homebuilders are particularly glum about the traffic of prospective buyers, but pretty upbeat about single family starts over the next six months. There is a belief among many that once 30-year fixed mortgage rates fall below the psychological threshold of 6 percent, the market will take off. That’s behavioral economics in action.

Durable Goods Orders

Orders for durable goods (things that last at least 3 years) increased in August, but that was almost entirely due to a sizable increase in airplane orders (very expensive and volatile). Excluding transportation, orders were up just 0.1% for the month and, year to date, have risen only 0.6%. That’s not great but, given the broader environment, should be viewed as good news.

ADP Pulse Jobs Data

Private employers lost about 10,000 jobs over the four week period ending November 1st, according to this new ADP data series. First, this is a new data series they started during the latest government shutdown, and we have no idea how good it is. Second, losing jobs isn’t great, but this estimate shows job losses slowing from the previous estimate and hires picking up. So, while far from good, another indication that the labor market remained reasonably stable through October.

Big picture, I wouldn’t read too much into this one.