Bananas Week in Review

Inflation, income, & more

This week brought us updates on inflation, small business and consumer optimism, 2024 income, and a lot more. Full disclosure, it was a disappointing week of data, though that comes with a nice silver lining for those in the housing industry; mortgage rates plunged to the lowest level since last October and look primed to fall again next week.

Monday

Consumer Credit

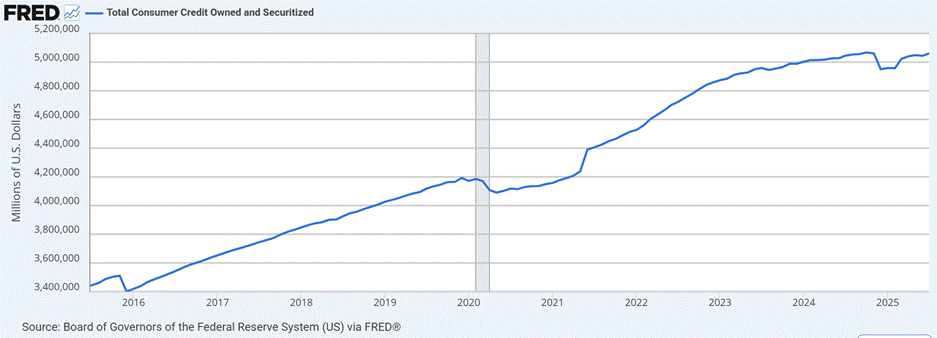

Outstanding consumer credit (i.e., consumer debt) rose at a 3.8% annualized rate in July. That’s the fastest increase since April and was largely driven by a big jump in revolving credit outstanding (think credit cards, HELOCs).

Despite the increase, outstanding consumer credit is still lower than it was in November 2024. Is this dip a result of the election? A wonky seasonal adjustment? I don’t have a good answer, but I’m not concerned about consumer debt levels right now.

Oil Stuff (Baker Hughes Rig Count, Gas & Diesel Prices)

Both gas prices and diesel prices inched higher this week, while the number of active U.S. oil rigs rose to the highest level since late July. Despite the increase, there are still 69 fewer active oil rigs than during the same week last year, a decrease of 14%. Overall, “oil stuff” remains remarkably stable, with both prices and rig counts low.

TSA Checkpoint Travel Numbers

The number of people flying has been volatile over the past few weeks, according to TSA data, but that’s normal given the timing of back to school and a holiday weekend. Flying over the past week was up 1.1% on a year-over-year basis, which is just fine.

Tuesday

2024 Census Bureau Income Data

Median household income rose (just slightly) to $83,730 in 2024. There was a big increase for households at the 90th percentile (+3.7%) but no real change for income at the 50th or 10th percentile.

But that’s household income, which includes people who aren’t related. Median family income increased to $105,800, the highest level ever (yes, it’s adjusted for inflation). There are now more families earning over $200,000 a year than under $50,000 a year

BLS Preliminary Benchmark Revisions

Based on microdata from unemployment insurance programs, BLS downwardly revised employment in March 2025 by 911,000 jobs (affects Mar-24 to Mar-25).

In terms of total jobs, this is a small revision—from 160.2 million to 159.3 million, a decline of just 0.6%. No big deal.

But in terms of job growth, we go from about 147,000 jobs added per month to 71,000 jobs added per month. Kind of a big deal!

This is getting more attention than it should given the recent newsiness of BLS revisions. If you don’t care to get into the weeds, skip to the next indicator!

If you do, here we go:

This is the second straight large and negative preliminary benchmark revision (-818,000 last year) and the largest since 2010 (Great Financial Crisis). With the caveat that revisions have generally gotten smaller over time, it’s worth noting that it’s harder to gauge employment levels during times of economic transition/turbulence.

And this certainly qualifies as a time of economic transition. Not because of trade and immigration policy (these revision pertains to March 2024 to March 2025, before recent policy changes) which will complicate matters next year. Rather, the pandemic was a singular, incredibly bizarre labor market event that started with nearly unprecedented labor market churn (lots of hires, quits, and job switching from 2021 to 2023) and has now moved to a labor market that’s utterly stagnant (few hires, quits, layoffs, etc.).

Also important to note: we’ve known—or at least strongly suspected—for many months that this would be another negative benchmark revision, and all the important parties (investors, the Fed, etc.) took that into account. There’s similar certainty that next year’s preliminary benchmark revision will be negative, so job growth is probably going to end up being a little slower than it currently appears.

As a final technical note, this is just the first of three benchmark revisions to the Mar-24 to Mar-25 data. Last year’s benchmark revisions (Mar-23 to Mar-24) went from -818,000, to -790,000, to -598,000. This year’s revision is likely to shrink with subsequent data updates as well.

As a final nontechnical note, it’s fine if you think these revisions are too big and the BLS should try to do better on their first guess. It’s not fine if you see this as evidence of anything untoward or corrupt.

If the BLS wanted to fake numbers, they’d just say they nailed it on the first try, end of story, no revisions needed. If the goal was to make Biden look good, well, I would have started with not showing inflation spiking to a 9% year-over-year rate in 2022.

Big picture, the only takeaway here should be that job growth was already slowing—and faster than we thought—last year. That shouldn’t materially change our understanding of the economy because other indicators, like the unemployment rate, retail spending, etc., remain unchanged.

NFIB Small Business Optimism Index

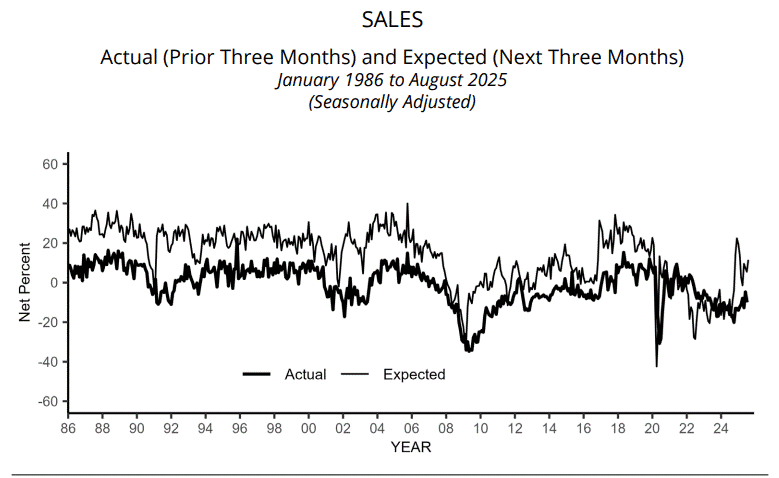

Small business owner confidence increased for the second straight month in August but remains about 4% lower than at the December peak. I don’t put too much value in confidence measures, and this one is especially tricky to interpret because small business owners really love when there’s a Republican in the White House.

Maybe my biggest takeaway is that the gap between actual sales (past three months) and expected sales (next three months) continues to grow.