Everything Everywhere All at Once, which took home the Oscar for Best Picture on Sunday, was a film I really enjoyed.

Everything Everywhere All at Once, which also describes the life we lived this past week, was something I didn’t enjoy at all. I feel like I was slapped in the face.

Anyway, this week gave us some more banking mayhem, two new pieces of inflation data, retail sales, a bunch of housing stats, and more.

Monday

Gas Prices

Gas prices increased for the second straight week and are now up to $3.568/gallon. This is about $0.10 higher per gallon than two weeks ago. Don’t expect this pattern to last, however. Oil prices have been falling globally due to concerns of financial contagion and the likelihood of softer worldwide growth.

TSA Checkpoint Travel Numbers

Travel numbers for the week ending 3/15/2023 were 2.9% below 2019 levels. It seems like we’ve settled into a groove of being about 3% below pre-pandemic levels here. My guess is that the difference comes from business travelers, many of whom are doing virtual conferencing instead of flying across the country for in person meetings.

Daylight Saving Time

Last year on DST, we talked about the Senate’s passage of the Sunshine Protection Act, a measure that would have made DST permanent but instead languished in a House committee. I’m not going to sugarcoat it: changing the clocks is awful, and tiring, and doesn’t really save energy (like proponents argue), and making DST permanent would reduce crime.

Okay, rant over. Onto the story of the week, which actually started on March 10.

Silicon Valley Bank Failure

Here’s the shortest possible version of what happened: Silicon Valley Bank (SVB) (once the country’s sixteenth largest bank) was, as the name suggests, a popular bank with tech companies. Those tech companies made massive deposits as their valuations swelled during the pandemic. Then interest rates increased, making it more difficult for those tech companies to raise money, and they started withdrawing their deposits at a faster rate to stay afloat.

SVB was overinvested in U.S. treasuries, which lost value when interest rates increased. The combination of fewer deposits and less valuable investments created balance sheet problems. Then the CEO announced that they were trying to raise a couple billion dollars to solve that problem when he simply should have said “no comment”. In fact, even saying that would have been excessive. He should have just stayed quiet, perhaps enjoying a glass of wine in Napa, but instead, in the interest of transparency . . . he said too much, and . . .

Depositors panicked (on social media/in a group chat with a couple hundred founders, if the stories are to be believed), and that led to a bank run. The CA Department of Financial Protection and Innovation closed SVB and the FDIC was appointed receiver.

The FDIC stepped in and transferred all of SVB’s assets (both insured and uninsured) to an FDIC-operated “bridge bank,” allowing SVB’s depositors to continue to access their funds. That was possible because of a systemic risk exception that was approved on Sunday.

There’s a lot to cover here, and we can’t even clip the tip of the iceberg in this Week in Review. The biggest takeaway is uncertainty. Before this happened, the only question was whether the Fed would raise rates by 25 or 50 basis points at their next meeting. Now it’s unclear if the Fed will raise rates, lower rates, or keep them the same at their next meeting. Professional forecasts are all over the place, and I imagine that not even the Fed knows what the Fed is going to do at this point. They are no longer data dependent; they are news cycle dependent.

The data releases this week were supposed to provide some clarity, but even those were a pretty mixed bag. Speaking of those ambiguous data points, let’s get to the big one for the week, inflation:

Tuesday

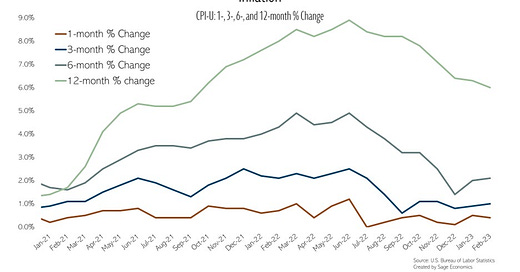

Consumer Price Index (CPI)

Keep reading with a 7-day free trial

Subscribe to Sage Economics to keep reading this post and get 7 days of free access to the full post archives.