Caveated Week in Review

Janky data, jobs, inflation, & more

There’s a great (but explicit, if you’re at work) scene at the end of the movie Burn After Reading in which J.K. Simmons’ character says, “What do we learn?...I guess we learned not to do that again.”

Given how (understandably) unsettled some of our recent data releases have been—including this week’s highly anticipated jobs and inflation reports—that’s precisely how I feel about this year’s government shutdown.

Which is to say, there are some caveats to discuss. Keep in mind that we might have another federal government shutdown in late January, and that would mean caveats on top of caveats.

Being an economist is challenging under such circumstances, but I’d rather be an economist than a New England Patriot this Sunday.

Monday

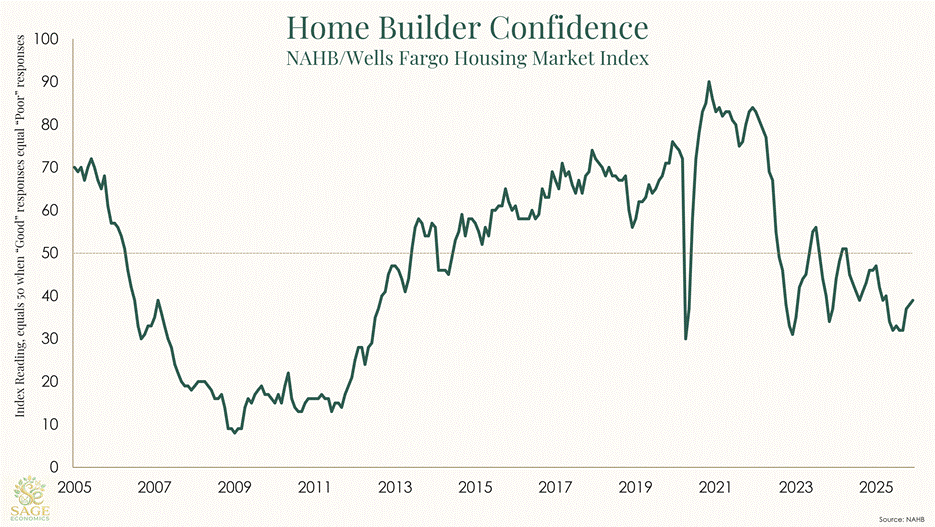

National Association of Home Builders’ Housing Market Index

This measure of builder confidence increased for a third consecutive month in December but is still extremely low by historical standards. The most interesting tidbit from the release: “40% of builders reported cutting prices in December, marking the second consecutive month the share has been at 40% or higher since May 2020.” My guess is that home builders are confident because they think mortgage rates are set to fall further, below the psychological threshold of 6% on a 30-year fixed.

TSA Checkpoint Travel Numbers

Air travel bounced slightly back ahead of year-ago levels, according to TSA data. This is encouraging after some choppy numbers over the past few weeks. I can vouch for the fact that you cannot discern anything approaching impending recession from airport activity.

Oil Stuff

Gas prices fell to an average of $3.02/gallon, the lowest rate in more than four years. Low gas prices are an economic stimulant. That, along with other upcoming stimulants—AI investment boom, One Big Beautiful Bill, corporate earnings, an accommodative Federal Reserve, and spending by wealthier families—should be enough to propel the U.S. economy through at least the first half of ‘26.

Diesel prices also fell. At $3.61, they are down about $0.26/gallon from one month ago.

Tuesday

Jobs Report

Job growth remains slow and the unemployment rate is rising, according to this delayed November jobs report (which also includes as much October data as we’ll ever get). While the private sector is still growing at a slow but steady pace, most of that growth is in the healthcare sector. The federal government is hemorrhaging jobs, which is especially bad news for states like Maryland. In total, the economy has lost 41,000 jobs since September, 14,000 of which were in the manufacturing sector.

While this report doesn’t quite point to an economy in recession, it does indicate that the labor market is real cause for concern entering 2026. Again, job growth might bounce back along with consumer spending early next year, but for now this has become a difficult moment for jobseekers. The unemployment rate stood at 4% to start the year. It’s now 4.6%.

You can read Zack’s more extensive thoughts here.

Retail Sales

Retail spending was unchanged in October. While that’s slightly disappointing, the lack of growth is due to a 1.6% decrease in spending at car dealerships. Excluding that category, sales grew at a healthy 0.4% for the month.

Zooming out, spending has held up well in 2025 and is 4.0% higher through the first 10 months of 2025 than during the same period of 2024. The U.S. consumer is like T-1000 from Terminator 2 —throw whatever you want at it, it just keeps going.