Cold Turkey Week in Review

The housing market, consumer confidence, & more

The past three days have been stuffed with economic updates, and I’m thankful for that after the shutdown had us going cold turkey on government data releases.

Housing market indicators are the week’s main course—they might leave a fowl taste in your mouth—and our sides include updates on consumer confidence, inflation, Chicago’s dire financial situation, and more.

Because of the holiday, this review is rolling out a few days early and is free to all subscribers. In the unlikely event something important happens with the economy tomorrow or Friday, we’ll cover it next week—like they say, butter late than never (sorry, I promise that’s the last pun).

Monday

Chicago’s Nightmare Fiscal Situation

Should the Feds Bail Out Chicago? I’d usually include this kind of thing under Links of the Week, but it gives such a vivid picture of Chicago’s dire financial situation—including factoids like “No major US city has a worse credit rating than Chicago. It’s got more pension debt than 43 US states”—that it gets its own header.

In a related story, Goldman couldn’t sell Chicago’s debt last week. Pretty bleak.

TSA Checkpoint Travel Numbers

Air travel volumes rebounded after last week’s nauseating decline, according to TSA data, but are still trending just slightly below year-ago levels. Optimistically, this is a lingering effect of the shutdown, and air travel will post a strong Thanksgiving weekend.

Oil stuff

Gas prices were unchanged at a very low $3.19/gallon and remain in great shape. Diesel prices inched lower for the week but are still up $0.29/gallon over the past year. Not too much to see here.

Tuesday

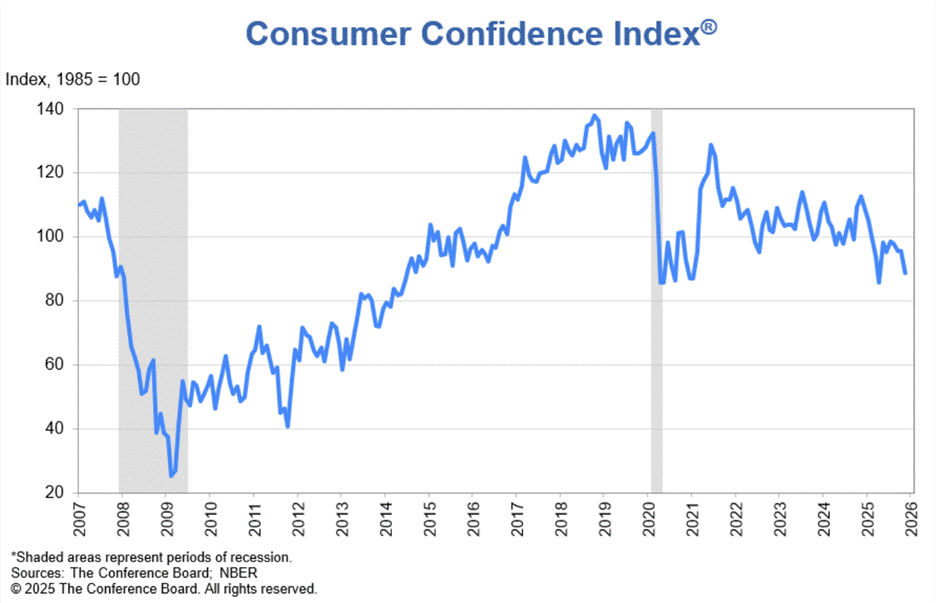

Conference Board Consumer Confidence Index

Consumer confidence fell sharply in November and is down to its lowest level since April. While the government shutdown probably has something to do with November’s dip, confidence just hasn’t come close to recovering from the April 2025 dip. That’s almost certainly the result of the Liberation Day tariff announcements and the 50+ announced tariff changes that have happened since then.

Retail Sales

Retail spending grew in September, but at a much slower pace than expected. That growth was largely due to more spending on gas, and if we exclude gas station sales, retail sales were flat for the month.

A lot of people—Anirban included—see this release as a bad sign. I’m less convinced. Retail sales were up 4.3% year-over-year in September and are up a healthy enough 4.0% year-to-date through the first 9 months of 2025.

Given poor sentiment and some other signs of weakness, the Holiday season will be the next big test for consumers. That said, the biggest lesson of the past few years is that you should never doubt U.S. consumers’ willingness to spend.

Producer Price Index

This measure of inflation, which looks at the change in prices received by U.S. producers, increased 0.3% in September. Goods prices rose really quickly for the month, but that had a lot to do with noncore goods (i.e., food and energy), which makes it a little less worrisome.

Overall, not much to see here. This is a relatively less important measure of inflation, and the data pertains to September, so it’s pretty stale.

You can see what Anirban had to say about the construction implications of this release here.

Pending Home Sales

Pending home sales, which are supposed to show us what actual home sales will look like a month or two down the road, increased in October, rising to the highest level since November 2024. That’s the good news.

The bad news is that pending sales were still lower than one year earlier, and there’s reason to think that home selling has slowed since October.

S&P Cotality Case-Shiller Home Price Indices

Home prices fell in September, according to this measure, and are up just 1.3% over the past year. That represents the fourth consecutive month in which year-over-year inflation outpaced the year-over-year increase in home prices.

Redfin Home Delisting Data

Redfin reports that demand for homebuying is so bad that 5.5% of all listings were delisted in September, making that the worst September since 2017. This is the result of falling home prices, and so it’s no surprise that delistings were most common in Florida (where the housing market is particularly weak at the moment) and with sellers who bought their house within the past five years. Not great!

Wednesday

Jobless Claims

Initial jobless claims fell to 216,000 during the week ending Nov. 22nd. This is very low—no sign of rising layoff activity.

Continued claims for unemployment insurance rose slightly and continue to trend higher, but at a not-concerning pace.

This is good news. Feel good about it!

Mortgage Applications

Mortgage applications inched higher this week but are still pretty low. Not to beat a dead market, but mortgage rates need to fall if we’re going to see any kind of meaningful rebound.

Links of the Week

Americans giving up on homeownership (Erdman Housing Tracker)

Why Are Latter-day Saints So Libertarian? (Connor The Capitalist)

Sunday Robotics introduces the first household robot that 1) I want and 2) doesn’t evoke the terminator movies (YouTube Video)

Final Thoughts

After this week, my outlook for the economy is: Better

Most of the data we’re getting is pretty stale, and the housing market is still in tough shape, but I’m reassured that unemployment claims—our most real-time labor market indicator—remain really low. Until those start rising, there’s no reason to panic.

Happy Thanksgiving!

Looking Ahead

Next week brings us some private sector data, including an ADP jobs report, December consumer sentiment, some inflation data for September, and more.

Very punny, Zack.