Construction in Recession?

Construction Trend Tuesday (#27)

Construction Trend Tuesday covers one (hopefully) interesting industry trend in a quick, two minute read. You can access the archive of CTT posts here.

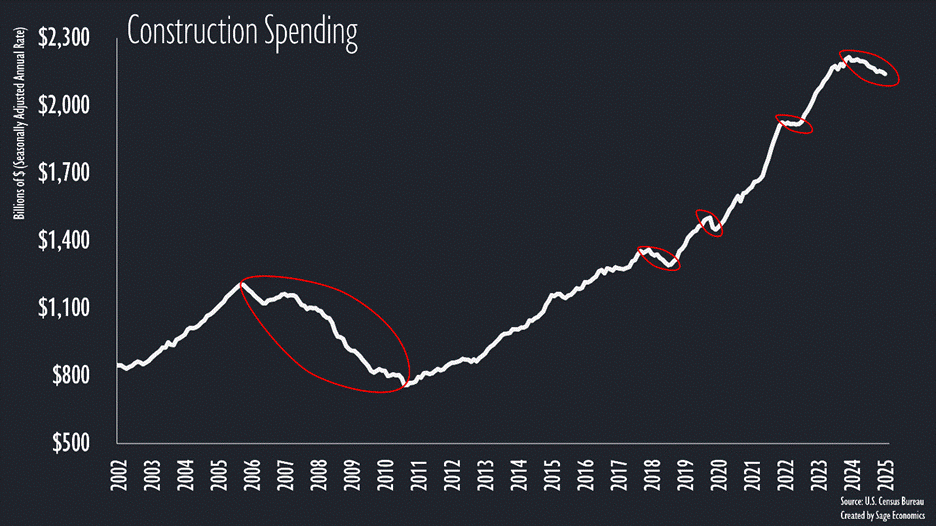

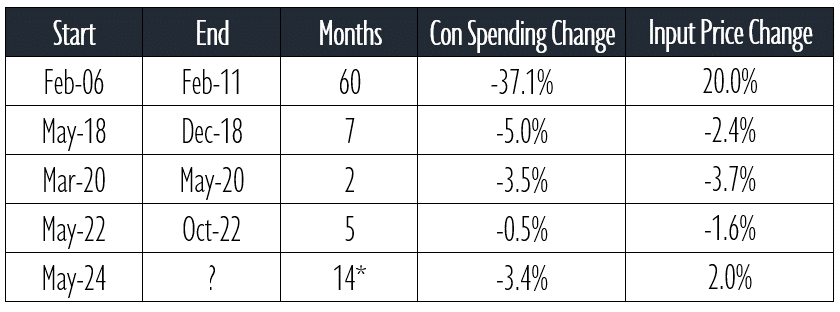

The construction industry is currently in its longest period of contraction since The Great Recession (2006-11); 14 months have passed since construction spending peaked in May 2024.

While this is the longest contraction in about 15 years, it’s not the steepest. Construction spending is currently down 3.4% from the May 2024 record high. At least in nominal terms (not adjusted for inflation), that’s a slightly smaller drawdown than over the second half of 2018 or the early months of the pandemic.

But that’s nominal terms, and construction input prices fell during the previous three contractions. That’s not the case this time. Input prices are up modestly over the past 14 months, with escalation accelerating over since early spring.

The upshot: there’s a good case to be made that the construction industry is in—and we don’t use this word lightly—recession.

What’s Next

We’re going to put together a longer post on the emerging construction recession early next month.

In the meantime, this week brings us some housing data and a critical update on the Fed’s preferred measure of inflation. We’ll dive into that and more in Week in Review, our every-Friday post that covers all the economic news and data in a breezy, five minute read.

Week in Review is only for paying subscribers. If that’s not you and you want it to be, just click the subscribe button.

You mention the price increase over the last 14 months and how this affects the actual construction decline, but how about how the significant price increases affected the actual build-up to May of 2024 as well?