Construction Trend Tuesday

Nonresidential momentum confined to two segments

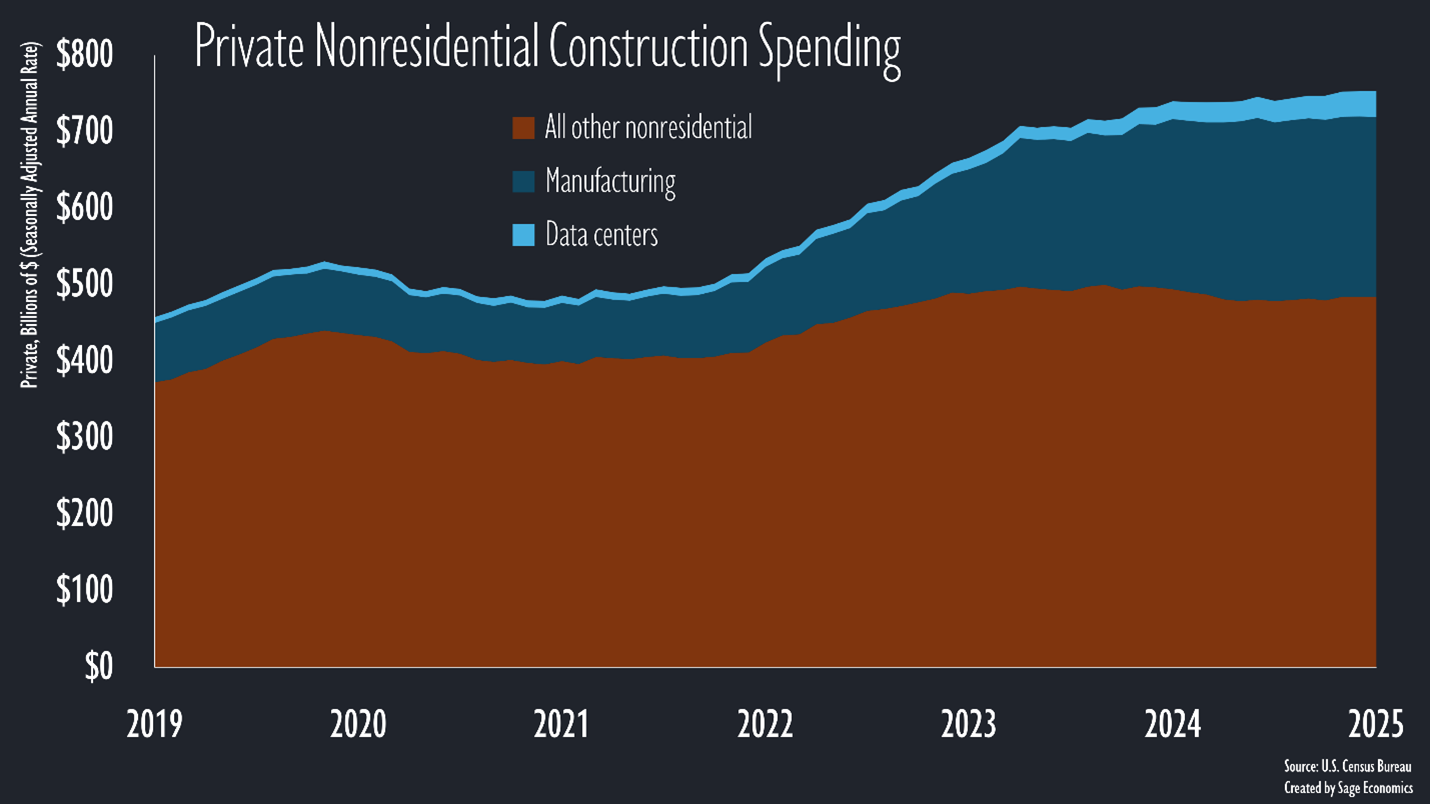

Overall nonresidential construction spending has held up fairly well over the past few years, but that’s only because of a boom in data center and manufacturing (specifically computer chip manufacturing) construction activity.

If we look at nonresidential excluding those two categories (the orange area above), you see that spending is:

only modestly higher than at the start of 2020, rising at about a 2% annualized rate over the past five years, and

lower than in the middle of 2023, falling about 3.2% over that span.

But that first chart is not adjusted for inflation. In inflation-adjusted terms, nonresidential construction activity excluding data centers and manufacturing is down considerably from both the pre-pandemic level and the April 2023 peak.

It probably says a lot about the state of society that so much of what we’re building is meant to support online activity.

It definitely says a lot about the state of nonresidential construction that spending growth is so concentrated in just two segments. Lower interest rates and looser lending standards cannot come soon enough.

What’s Next

We’ll send out our every-Friday Week in Review post on—you guessed it—Friday. Week in Review covers all the economic news and data in a breezy, five minute read. That’s only for paying subscribers. If that’s not you and you want it to be, just click the button below.