Construction Trend Tuesday (#10)

Office officially struggling

Construction Trend Tuesday covers one (hopefully) interesting industry trend in a quick, two minute read. You can access the archive of CTT posts here.

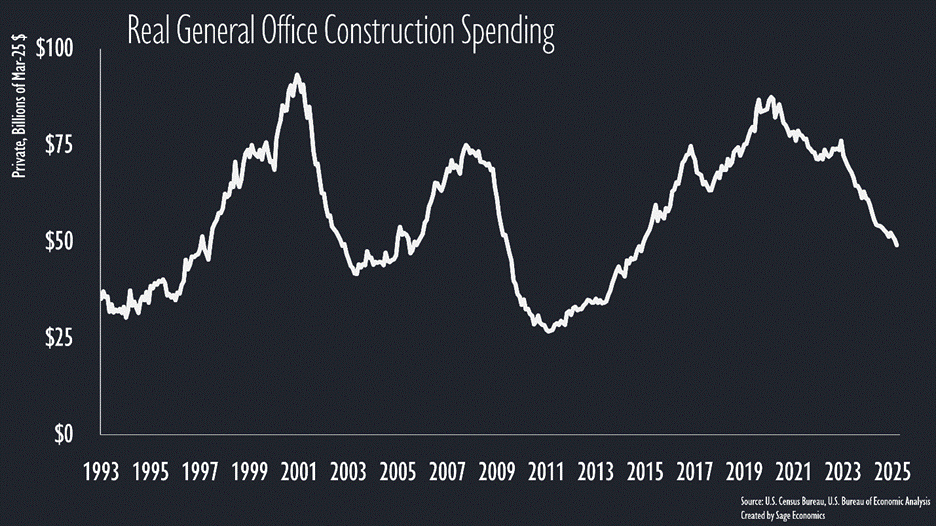

Office construction spending plunged during the pandemic as remote work devastated demand, and a couple years of high interest rates have only made matters worse. Investment in general office buildings is down 44% since the February 2020 peak and falling fast.

I’m not too optimistic about an imminent rebound.

Just 3.3 million square feet of office buildings were completed in Q1 2025, according to CBRE, the fewest in any quarter since 2013. Despite that paltry number, it still outpaced net absorption, meaning the overall office vacancy rate increased over the first three months of the year despite the lack of inventory growth.

In addition to the effects of remote work and high interest rates, AI could reduce the demand for white collar workers (that might already be happening), further reducing the need for new office buildings.

Notably, and somewhat ironically, the reduction in general office investment has been more than offset by the increase in construction of data centers, which power the AI models that could replace traditional office workers. Because data centers are included under “Office” in construction spending data, that broader category remains near an all-time high.

What’s Next

Week in Review, our every-Friday post that covers all the economic news and data in a breezy, five minute read, will come out on—you guessed it—Friday.

Week in Review is only for paying subscribers. If that’s not you and you want it to be, just click the subscribe button.