Construction Trend Tuesday (#13)

Residential construction rolls over

Construction Trend Tuesday covers one (hopefully) interesting industry trend in a quick, two-minute read. You can access the archive of CTT posts here.

Faced with scary high interest rates (by contemporary standards), the residential construction market has rolled over and is, at least for the moment, playing dead. Spending in the segment is down almost 5% over the past year, with the decline led by a massive 11% annual drop in new multifamily construction.

Single-family building permitting is stable, but I’m being told by more economic development professionals (who increasingly understand that housing development and economic development go hand-in-hand) that permits are not translating as readily to construction starts due to stubbornly high interest rates, sagging consumer sentiment, and rising construction delivery costs.

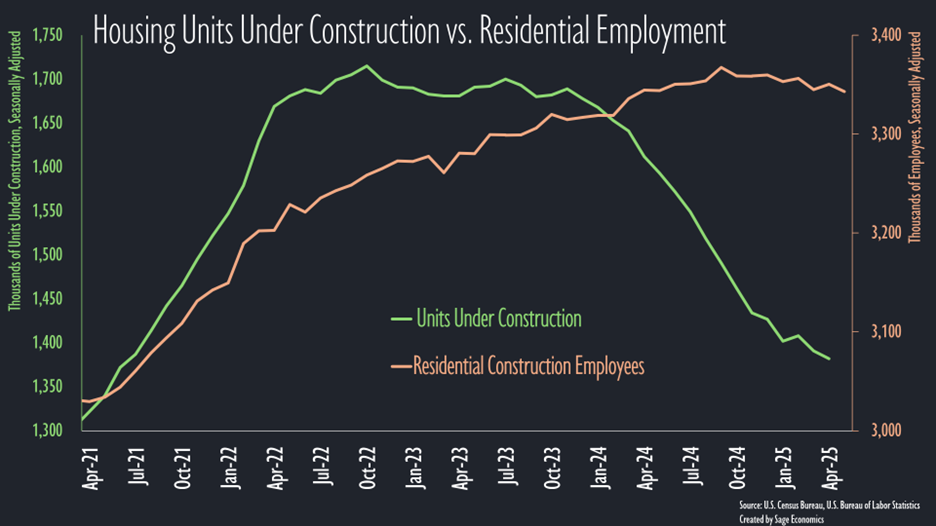

While residential construction spending has been falling for the past year, residential construction employment only began to decline in January and is down just 0.5% from the cyclical high attained at the 2025’s onset.

With the number of housing units under construction shrunken, it is conceivable that there will be more layoffs in residential construction later this year. That process may have already begun more forcefully than the data indicate, but this dynamic could be hidden by the fact that jobs held by undocumented migrants may not have been fully captured in prior data, which means their job losses may also not be statistically embodied.

There’s little to like about the residential construction outlook right now. Permitting has slowed, interest rates remain elevated, and renovation and repair work (-5.5% year over year) has begun to drift lower. Maybe I’m being too pessimistic because the Orioles still have a losing record, but homebuilders seem to agree; the NAHB’s Housing Market Index just dipped to its lowest level in more than a decade in May (excluding April 2020).

The upshot is that residential construction activity is poised to contract in both single-family and multifamily contexts. The segment’s workforce will also shrink over the next several months unless interest rates fall meaningfully and soon. I wouldn’t hold my breath.

What’s Next

We get some critically important inflation data this week. We’ll cover that and a lot more in Week in Review, our every-Friday post that covers all the economic news and data in a breezy, five-minute read.

Week in Review is only for paying subscribers. If that’s not you and you want it to be, just click the subscribe button.