Construction Trend Tuesday (#22)

Musings on Multifamily Construction Costs

Construction Trend Tuesday covers one (hopefully) interesting industry trend in a quick, two minute read. You can access the archive of CTT posts here.

Last week, the CEO of MAA, one of the biggest multifamily REITs, said that their costs “are pretty flat at the moment.”

So we still feel really good about our approach to development on the cost side. Honestly, we’re not seeing — your costs are pretty flat at the moment. We’re not seeing really any increase associated with tariffs or immigration or anything like that at the moment. Certainly something that will continue to keep an eye on the labor market and things of that nature. But feel really good about our development opportunities that we are under construction on right now as well as the — a few others that we’re pursuing at the moment.

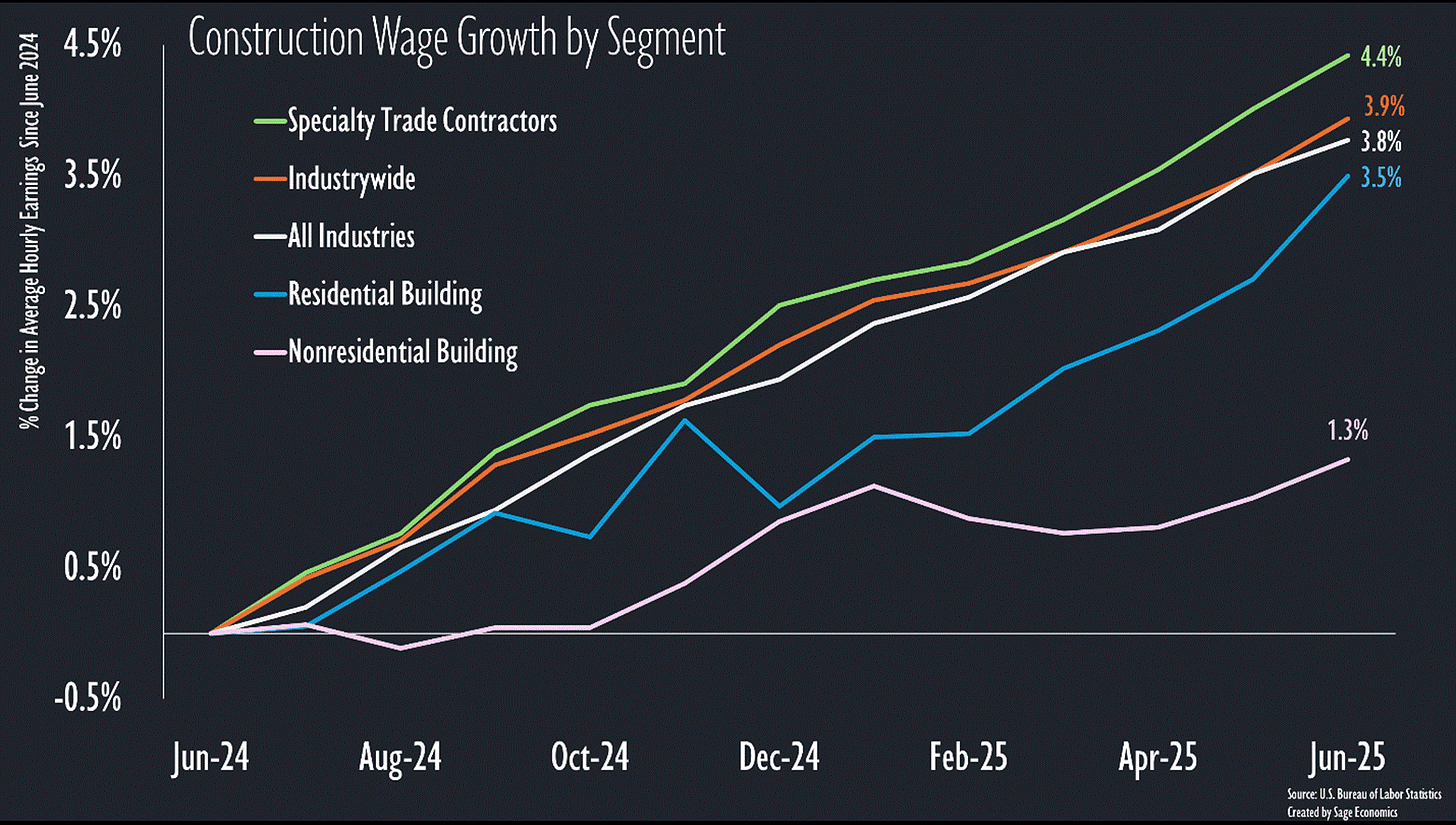

Count me surprised. Average hourly earnings for residential building workers are up slightly less than economywide earnings over the past year, but growth has clearly accelerated since February.

There’s also been a rapid increase in specialty trade contractor earnings over the past year, almost certainly due to occupation-specific worker shortages.

Multifamily materials cost increases have also started to accelerate, rising 2.5% since January—the largest six-month jump since late 2022.

So the CEO says one thing, the data another. What gives?

MAA operates in the South and Southwest. It wouldn’t surprise me if those regions have seen slower cost increases than other parts of the country over the past few quarters.

It’s probably not in MAA’s interest for the CEO to speculate about emerging cost pressures on an earnings call.

Construction cost increases were pretty tame in 2024, especially compared to the big jumps in 2022 and 2023. A pick up over the past few months may not be meaningfully affecting project costs yet.

We don’t have a great read on how undocumented workers are or are not reflected in earnings data, and there are big shifts in the industry’s undocumented workforce underway right now.

We get a new producer price index release next week, and that’s our best source of data on construction input cost escalation (see what Anirban had to say about that data last month).

My guess: next week’s PPI data will show accelerating construction input cost escalation, including for multifamily. Here’s to hoping I’m wrong.

What’s Next

This week is light on economic data, but we still get a few new industry-specific measures, some housing stats, and (potentially) updates on the tariff front. We’ll cover all that and more in Week in Review, our every-Friday post that covers all the economic news and data in a breezy, five minute read.

Week in Review is only for paying subscribers. If that’s not you and you want it to be, just click the subscribe button.