Data centers keep construction industry afloat

Construction Trend Tuesday (#23)

Construction Trend Tuesday covers one (hopefully) interesting industry trend in a quick, two minute read. You can access the archive of CTT posts here.

How hot is the data center segment? Google alone spends more on capital expenditures than the UK spends on its defense budget.

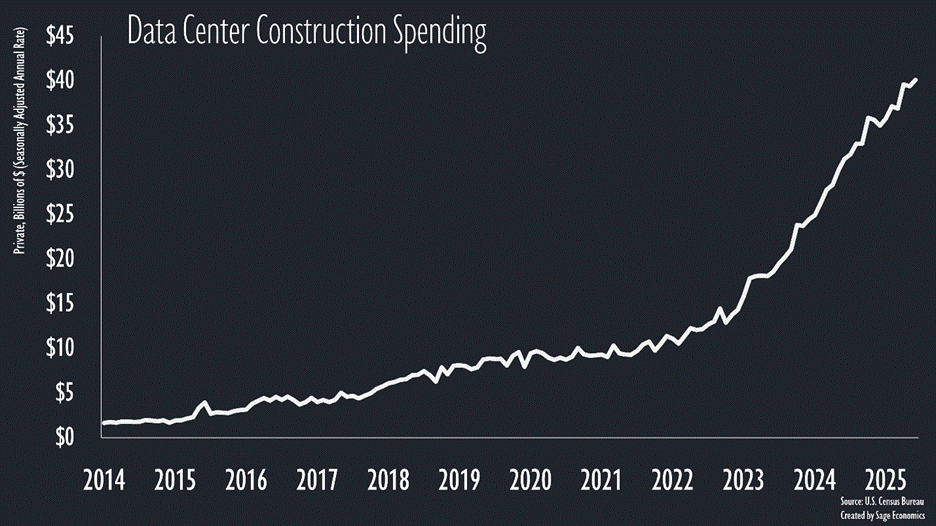

Only a fraction of this investment goes toward construction (the equipment inside a data center is absurdly expensive), but data center construction spending is still blasting off into orbit.

And thank goodness it is, because the rest of the nonresidential segment is struggling mightily. Since the start of 2024 private data center construction spending has increased by $15.2 billion (seasonally adjusted annual rate). All other private nonresidential spending declined by about $52 billion over that span.

Data centers aren’t just carrying the construction industry (1 in 7 ABC members are currently under contract on a data center project), they’re propping up the entire economy. Information processing investment accounted for more than half of GDP growth during the first half of 2025 (notably, GDP grew at a supremely disappointing 1.3% annual rate over those six months).

The obvious question is: how long will this investment boom last? The consensus seems to be that it will persist for at least a few more years. Mark Zuckerberg, for instance, has legendary plans for his AI buildout. He’s offering 9 figure contracts for AI engineers, a clear sign that he won’t skimp on data center infrastructure. Everyone else has to compete with that and will throw around similarly gaudy sums of cash.

After the next few years, however, it will depend on whether or not investment returns materialize as expected, which is at least partially a function of whether AI can ramp up its revenue generation. So far, companies seem to be exceeding expectations on that front (no idea what that suggests for future trends).

For a dive into the weeds on data center investment risk, Noah Smith has a good (and recent) overview.

What’s Next

Today brought us the first inflation data for July which, in the world of economic data, is about as big as it gets. We’ll dive into that and more in Week in Review, our every-Friday post that covers all the economic news and data in a breezy, five minute read.

Week in Review is only for paying subscribers. If that’s not you and you want it to be, just click the subscribe button.