Consumer Debt, Inflation, & More

Week in Review: Jan. 8-12

Three legendary football coaches (Carroll, Saban, and Belichick) retired this week at the ages of 72, 72, and 71, respectively. Saban hinted this was coming last month when he explained to ESPN that “14-hour days were a lot harder to navigate at 72 than they were at 62.” 14 hour days aside, If one of these coaches decides to run for president in 2028, they’ll still be younger than any of the presumptive candidates in this year’s election.

Anyway. This week brought us updates on inflation, consumer debt, and a whole lot more.

Monday

Consumer Credit

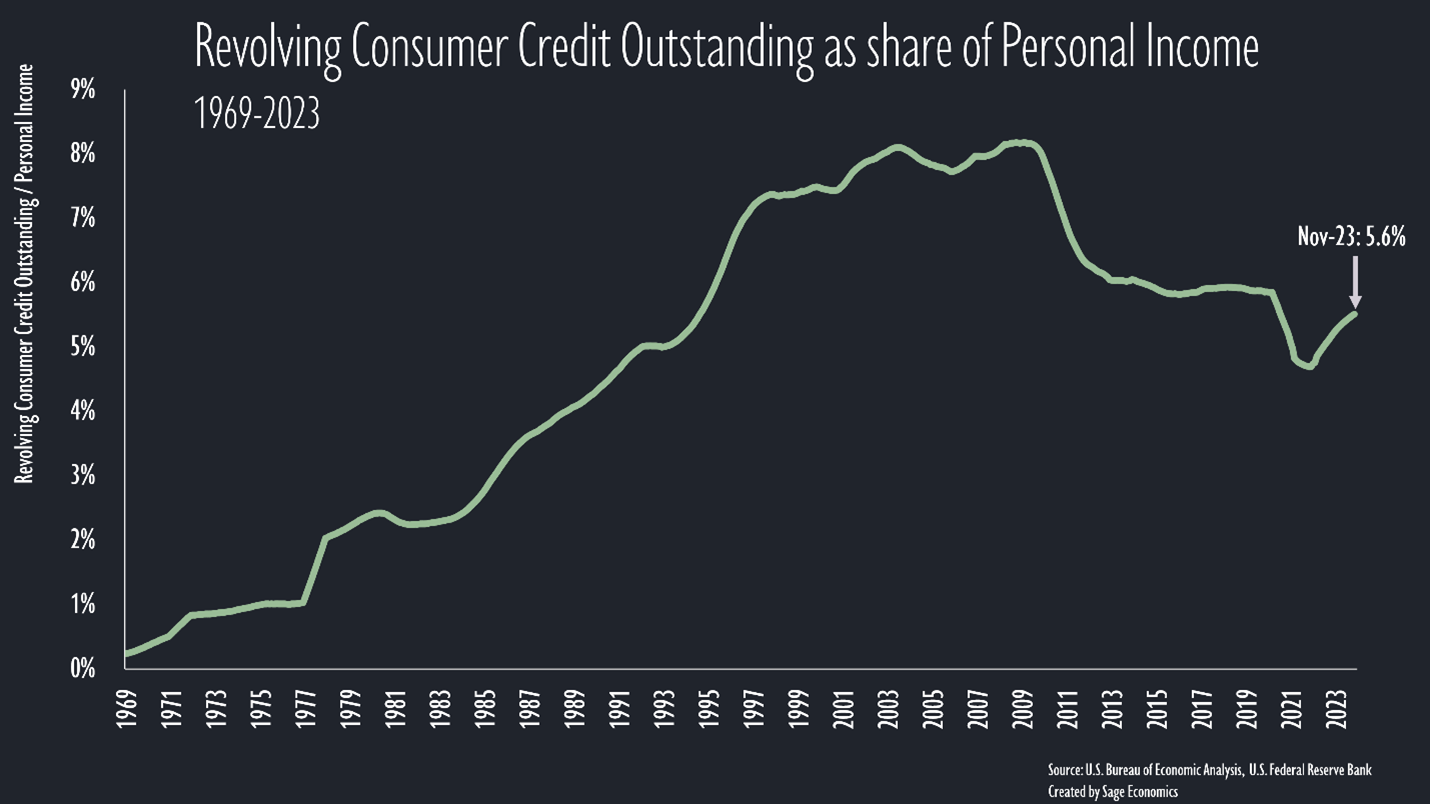

You might have seen some pretty panicked headlines about this one. Consumer credit (debt owed by consumers) increased at a 5.7% annual rate in November. Revolving credit (think credit cards) accounted for most of that, increasing at a 17.7% annual rate. This represents a continuation of the credit card debt spike, with delinquencies already on the rise. If you’re looking for a reason to believe the economy will falter, this is a very good one.

If you’re not, note that revolving consumer credit as a share of personal income currently stands at 5.6%, which is lower than at any point between the start of the pandemic (5.8%) and the mid-1990s. Which is to say, the trend is certainly not ideal, but credit card debt as a fraction of personal income is still low by pre-pandemic standards.

Gas Prices

Gas prices declined for a 15th consecutive week and are below $3.20 for the first time since June 2021.

Diesel Prices

Diesel prices also fell and are still at their lowest level since mid-2023.

TSA Checkpoint Travel Numbers

The number of travelers passing through TSA checkpoints has been 10% above 2023 levels through the first nine days of 2024. The most exciting part here is that after several years of having to compare data to 2019 due to pandemic impacts, we can finally look at this on a year-over-year basis. We’re back baby!!!

Tuesday

NFIB Small Business Owner Optimism Index

The good news: small business owner optimism improved in December. The bad news: they’re still very pessimistic. They point to the usual suspects to explain their pessimism: inflation and labor shortages/rising wages.