Credit cards, jobless claims, & markets go weeee!

Week in Review: Aug. 5-9

This was an exciting week for markets but a slow one for economic data releases. That said, we still received a handful of updates that suggest the economy is not nearly as bad as last week’s employment report made it seem. It’s good to be alive!

Monday

Markets go Weeeeee!

Markets plunged, led by the Japanese Nikkei 225, in what first seemed to be a panicked reaction to last Friday’s jobs report but was instead—probably, and mostly—a result of a strengthening Japanese currency and the unwinding of Yen carry trades. If you want to understand what that means, watch this short video.

If you don’t particularly care, just know that markets aren’t crashing; the S&P 500 has, as of this writing, regained about 86% of the value lost on Monday morning. Beyond those technical yen carry trade factors, there were some fundamental factors at work.

America had a growth scare. Slower growth would be bad for corporate earnings, and stock prices zoomed lower. But once economists had an opportunity to dig into last week’s jobs report—I mean to really take a deep dive—it became clear that the fear was overblown. I’m now convinced that Hurricane Beryl did in fact impact the data despite government economists’ protestations otherwise. Markets seem to agree. What’s more, there has been better news lately. For instance, see immediately below.

ISM Services PMI

The services side of the economy expanded—and at a faster-than-expected rate—in July, according to this survey of industry managers. The most upbeat part of this report is that the employment component showed expansion, defying expectations.

This was a nice (albeit relatively unimportant) palette cleanser after last Friday’s employment report.

The Senior Loan Officer Opinion Survey (The SLOOS)

A majority of banks kept lending standards unchanged in the second quarter. Demand for loans remained subdued but didn’t get much worse. The third quarter SLOOS should be much more telling as expectations for looser monetary policy build.

TSA Checkpoint Travel Numbers

Air travel declined this past week, according to TSA data, but that’s normal for early August. Travel volumes are still trending about 5% above 2023 levels. I’m in Detroit’s airport as I write this, and the joint in jumpin’.

Gas Prices & Diesel Prices

Gas prices fell to an average of $3.56/gallon. Diesel prices fell for a fourth straight week, though by only $0.01/gallon. That’s good news for consumers, many of whom have begun back to school shopping.

Tuesday

Second Quarter Household Debt and Credit

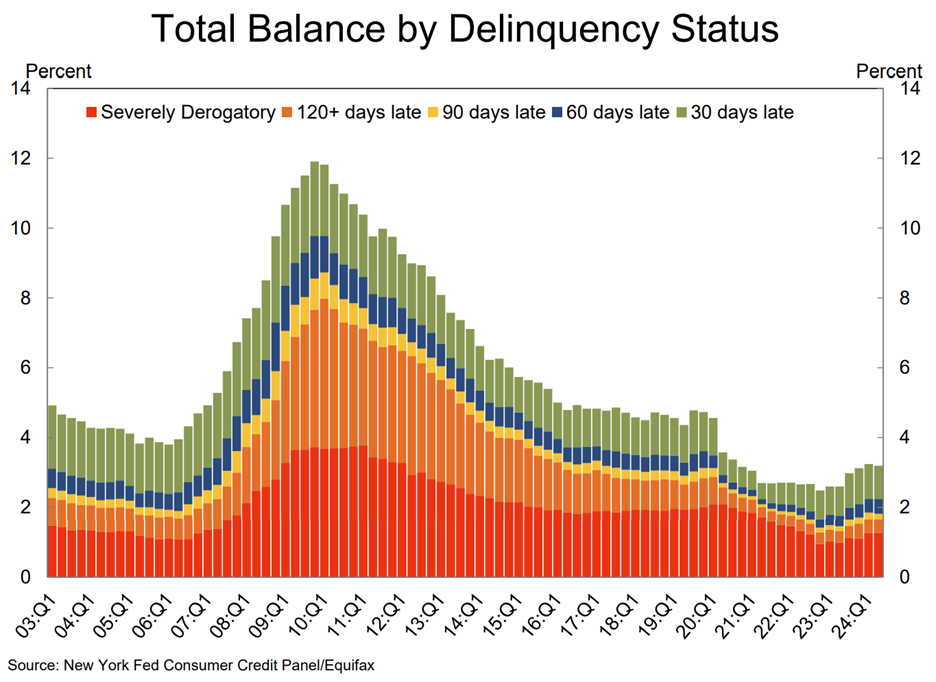

This is a choose your own adventure data series. If you want to panic, look at the fact that the percentage of credit card debt 90+ days overdue rose to its highest level since 2012.

If you want to feel slightly better about that fact, consider that total credit card debt is up just 1.2% since the fourth quarter of 2023.

And if you want to feel much better about the economy in general, consider that just 1.8% of all debt is currently overdue, lower than at any point on record before 2021 (the record goes back to 2003).

I remain concerned, however, about increases in credit card and auto loan delinquency. I think those are bad signs. Much summer travel was financed with credit cards, and now there is back to school sales, and then there is all that holiday shopping. I don’t think many consumers can keep this up for much longer.

Construction Spending by State

The Census Bureau released 2023 state-level private nonresidential construction spending data, and the fastest increases occurred in Ohio, Kansas, Georgia, Idaho, and Arizona. At least for Ohio, Georgia, and Arizona, I can confidently say that has to do with manufacturing related construction activity. This is the era of the megaproject, baby, and large-scale projects are apparent in much of our nation, including the states listed above along with Texas, New York, etc.

Wednesday

Mortgage Applications

Mortgage applications jumped to their highest level since January, with an especially large increase in refinancing activity. More of this as rates come down, though I continue to believe that we will need at least 1.5-2 percentage points to come off current mortgage rates to really get the housing market popping. 2026 will be the Year of the Realtor.

Thursday

Jobless Claims

Initial jobless claims fell last week and are back down to 233,000. There was a particularly large decline in Texas as the effects of hurricane Beryl began to unwind. Continued claims for unemployment insurance continued their steady upward climb, but overall, these claims data suggest that last Friday’s employment report is not a significant cause for concern. Did I mention that the markets seem to have figured that out?

Mortgage Rates

Mortgage rates fell again this week. The average 30-year fixed (6.47%) is at its lowest level since May 2023. Rates will keep falling over the next few months, you just watch.

U.S. Crude Oil Production

U.S. oil production ticked up to 13.4 million barrels per day last week, which is the highest level ever. Going forward, we might switch to using the monthly data series for oil production, which is slightly more authoritative.

Friday

Nothing

Go O’s and enjoy the weekend!

Links of the Week

How California Turned Against Growth (Construction Physics)

How tariffs on China could help the world (Noahpinion)

How the stressed-out brain can weaken the immune system (Nature)

Final Thoughts

After this week, my outlook for the economy is: improving

Yeah, I get it. I’m the one always calling for recession right around the corner. Oh, I still think there is a high probability over the next 12 months, but not right now. The economy simply retains too much momentum. But the economists at JP Morgan increased their recession probability this week to 35 percent by year’s end. That’s where I have been. See, things are moving in my direction. I will be right . . . eventually.

Looking Ahead

Things pick back up next week with new inflation data, a handful of housing indicators, and more.