Disinflationary Week in Review

An oil outlook, inflation, sentiment, & more

This week was all about the inflation data released on Wednesday—which, unlike the weather here, was cooler than expected—but also featured a concerning print on unemployment insurance claims, a few confidence measures, and more.

Monday

EIA Short-Term Energy Outlook

U.S. crude oil production is projected to decline in 2026, according to the Energy Information Administration. That would be the first annual decline since 2021, and the first non-pandemic-related decline since 2016 (and 2008 before that).

Why are they expecting a drop in oil output? Well, it has a lot do with…

Baker Hughes Rig Count

The number of active U.S. oil rigs fell again during the first week of June and is now down about 6% from its cyclical peak in March. The combination of low oil prices and high tariffs simply does not incentivize oil production. Oil producing infrastructure is largely comprised of steel in the ground, and enhanced steel prices render such investment less economical all things being equal.

[Note: this was written prior to Israel’s Thursday night attacked on Iran. While that did cause a spike in oil prices, forecasters seem unfazed]

Gas Prices & Diesel Prices

Given rig count and oil production projections, no surprises here. Gas prices fell to $3.24/gallon this week. That’s so low you should drive just for the sake of driving, especially if you have a convertible. Diesel prices inched higher, but remain low by recent standards.

Tuesday

NFIB Small Business Optimism Index

Small business optimism rebounded somewhat in May, but is still considerably lower than in November (small business owners tilt hard to the right, so the election caused a large increase in confidence). While there’s some cause for concern here, the good news is that more than one in five owners plan to make capital outlays over the next six months, the highest level this year.

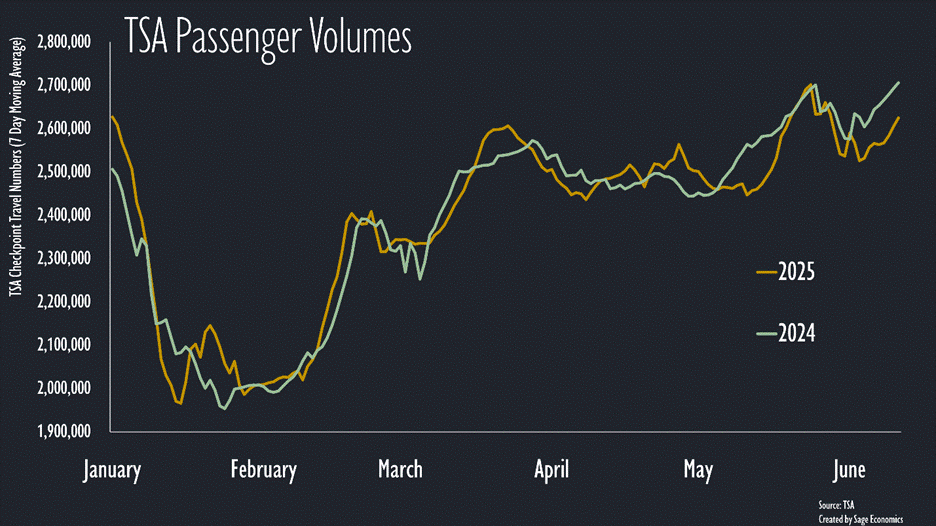

TSA Checkpoint Travel Numbers

The summer travel season is off to a bad start, with TSA travel numbers down more than 3% compared to last year. The question is whether this is due to less international tourism (Canadians are really, really mad), fewer business travelers, or weak consumer demand, and the answer is probably some combination of all three. No matter the reason, this is not an especially good sign.