Encouraging Week in Review

Inflation, retail spending, & more

Mortgage rates fell to within spitting distance of 6.0% this week, and the housing market will take off if we can get to a 5 handle. That, along with a lukewarm inflation reading, falling gas prices, and more evidence that the U.S. consumer simply cannot be stopped has me feeling better about the economy as we head into the long weekend.

Monday

TSA Checkpoint Travel Numbers

It’s been a blistering start to the year for air travel, according to TSA data. The number of people who have passed through security is up 2.3% year-to-date, with a particularly large increase over the past week.

Oil Stuff

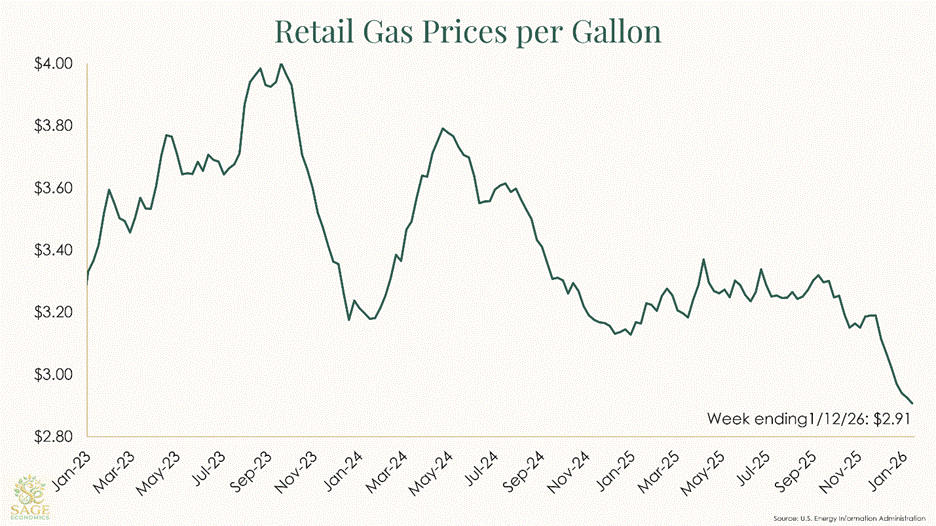

Gas prices are down to $2.91/gallon. That’s exceptionally low, which is great for consumers.

It’s less great for oil producers, who aren’t particularly fond of low oil prices. Unsurprisingly, domestic production has dipped below 13.8 million barrels per day for the first time since October (though it’s still very high by historical levels).

It’s an interesting time for the oil industry, and once the dust settles on the Venezuela situation and how that could affect the domestic economy, we’ll try to put together a longer post on the subject.

Tuesday

Consumer Price Index (Inflation)

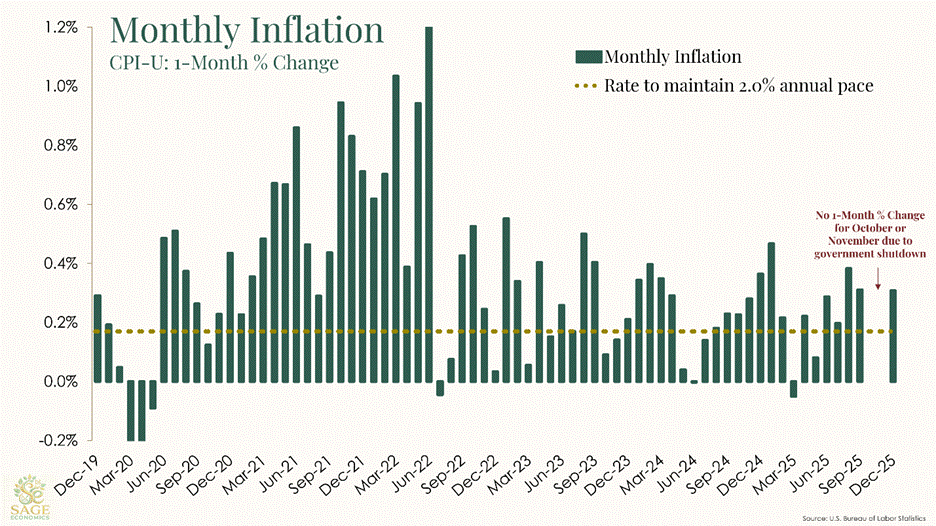

Consumer prices increased less than expected in December, though still at a faster-than-2% annualized pace.

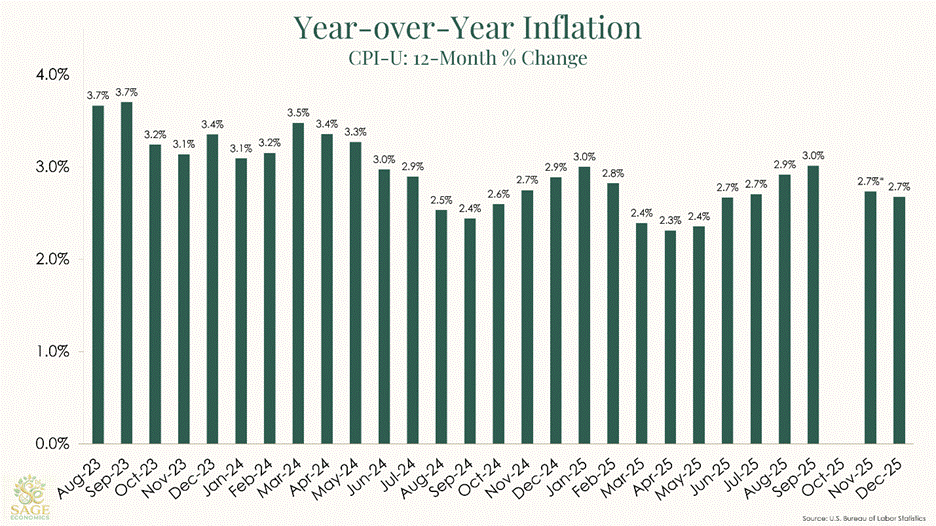

Year-over-year, prices are up 2.7%, while core prices (exclude food and energy) are up 2.6%. That’s a nice improvement over the past few months, but inflation is still well above target.

Inflation has run at a roughly 2.5% annualized pace the past couple months. Are we okay with that? The Fed doesn’t appear to be, though others are clearly clamoring for lower rates, inflation be damned.

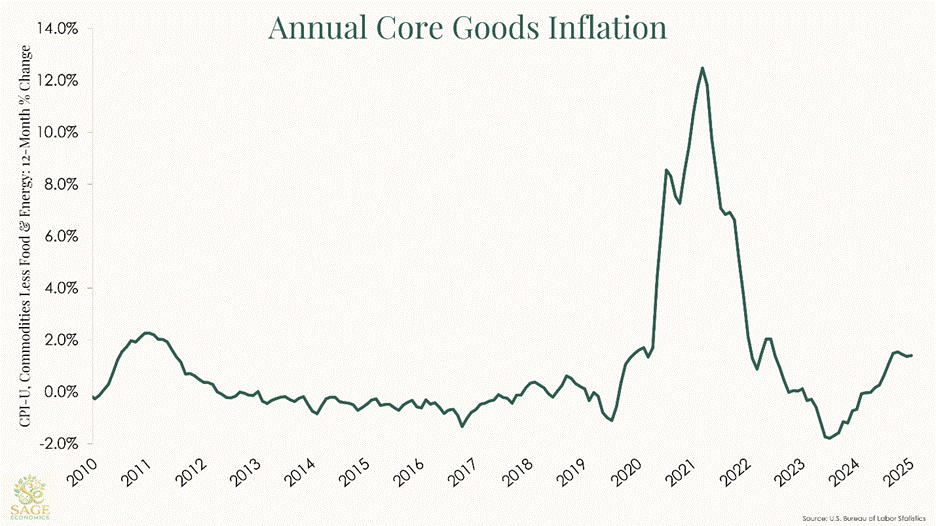

It’s also still unclear how tariffs have been (and will be) passed through to consumers. Core goods prices are rising at a nearly 2.0% year-over-year pace. While that’s not terrible, it’s also unusual (outside of the early months of the pandemic).

Big picture, inflation is in a better place than it was, but it’s not quite good enough, and rising goods prices represent an ongoing cause for concern.

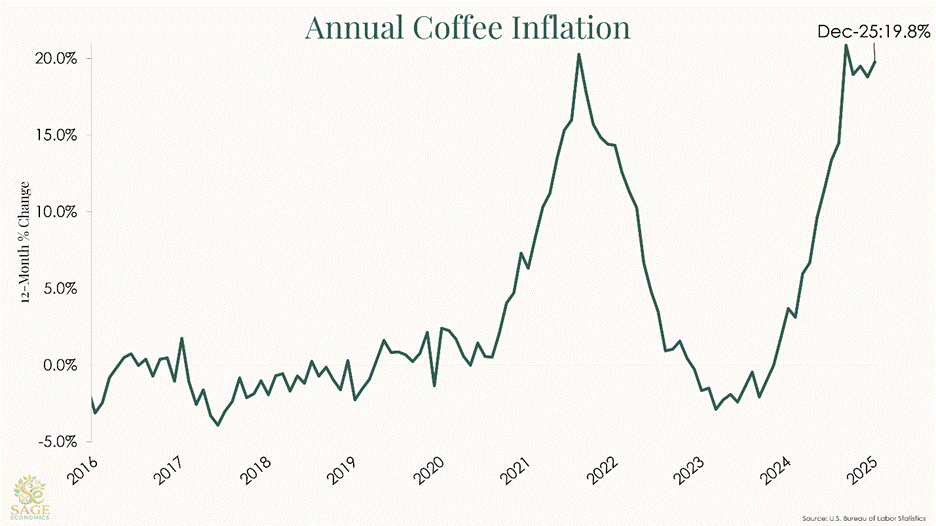

As a final note, coffee prices continue to soar and, after rising another 1.9% in December, are up a punishing 20% year over year.

NFIB Small Business Optimism Index

This measure of small business optimism increased in December but remains well below year-ago levels. Notably, the uncertainty component of the index fell to the lowest level since April 2024. A stable policy environment would go a long way for businesses in 2026.

New Home Sales

New home sales were virtually unchanged in October (this is a delayed data release, so pretty old news). Not much to see here, though inventories seem to be trending gradually lower as new home construction slows.