From Gas Prices to Consumer Sentiment

Week in Review: Dec 5-9

Some economists think recession is coming next year. Others don’t. Either way, it’s pretty clear that next year will be anything but boring. For now, we have to get through 2022, so let’s talk about the first full week of the year’s final month, beginning with . . .

Monday

Gas Prices

Gas prices fell to $3.504 per gallon, the lowest level since the end of January. Gas futures prices are now at their lowest point since November 2021. Good for you, bad for Putin.

Measures of the Services Economy

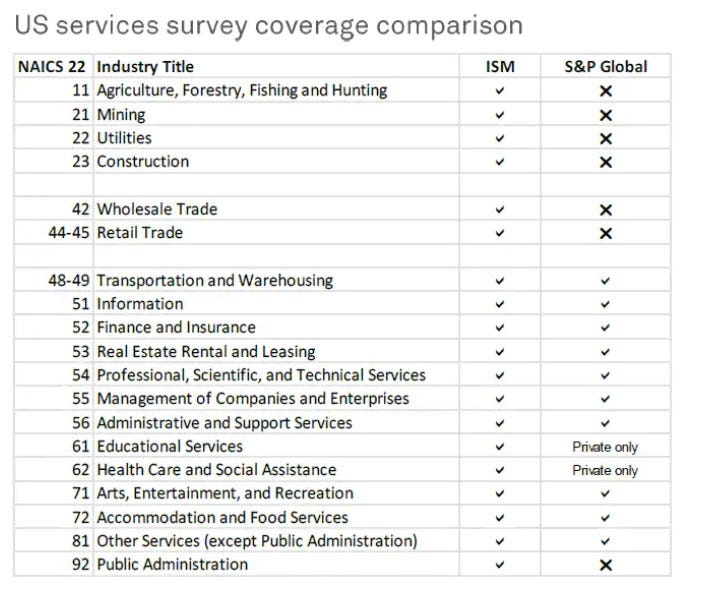

The ISM Services PMI—a measure of economic activity in the U.S. services sector—increased in November, indicating that the services sector expanded at a faster rate than it did in October. That’s inflationary. The S&P Global U.S. Services PMI fell, however, and remained below 50, meaning the service sector contracted at a faster rate than it did in October.

What’s the difference between the two measures? The ISM measure captures a much larger piece of the economy, as you can see in the table below. So the more narrowly defined group of industries captured by S&P are (allegedly) contracting, but the broader group captured by ISM are expanding. I’m going with ISM. I think the service sector is still active, including in the form of the delivery of construction services.

Factory Orders

New orders for manufactured goods increased 1.0% in October and have now risen during 12 of the past 13 months. Orders were up for both durable and nondurable goods. Inventories of manufactured goods increased again and have now risen in 21 straight months. If recession is coming, it’s not imminent.

Tuesday

Trade Balance

The U.S. trade deficit expanded from $74.1B in September to $78.2B in October. Imports increased and exports decreased. This is: 1) a sign of domestic economic strength; 2) a sign of global economic weakness; and 3) largely attributable to exports of pharmaceutical goods, which were volatile before the pandemic and have gotten a whole lot more volatile since, falling by $2.2B in October.