Gas Prices, A Rating Downgrade, & More

Week in Review: Jul. 31-Aug. 4

After the past few weeks gave us an onslaught of hotter-than-expected economic data, this week’s data and developments—including updates on credit conditions, gas prices, construction spending, a downgrade to the U.S. credit rating, a jobs report (you can read Zack’s take on today’s jobs report here), and more—were closer to lukewarm. In other words, this week did very little to resolve the question of whether or not we are headed toward a soft landing.

Monday

Senior Loan Officer Opinion Survey (SLOOS)

Banks tightened lending standards over the past three months. Standards tightened at a particularly rapid pace for commercial and industrial, land, CRE, and residential development loans. Given tighter credit conditions and high rates, demand for these loans continued to fall.

On the consumer side, banks tightened standards for mortgage (just slightly, as they were already tight), credit card, car, and other personal loans, and demand for consumer loans fell for the fourth consecutive quarter.

To date, neither higher interest rates nor the bank failures earlier this year have managed to significantly carve away at economic momentum (we wrote about this last week), but at some point tight credit conditions and steep borrowing costs will catch up with us. And that could be soon.

Gas Prices

Gas prices increased for a fourth consecutive week, up $0.16 during the week ending July 31st, and are as high as they’ve been since mid-November 2022. Gas prices don’t usually increase this quickly; this is the 12th largest weekly increase dating back to 1993.

Hot weather is a big factor here, as oil refineries aren’t designed to operate at abnormally high temperatures. Another cause is the 1 million barrels per day cut OPEC+ implemented starting in July.

TSA Checkpoint Travel Numbers

The number of people passing through TSA security during the week ending July 31th was up a little less than 1% compared to the same week in 2019, and travel volumes have stayed above 2019 levels for the past two weeks, the longest streak since the start of the pandemic.

Quite a few people (including me) have said that airport crowds seem more than 1% larger than in 2019. I suspect this is due to the increase in leisure travel and the decrease in business travel. First, this dynamic likely shifts the times (and routes) that people are traveling. Second, business travelers move through the airport with the quiet calm of a professional, while there’s nothing calm about overstressed parents herding their kids through the terminal.

Tuesday

Job Openings & Labor Turnover Survey (JOLTS)

The number of open, unfilled jobs fell to 9.6 million on the last day of June. That’s the fewest since April 2021 but still about 2.6 million more than before the pandemic. While job openings have clearly trended lower since peaking in March 2022, 5.8% of all positions are currently unfilled, significantly higher than at any point between the start of the data series in 2000 and the start of the pandemic. So we’re still dealing with labor shortages, but there were some good signs in this report.

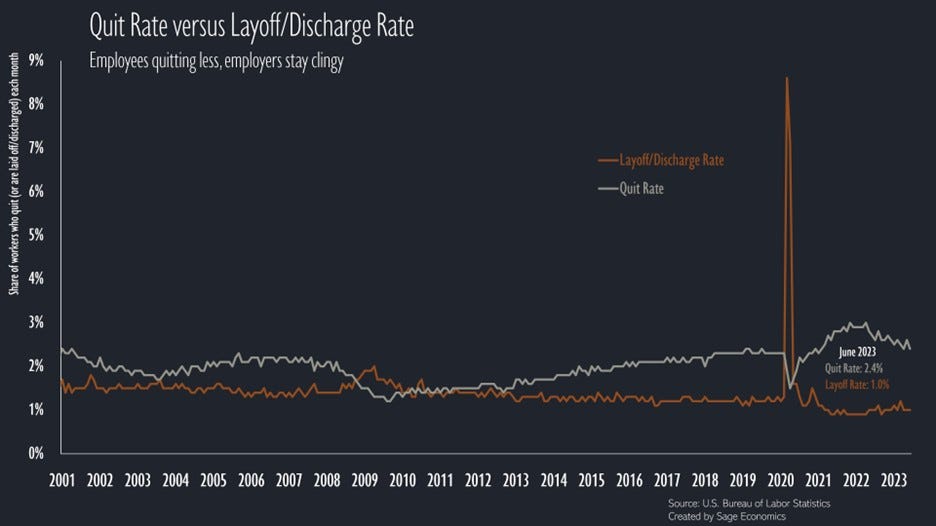

A lot of workers quit their jobs over the past two years because new hires tend to get large pay raises when labor is scarce. That trend is starting to fade; just 2.4% of workers quit their jobs in June. That’s roughly in line with 2019 levels and well below the 2021-2022 quit rates.

While workers are starting to settle into their positions, employers remain reluctant to get rid of workers. The layoff/discharge rate stayed at 1.0% in June, lower than during any month before March 2021.

There are still about 1.6 open jobs per unemployed person, meaning there just aren’t enough available workers to meet the demand for labor. On the one hand, this means the demand side of the economy can (at least theoretically) cool considerably before it meaningfully impacts unemployment. On the other hand, the imbalance between the supply of and demand for labor is pushing wages higher, contributing to inflation. The longer that dynamic persists, the longer the Fed will keep interest rates elevated. Higher for longer has become the consensus view.