Halloween Week in Review

Tariffs, Candy Prices, & More

The federal government has been shutdown for 30 days, and prediction markets put the odds of at least another two weeks of shutdown at a little over 50%. Hopefully prediction markets are overly pessimistic.

Even with the shutdown, this week gave us updates on private jobs data, trade talks, symbolic senate votes on tariffs, consumer confidence, and more.

Monday

Texas Manufacturing Outlook Survey

This survey from the Dallas Fed shows that manufacturing activity in Texas expanded slowly in October. Given everything that’s going on with manufacturing, even reports of slow growth should be viewed as good news.

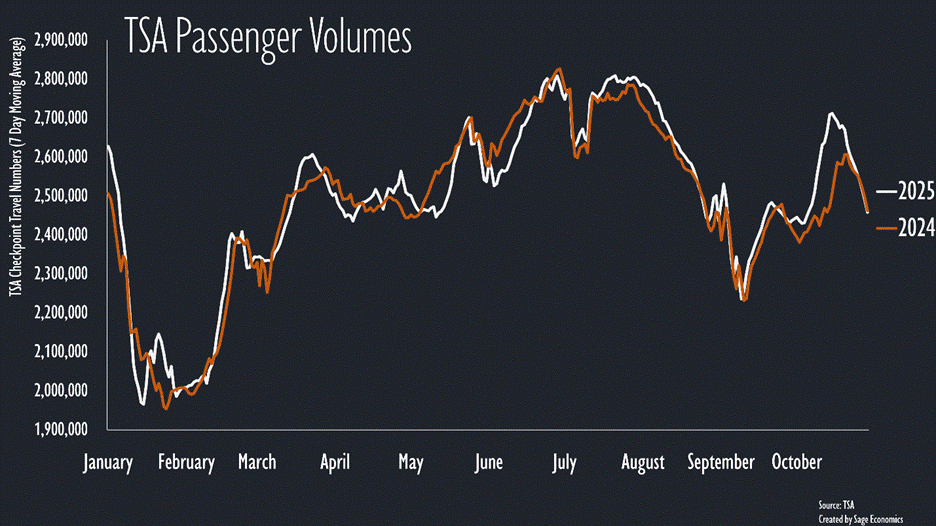

TSA Checkpoint Travel Numbers

The number of people flying dipped below year-ago levels over the past week, according to TSA data. Also of interest: we speculated that the shutdown was affecting this data series the past few weeks, but—as a helpful reader pointed out—the gap in flying volumes is likely the result of bad weather in the middle of October 2024 rather than bad data.

Oil Stuff

Oil stuff remains boring, which is in no way a bad thing. The number active U.S. oil rigs and gas prices inched higher, while diesel prices rebounded after falling pretty sharply the previous two weeks.

Tuesday

ADP Private Employment Data

ADP (a payroll processing firm) is going to start publishing private employment estimates every Tuesday. This is especially exciting during a government shutdown, but even once the government reopens it will be nice to have another high frequency labor market indicator.

Their first release estimates that the private sector added an average of 14,250 jobs per week since October 11. That’s a healthy pace of growth and should make us feel just slightly better about the labor market situation (“slightly” because we have no idea how useful these data are just yet).

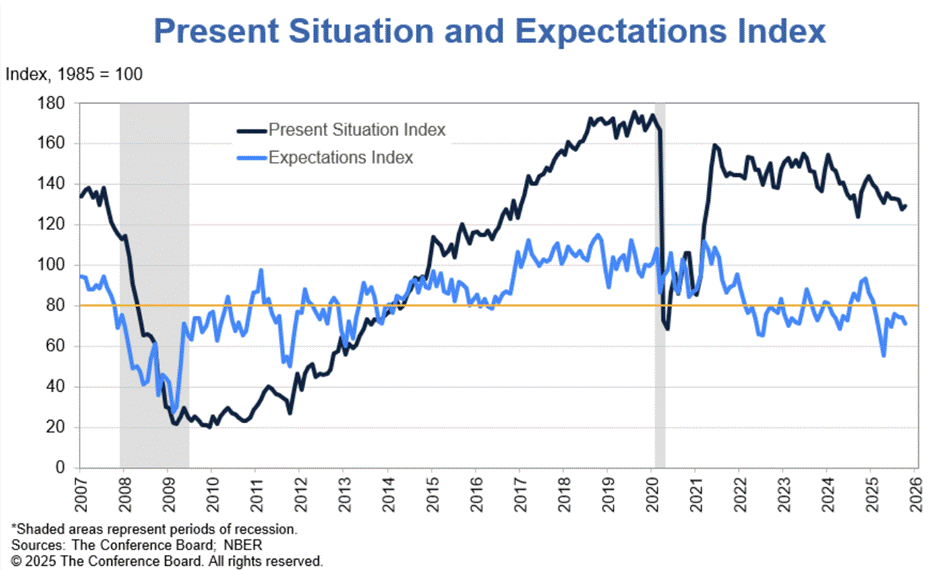

Conference Board Consumer Confidence

This measure of consumer sentiment fell in October. There are two parts of this index; the one that assesses current conditions improved for the month, while the forward-looking component worsened.

What should you take from this? Consumers remain pretty pessimistic about the future.

S&P Cotality Case-Shiller Home Price Index

First: the name of this indicator keeps getting longer and worse (it was the S&P CoreLogic Case-Shiller Home Price Index last month). I half suspect they’re doing it just to piss me off.

Second: home prices remain really tame, up just 1.5% between August 2024 and August 2025. While that’s good news for potential homebuyers, a drop in mortgage rates would do a lot more for housing affordability.

Richmond Fed Manufacturing (& Non-Manufacturing) Survey

Manufacturing activity in the fifth Fed district (covers MD, VA, NC, SC, most of WV, and DC) shrank in October, though at a slower rate than in September. It’s been about 2 years since this measure has indicated growth.