Hiring Cooled in October

Wage growth also slowed

This post is sponsored by Pivot Workforce. I wouldn’t accept a sponsor for this newsletter unless they were 1) a company I know and trust and 2) tackling an important problem like the construction industry's skilled labor shortages. Pivot checks both those boxes. Their goal is to help construction companies get the high-quality talent they need, and they have over three decades of experience staffing difficult-to-fill positions for some of the most recognized names in the construction industry. I urge any contractors struggling to find workers to give Pivot a look.

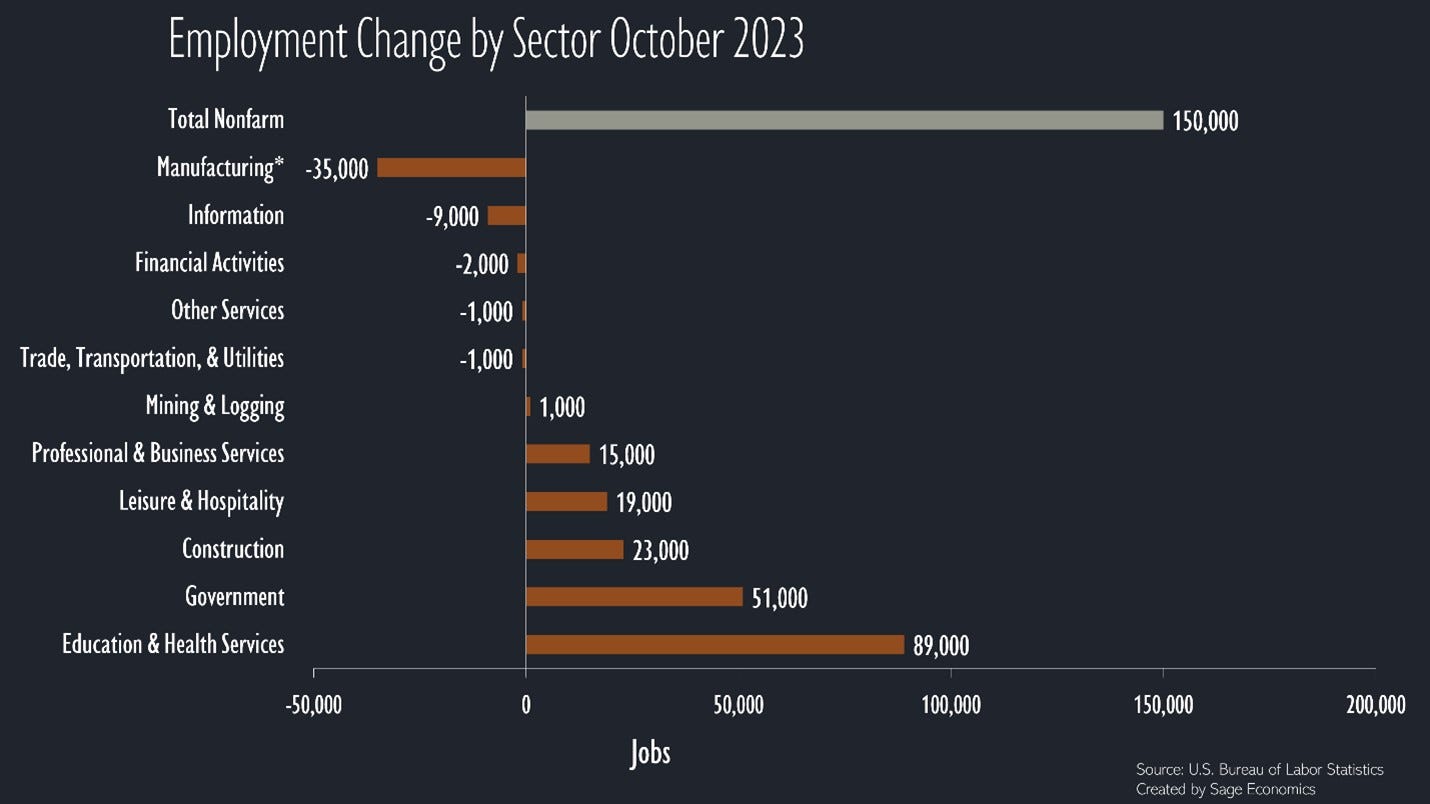

U.S. payroll employment increased by 150,000 in October. That’s fewer than forecasters expected, but the UAW strike probably subtracted about 30,000, and those will be back next month.

The details of today’s report are weaker than the headline number. Revisions to August and September’s estimates subtracted a combined 101,000 jobs, and public sector positions accounted for over a third of October’s growth (51,000 jobs). A handful of sectors lost jobs for the month, though manufacturing employment was probably closer to flat given the impact of strikes.

The unemployment rate inched up to 3.9% (as expected). That’s the highest level since January 2022, though still low by historical standards, and the labor force participation rate ticked down to 62.7%. That’s just barely below last month’s post-pandemic high of 62.8%, but we’re still well short of the February 2020 level of 63.3%.

The household survey (which asks people about their employment status instead of looking at payrolls) suggests we lost 348,000 jobs in October. That’s a significantly more volatile indicator than the establishment survey (which gives us the headline jobs number), but it’s another check in the “weak report” column.

Big picture, it certainly looks like the demand for labor is slowing. This is exactly what everyone thought would happen. They just thought it would happen much earlier in this cycle of rising interest rates.

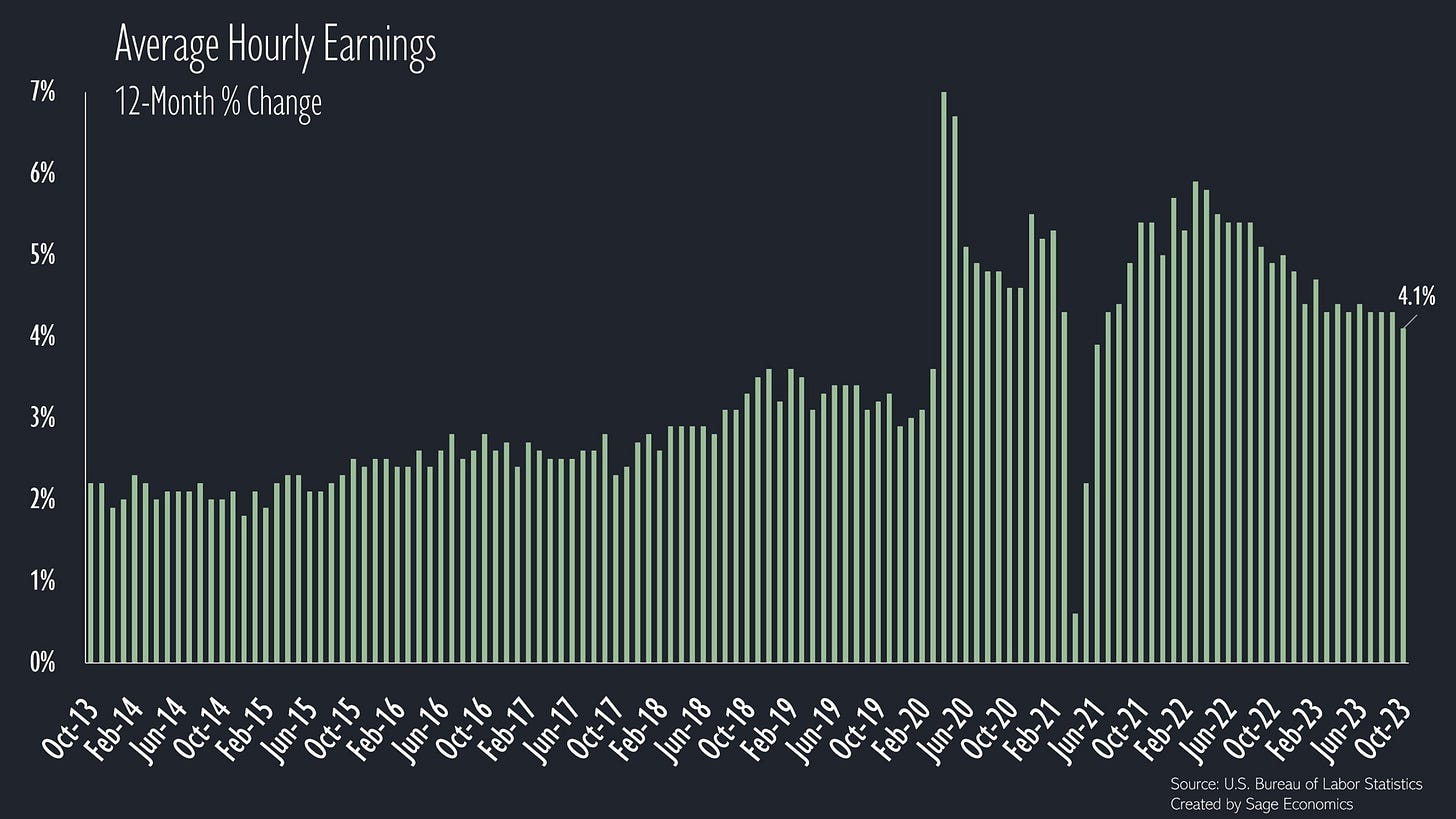

The Fed, which decided not to raise rates at their meeting earlier this week, will like what they see in today’s report. Why? Because slower job growth comes with slower wage growth; average hourly earnings rose just $0.07 (0.2%) in October, the smallest monthly increase in both absolute and percentage terms since February 2022. Over the past year, earnings are up 4.1%. That’s still way too fast to get inflation back to the Fed’s 2% target, but it’s trending in the right direction.

You can read what Anirban had to say about construction hiring over at ABC.

Final Thoughts

I have two takeaways from this report. First: the economy has added jobs in 34 straight months, and despite a weakening labor market, job growth has averaged 204,000 over the past three months. If wage pressures keep abating, a soft landing is a real possibility (though far from a certainty; inflation still needs to come down).

Second: after this release, the S&P 500 jumped and two-year treasury yields plummeted. This is markets way of telling us they think the Fed is done with interest rate increases, and I agree.

What’s Next

Anirban may disagree with me on both of those takeaways. His Week in Review, which is only for paying subscribers, will be out later today. If that’s not you and you want it to be, just click the button below.