This post is sponsored by Pivot Workforce. We wouldn’t accept a sponsor for this newsletter unless they were 1) a company we know and trust and 2) tackling an important problem like the construction industry's skilled labor shortages. Pivot checks both those boxes. Their goal is to help construction companies get the high-quality talent they need, and they have over three decades of experience staffing difficult-to-fill positions for some of the most recognized names in the construction industry. We urge any contractors struggling to find workers to give Pivot a look.

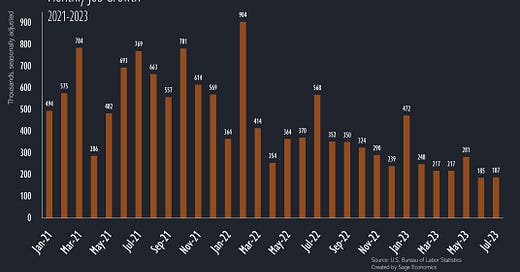

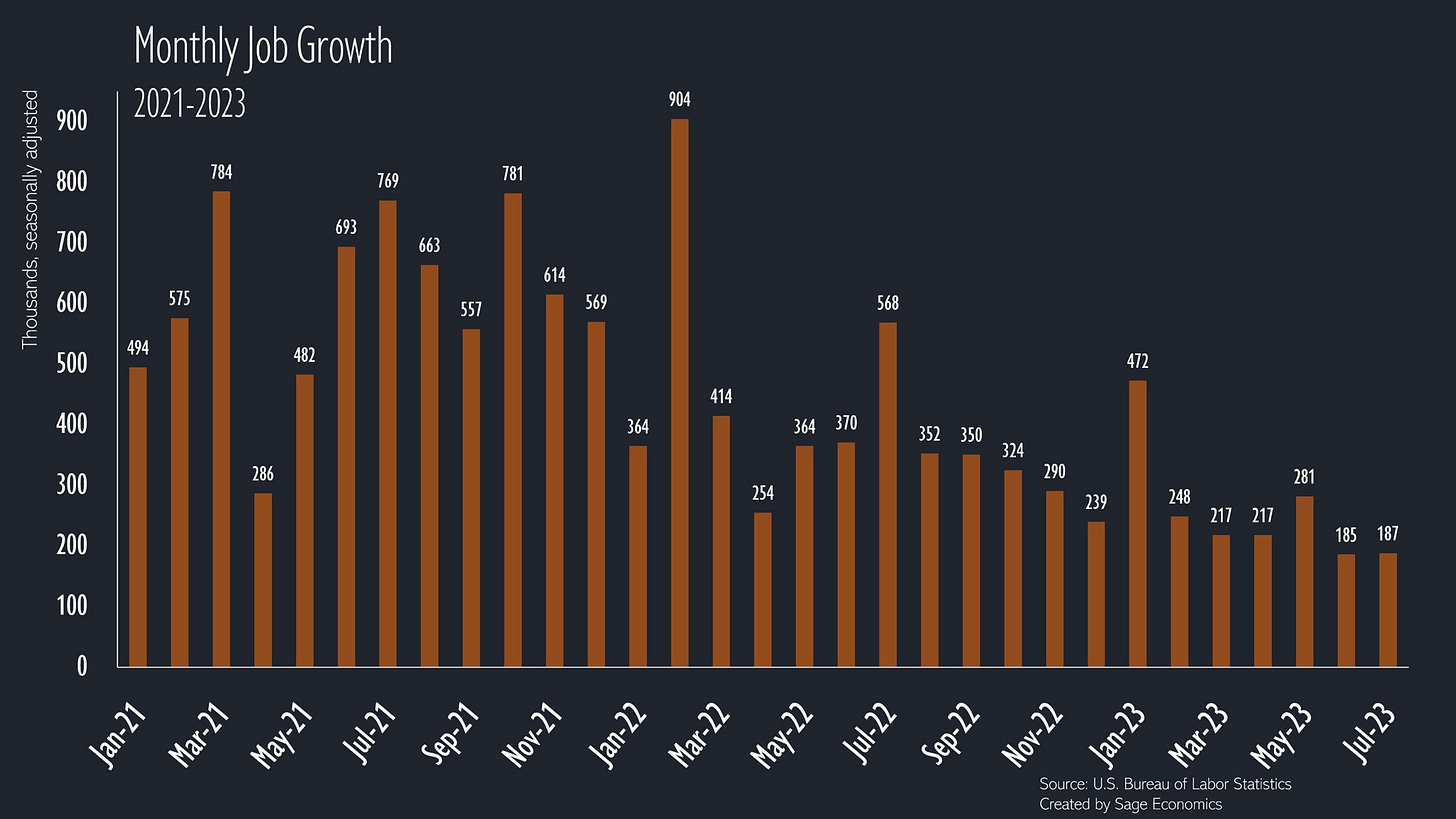

U.S. payroll employment increased by 187,000 in July, about 13,000 fewer new jobs than expected, and the unemployment rate fell to 3.5%, just a hair above the lowest rate since 1969. May and June’s employment estimates were revised down by a combined 49,000 jobs, so growth was a bit slower during the second quarter than we initially thought.

Today’s report doesn’t change much about our understanding of the economy. Job growth is still fast by historical standards but has been slowing from the unsustainably rapid pace of the past two years. That’s exactly what the Fed wants to see as it tries to cool down the economy in its efforts to suppress inflation.

That said, one part of today’s jobs report won’t sit well with the Fed: hotter than expected wage growth. Average hourly wages are up 4.4% over the past year, and the pace of wage growth has actually accelerated over the past two months, rising at a 4.9% annualized rate in both June and July.

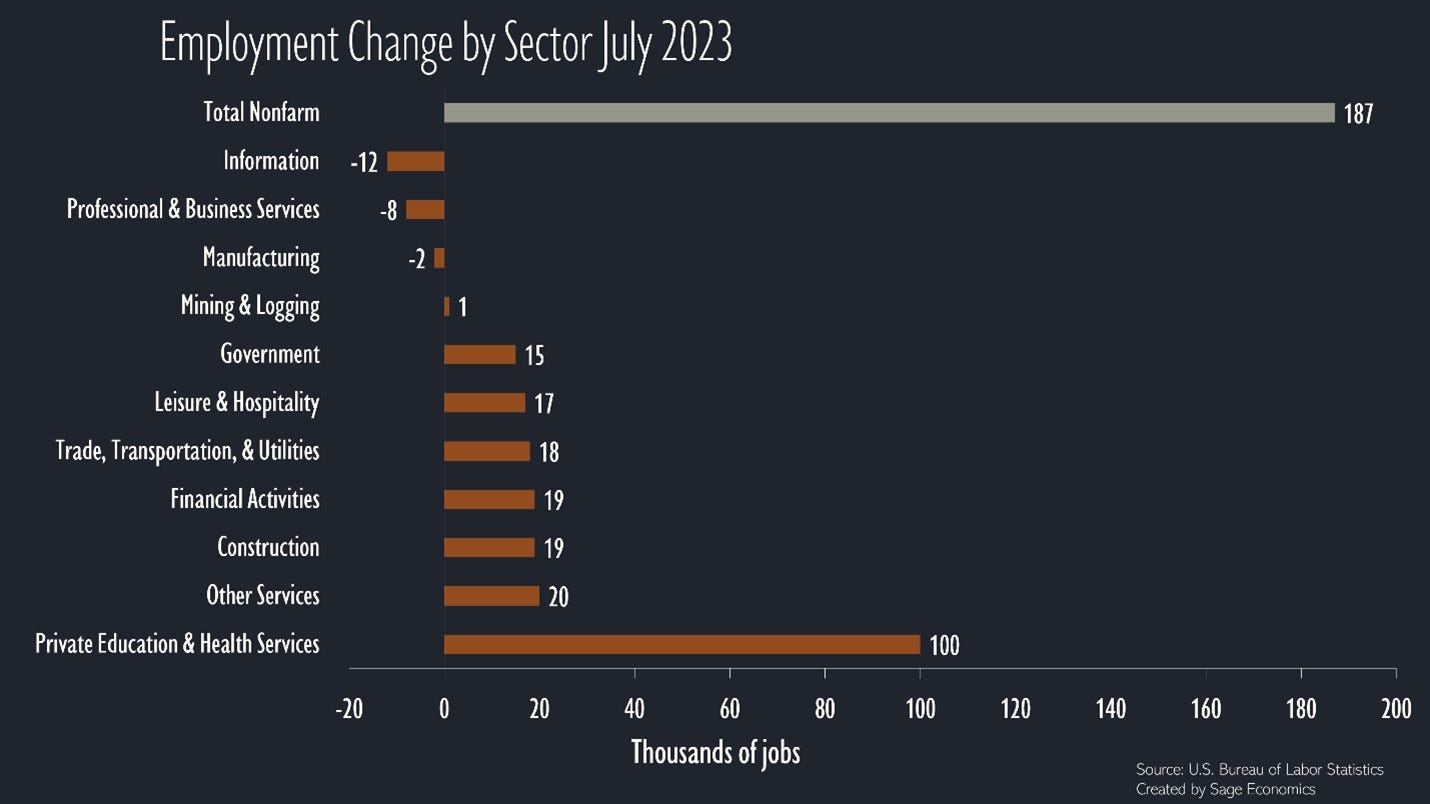

The information sector lost 12,000 jobs in July, but that includes the motion picture and sound recording industries subsector, and a majority of those lost jobs likely pertain to the SAG-AFTRA actors’ strike. The information subsector most closely associated with the tech industry actually gained jobs in July.

The professional and business services segment also lost a significant number of jobs in July, and that’s entirely due to a massive decline in the temporary help services category (think temp agencies). This is usually thought to be a leading indicator that predicts job growth in future months, and if that’s true, job growth will slow meaningfully over the next few months.

But I’m not sure that is true. With the unemployment rate at 3.5% and the demand for labor so much higher than the supply, who needs to temp? It’s arguably never been easier to go out and get a job sans the help of a staffing service.

We expected hiring to be a lot faster in service-related sectors than goods-related sectors in July, and that’s exactly what happened. Over half of July’s job growth occurred in the private education and health care segment. Employment in that segment remains well below the pre-pandemic trend, so expect continued job gains there.

Hiring in goods-related segments, like manufacturing, which lost 2,000 jobs for the month, was as weak as expected in July. This trend should continue over the next few months as spending reverts toward the pre-pandemic balance of goods and services.

The biggest surprise in the July data was a second consecutive month of weaker than expected leisure and hospitality hiring. This is especially surprising because the ADP employment report earlier this week showed a 201,000 increase in leisure and hospitality employment in July. Either the BLS or ADP are wrong about this segment, and my guess is that the error has something to do with seasonal adjustments.

You can read what Anirban had to say about construction hiring over at ABC.

Final Thoughts

Employment growth is slowing but remains strong, the unemployment rate remains historically low and employers still struggle to find workers, the services side of the economy is stronger than the goods side, and wages are rising too quickly, complicating the Fed’s effort to suppress inflation.

Despite the concerning wage data, today’s release supports the notion that a soft landing is possible, and maybe even probable. Quite a few forecasters, including Bank of America, have rescinded their recession calls for later this year, and while we’re not out of the woods just yet, the economy is looking better than quite literally anyone expected it would at the start of the year.

What’s Next

We’ll have Anirban’s Week in Review out for paying subscribers later today. If that’s not you and you want it to be, just click the button below.