Hiring Smashes Expectations in December

256,000 new jobs, unemployment rate down to 4.1%

This post is sponsored by KODIAK – Proven Workforce Solutions. I wouldn’t accept a sponsor for this newsletter unless they were 1) a company I trust and 2) addressing critical issues like skilled labor shortages in construction. KODIAK, which recently merged with Pivot, checks both those boxes. Their mission is to help construction companies find experienced talent, including engineers and project managers for Direct Hire, as well as skilled craft professionals like welders and electricians for contingent staffing. With over three decades of experience, I encourage contractors struggling to find workers to consider KODIAK.

Boom! U.S. employers added 256,000 jobs in December. That 1) smashes expectations, 2) makes 48 consecutive months of job gains, and 3) is the fastest monthly growth since March.

As you can see, employment growth slumped in the middle of 2024 but has clearly picked up since September.

The unemployment rate fell to 4.1%, and it fell for all the right reasons. The number of people looking for jobs increased, the number of people with jobs increased even more, and the number of people looking for jobs who don’t have one fell by the largest amount in over a year.

There are a few potential explanations for this stronger-than-expected data. First, some firms delay decision making before a presidential election. That, combined with the fact that business owners, and especially small business owners, are fond of Trump, could explain the November and December uptick in hiring.

It’s also possible that the U.S. consumer, despite many predictions to the contrary, is actually unstoppable. The details support this; traditional brick and mortar retail establishments added 43,400 jobs for the month (this could also be due to Holiday shopping patterns returning to some semblance of normalcy following the pandemic, something that could skew seasonal adjustments).

But What About Interest Rates?

I’m of the surprisingly unpopular opinion that good news is, in fact, good news. And to be clear, this jobs report is definitely good news.

But yes, today’s jobs report does not bode particularly well for the path of interest rates in 2025. For rates to come down, inflation needs to slow, and today’s better-than-expected data suggests inflation might remain too hot in the coming months.

Markets certainly buy this theory. Ten-year treasury yields surged immediately after the report was released, rising to the highest level since October 2023.

Put simply, there’s not a particularly convincing argument right now for lowering interest rates.

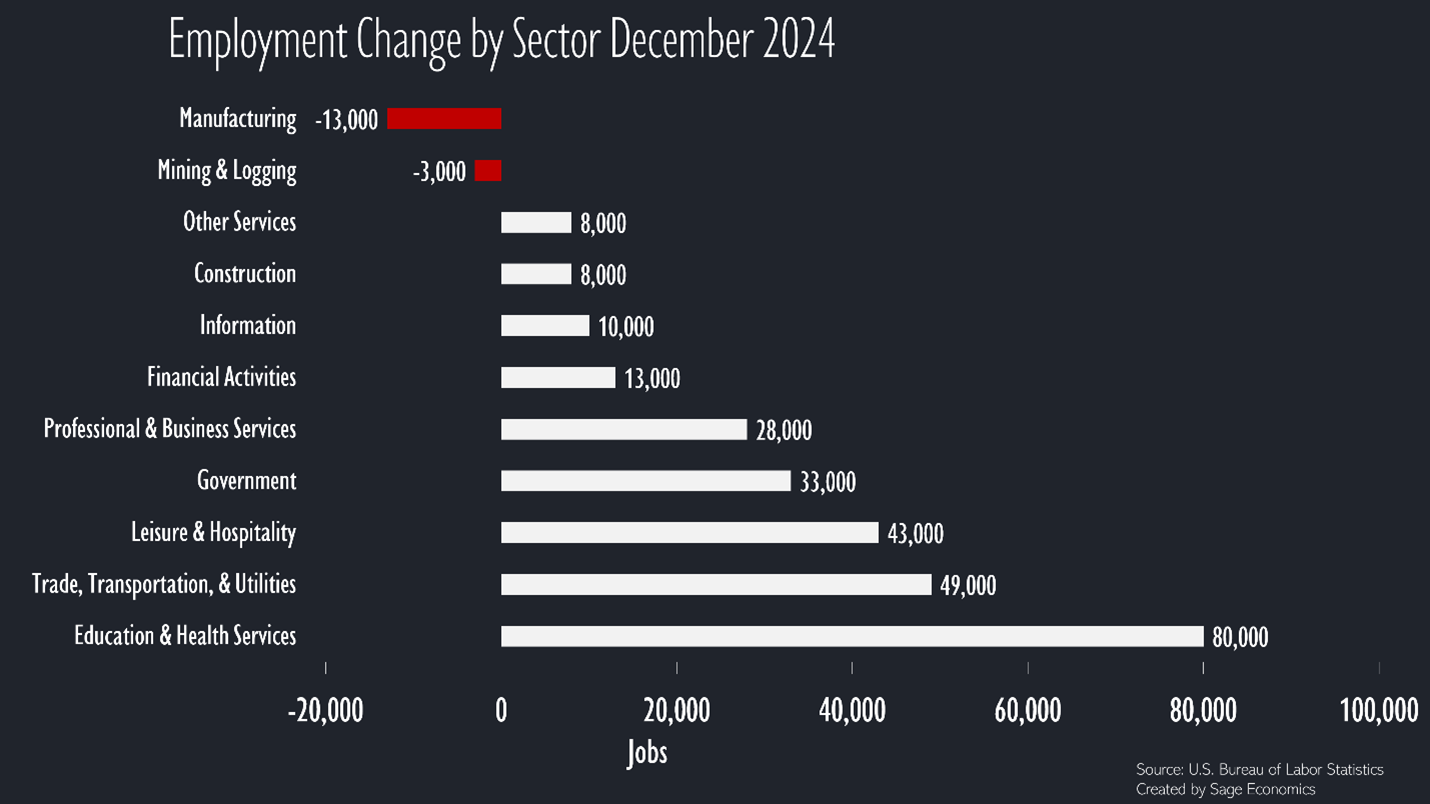

By Sector

Healthcare keeps churning out jobs, and as mentioned above, it was a great month for retail hiring. Restaurants also hired at a brisk pace in December.

The weakness in manufacturing was concentrated on the durable goods side (things that last at least three years). There was a particularly large downturn in computer and semiconductor manufacturing, which is a little confusing given the slew of megaprojects currently underway.

Finally, it was a bit of an underwhelming month for the construction industry. You can see what Anirban had to say on that over at ABC.

Final Thoughts

The labor market appeared to be weakening in the middle of the year, but it’s obviously stabilized in recent months. This makes me feel better about how the economy will perform in 2025, although we might be looking at higher-for-longer interest rates.

What’s Next?

Anirban is currently working on Week in Review, our every Friday post where we concisely cover everything you need to know about the economy. That’s just for paying subscribers. If that’s not you and you want it to be, just click the button below:

Thanks for the summary.