Home Sales, Election Uncertainty, & More

Week in Review: Oct. 21-25

This week gave us a lot of housing market indicators, none of which were particularly encouraging. According to Fannie Mae, it would take one of these things for housing affordability to return to pre-pandemic levels:

A 38% drop in the median price of a single family home (not going to happen)

A 60% increase in median household income (also not going to happen)

Mortgage rates fall to 2.35% (still not going to happen anytime soon)

Blessed are those who bought homes before 2022. Also, blessed our those who root for teams featuring Derrick Henry, #22.

Monday

New FTC Rule on Fake Reviews

A new rule banning fake online reviews and testimonials went into effect on Monday. On the one hand, I’m not a fan of government overreach. On the other, fake reviews are an annoying market distortion…

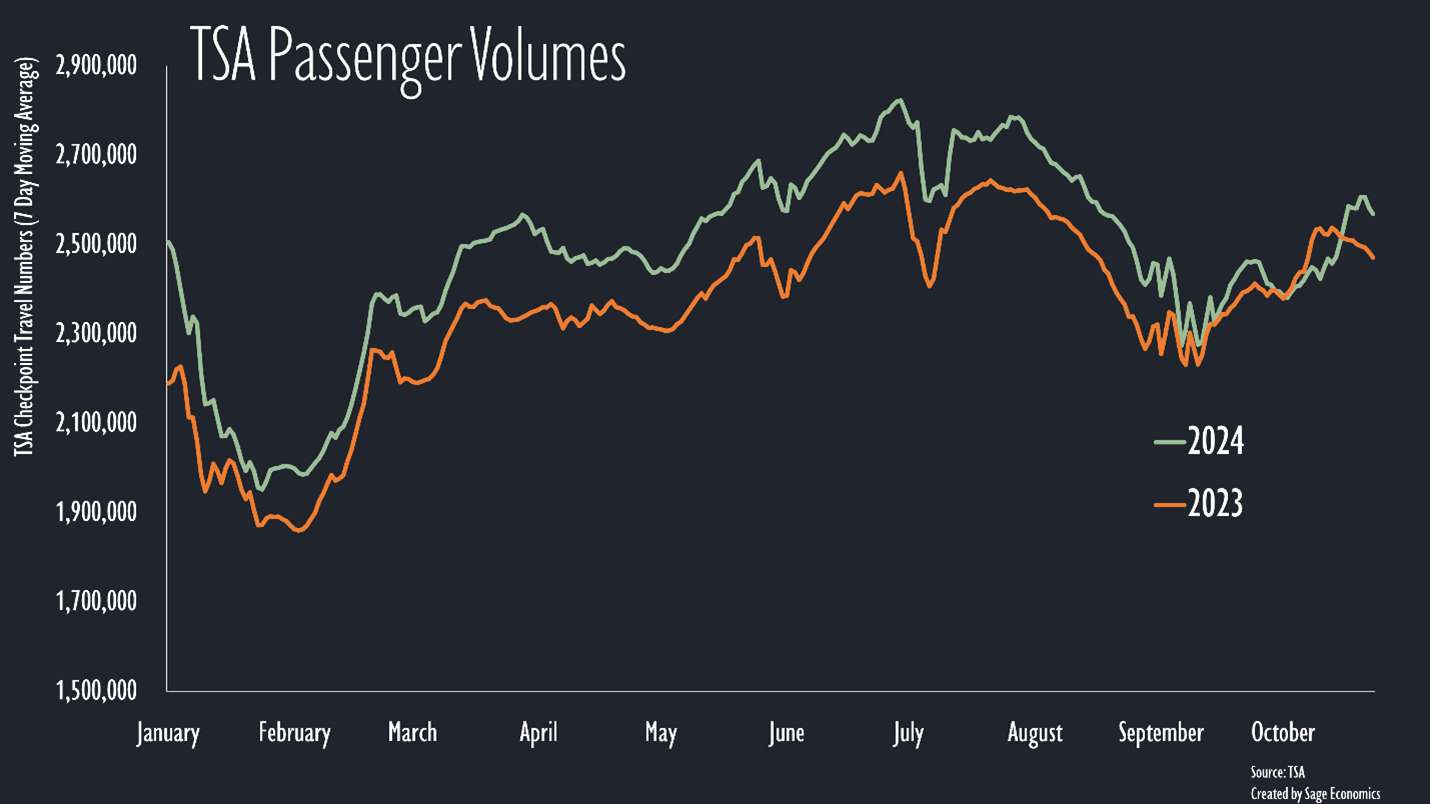

TSA Checkpoint Travel Numbers

Travel volumes are back to running about 4% above 2023 levels, according to TSA data. The reduction in air travel caused by the hurricanes is pretty clearly visible on the chart below.

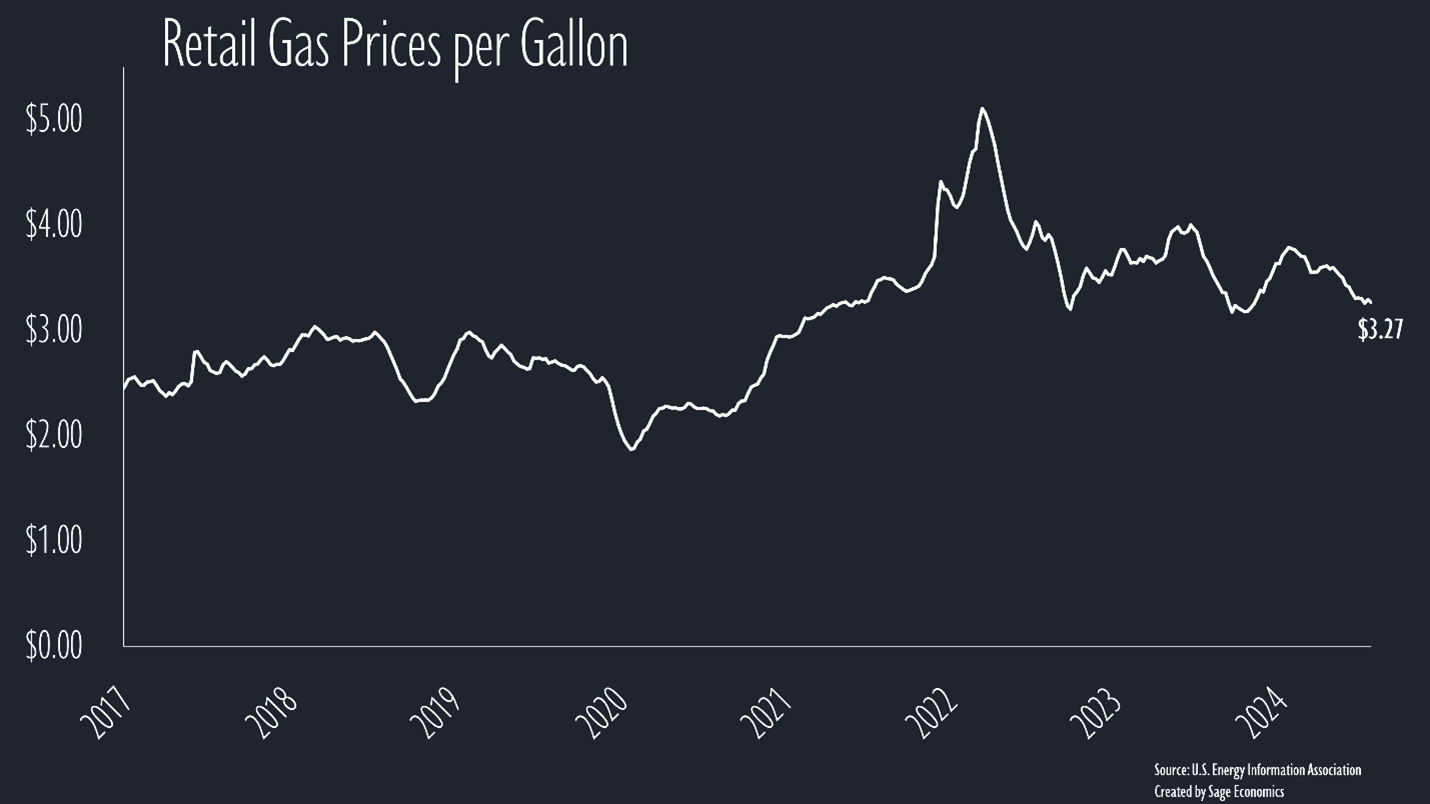

Gas Prices & Diesel Prices

Gas prices edged down to $3.27/gallon last week, right about at the lowest level since early February. Diesel prices fell to $3.55/gallon. This is another tailwind for consumers as we enter the heart of the holiday spending season.

Tuesday

State Employment & Unemployment

Unemployment rates were largely unchanged in September, with 44 states and D.C. seeing no meaningful changes. The same is true of employment; 45 states saw no meaningful change in jobs in September, while the other five and D.C. added jobs for the month.

South Dakota had the lowest unemployment rate of any state at a quite frankly unthinkable 2.0%. Given unemployment related to people switching jobs, that almost seems impossible. D.C. had the highest rate at 5.7%, which is still relatively low by historical standards.