Hot Week in Review

Inflation, retail sales, & more

This week was absolutely loaded with economic data releases. Like the weather across much of the country, most of them came in hotter than expected—both in a good (retail sales) and bad (inflation) way.

Monday

TSA Checkpoint Travel Numbers

The summer travel season is going great, according to TSA data. This was a big concern for me around May, so I’m reassured by the fact that Americans are traveling in droves.

Baker Hughes Rig Count

The number of active U.S. oil rigs slipped lower again this week and remains about 11% lower than one year ago. To the extent falling rig counts reflect tariff-boosted input costs, this is bad. To the extent it reflects lower oil prices, I doubt drivers are too upset about it.

Gas Prices & Diesel Prices

Gas prices were flat this week at $3.25/gallon and are $0.36/gallon cheaper than one year ago. Lower gas prices have provided a critical boost to consumer health this summer. Spending at gas stations was about $500 million lower in June 2025 than in June 2024 (more on this data under Retail Sales on Thursday).

Diesel prices rose again but remain about $0.10/gallon below year-ago levels.

Tuesday

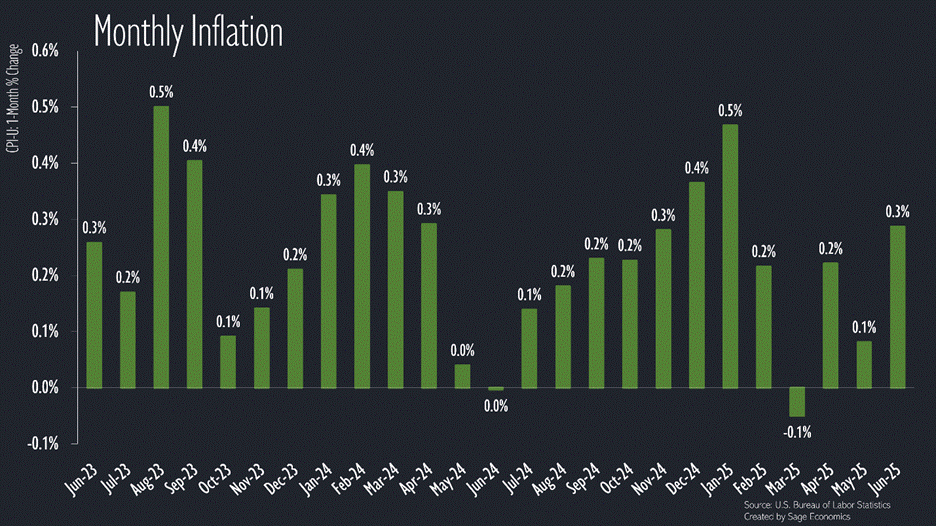

Consumer Price Index (Inflation)

Consumer prices increased quickly in June, ending a 3-month streak of tamer-than-expected inflation. Prices were up 2.7% year over year in June, a 0.3pp increase from May.

The monthly acceleration isn’t great, but it’s also not terrible—at least at a glance. It’s the details that give some cause for concern.

The goods you’d expect to be affected by tariffs are starting to look pretty affected by tariffs. Appliance prices jumped in June, as did tools, hardware, and supplies prices, with both categories rising at a roughly 11% annual pace in the second quarter.

It’s still way too soon to know the ultimate impact of tariffs on prices (and not just because the rates are still far from set). It could be the case that companies stocked up on inventories in the first quarter, meaning that we won’t really feel the higher taxes until those inventories wear down. There’s also a chance that goods prices take off but services prices either rise at a slower pace or outright fall.

Don’t trust anyone who claims to know what will happen with prices over the next few months. How much of these higher costs can (or will) businesses swallow? How easily are these tariffs being circumvented? Are consumers taking it on the chin or shifting their spending to less affected goods or services? Nobody knows.

What do we know? After this release, we can wave goodbye to the idea of July rate cut.

Empire State Manufacturing Survey

Manufacturing activity picked up in New York in July, though just slightly, expanding for the first time since February. While we don’t usually cover regional Fed surveys, it’s notable that businesses appear to be acclimating to heightened uncertainty.