We didn’t cover Friday’s data in the last Week in Review, so this is a longer post digging into the details of the Census Bureau’s May 2023 Personal Income and Outlays report.

Inflation

When the Fed talks about its 2% inflation target, they mean that they want to see the PCE Price Index increase 2% every twelve months. We’re slowly getting closer to that target, with overall prices up just 0.1% in May and 3.8% over the past year. Core inflation (excludes food and energy prices because they’re volatile) increased 0.3% in May and is up 4.6% over the past year.

This is an improvement, but trimming inflation from 4% to 2% might be a slog. Jerome Powell, chairman of the Fed, thinks we won’t get there until 2025. That seems like a reasonable estimate.

Personal Income

Americans’ personal income increased slightly faster than inflation in May, up 0.4% for the month. That’s a healthy rise and right about what was expected. Disposable income also climbed 0.4% in nominal terms and 0.3% after adjusting for inflation. This is pretty healthy growth; not too slow to sustain growth, not so fast that it puts upward pressure on prices.

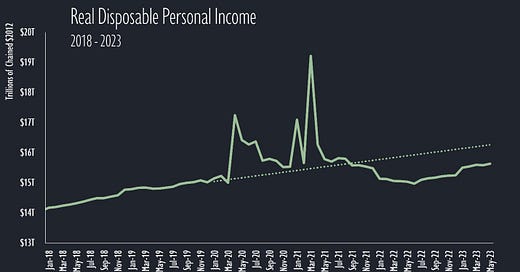

Real disposable personal income (adjusted for inflation) has now risen in 10 of the past 11 months but, as you can see below, remains under the pre-pandemic trend.

Personal Consumption Expenditures

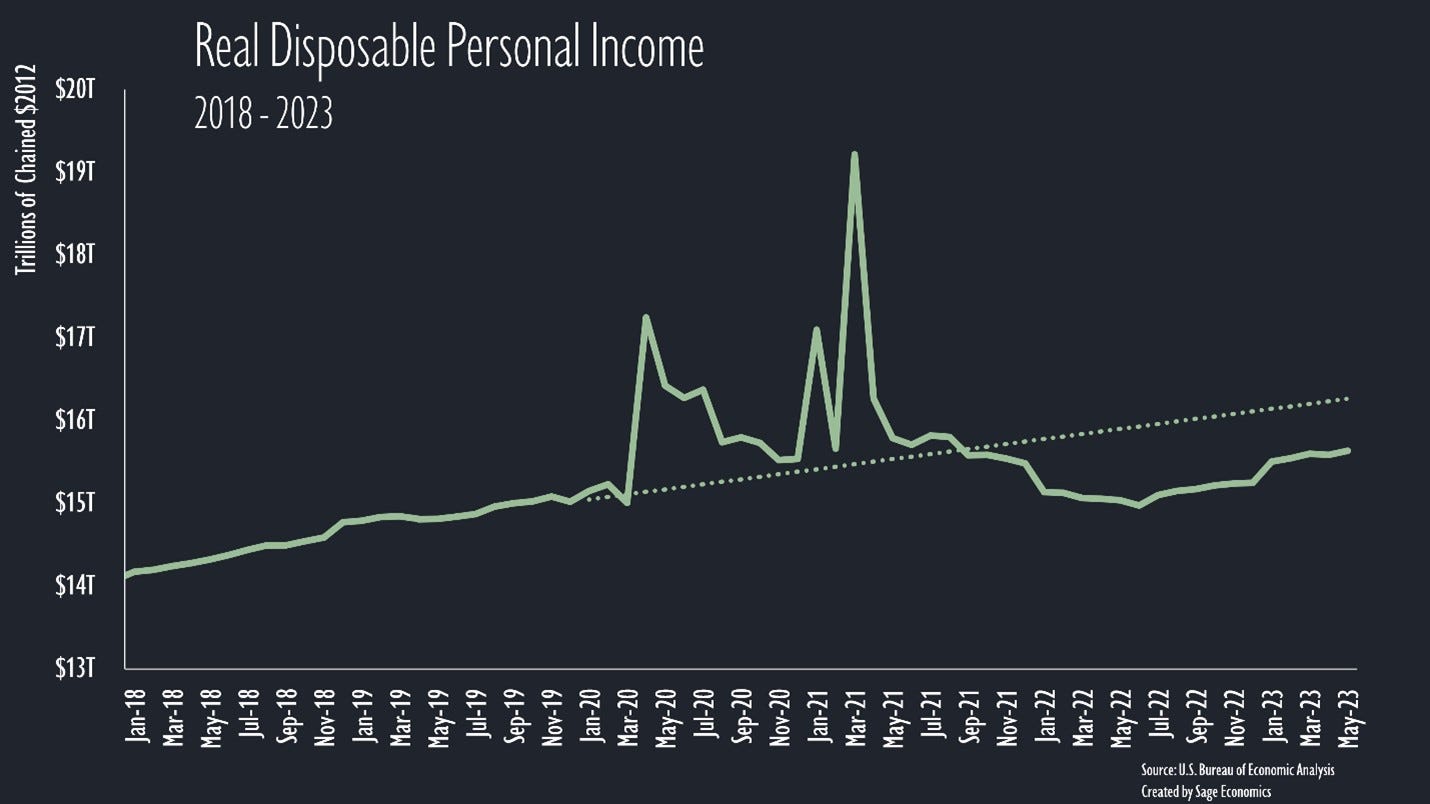

Consumer expenditures, on the other hand, are right about on trend, and the balance between goods and services spending is getting back to normal. After spending on goods surged during the early part of the pandemic, it’s since floated back down to normal levels. The opposite is true for services.

Personal Saving Rate

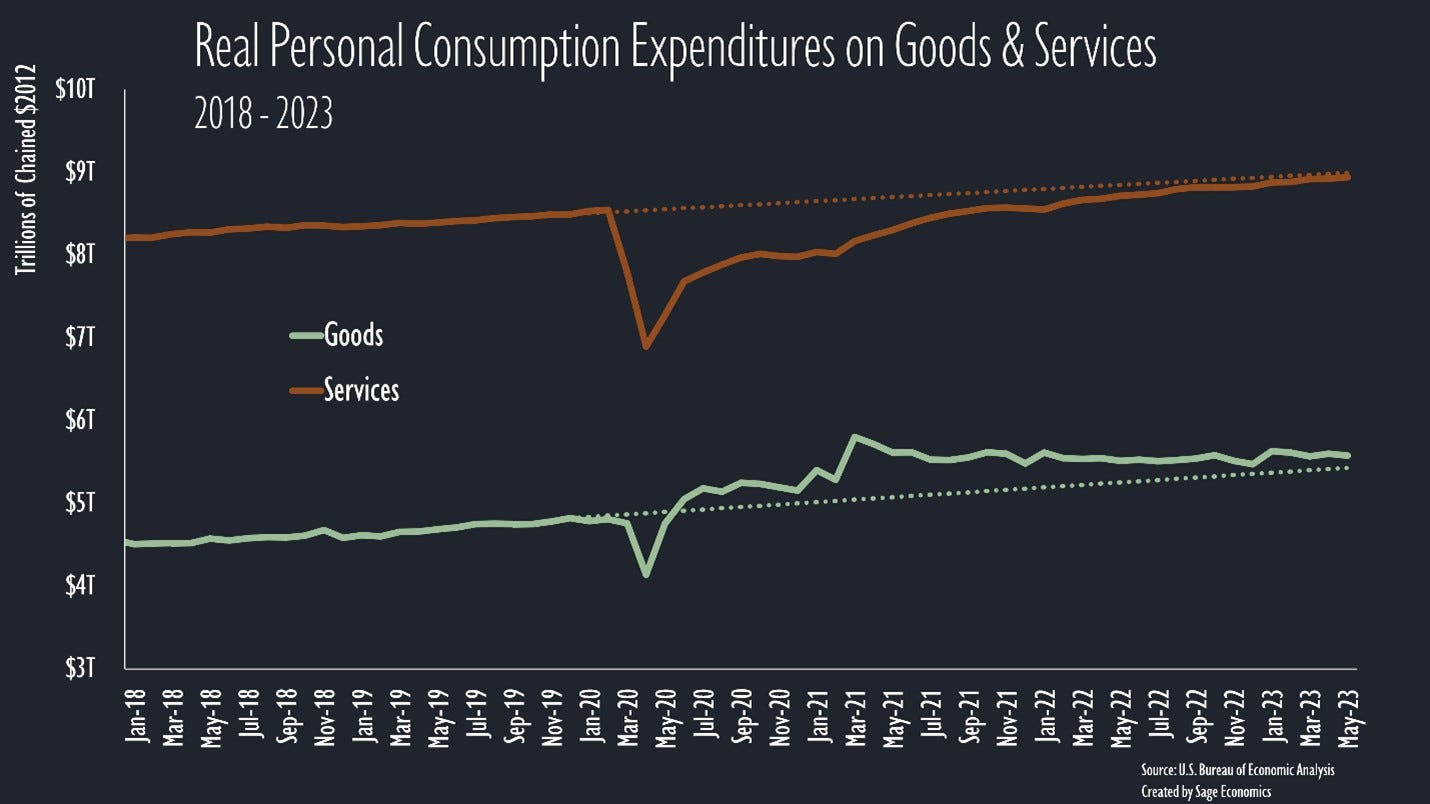

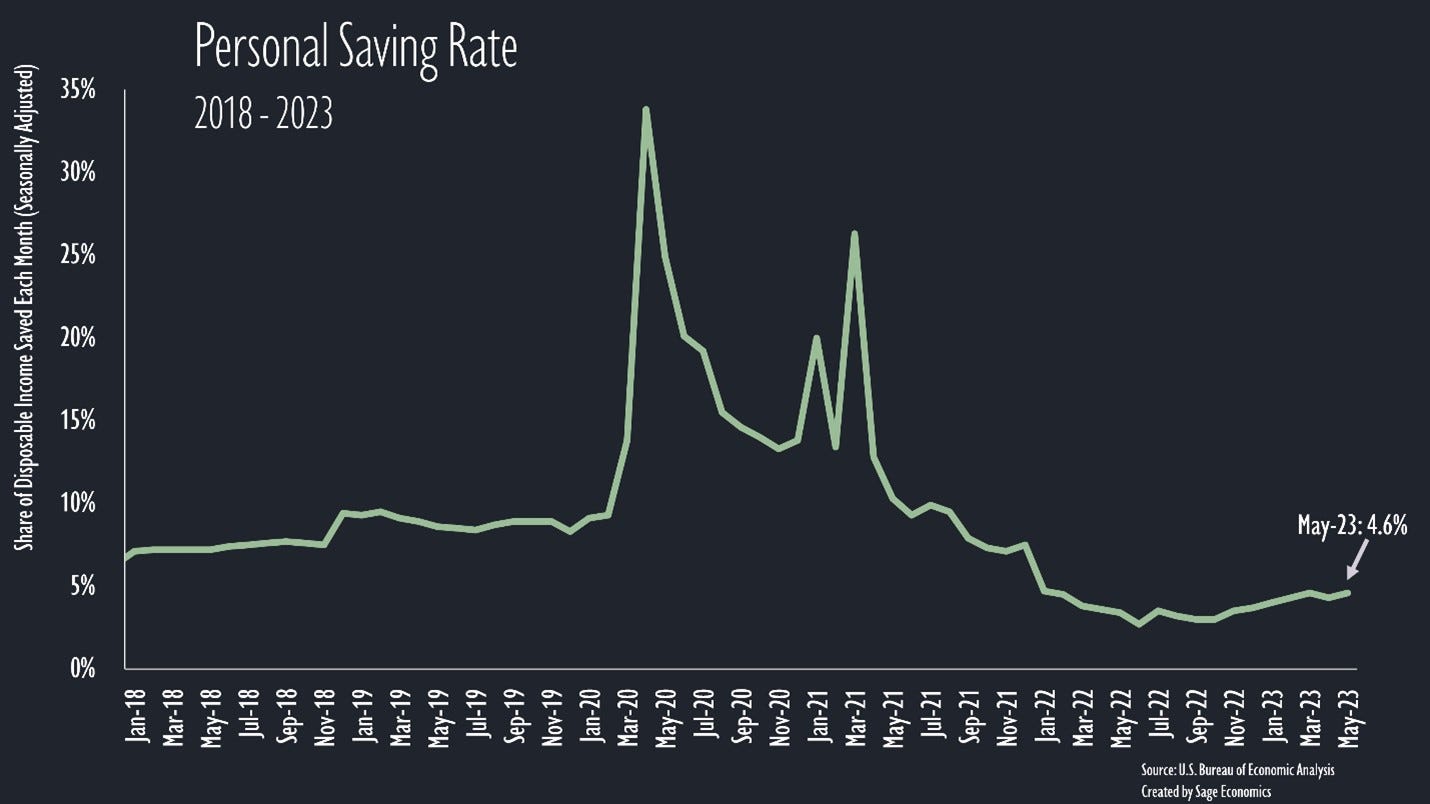

Americans have saved more of their disposable income in recent months but, as a share of total disposable income, only about half as much as they were saving before the pandemic (4.6% in May vs. 9.3% in March 2020).

The big unknown right now is when consumers will exhaust the excess savings generated during the early months of the pandemic. The best guess seems to be roughly by the end of the year. BCA Research thinks they’ll run out as soon as September (that gels with when Anirban thinks recession will start). The San Francisco Fed thinks they’ll run out at some point in the fourth quarter, and other Fed researchers seem to agree.

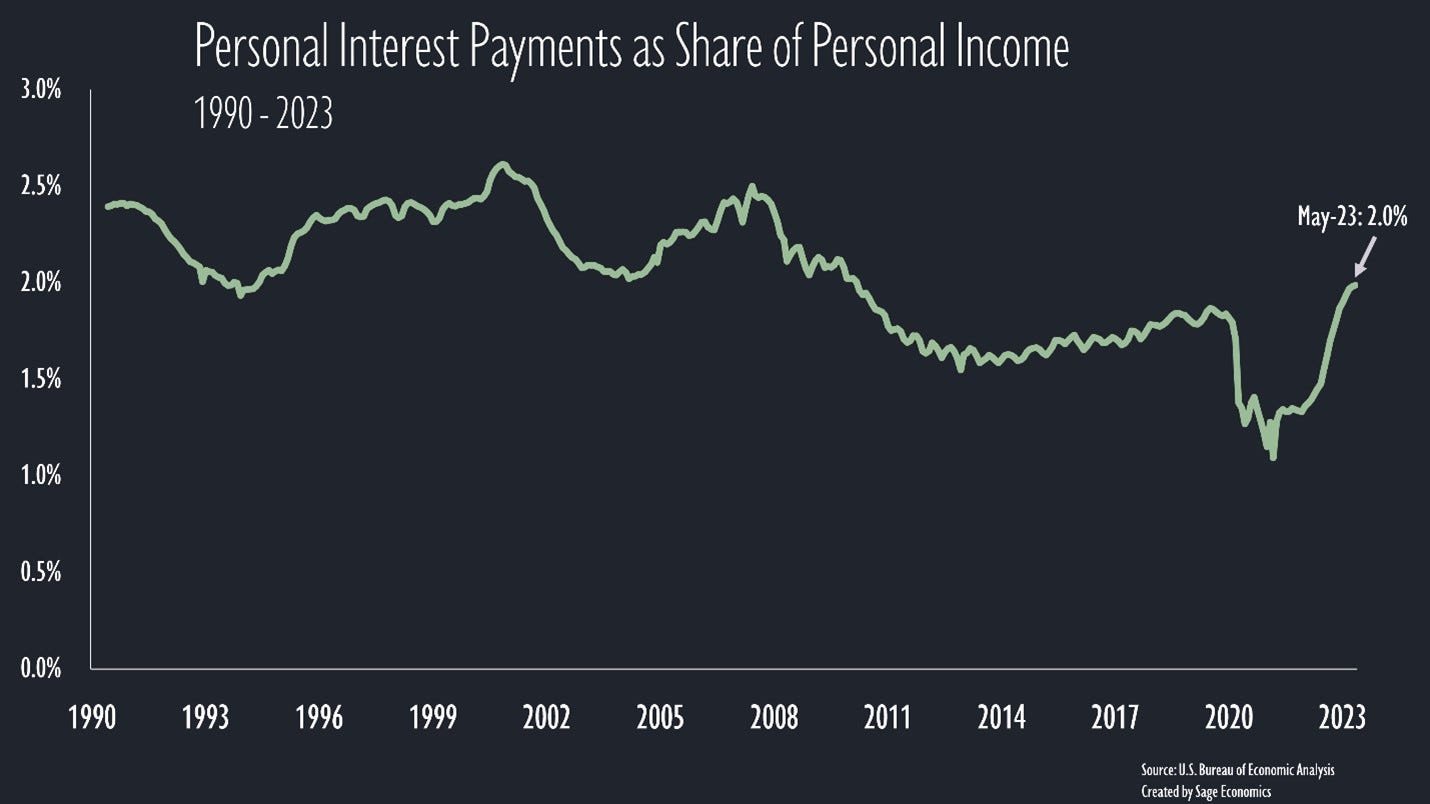

Personal Interest Payments

There’s a lot of detail in this release, but one component that stood out is personal interest payments (which exclude mortgage payments). Interest payments have risen 87% since the low point in December 2020 and are up about 31% since the start of the pandemic (not adjusted for inflation). Taken out of context, this sounds terrible.

Context helps, though; the rate at which personal interest payments are increasing has slowed in recent months, rising 0.8% in both April and May. That equates to about a 10% annual rate, which is still too fast but also the smallest monthly increase since 2021.

Personal interest payments are currently 2.0% of total personal income, above the 1.8% pre-pandemic share but lower than in any month between the early 1990s and the start of 2010. If the pre-pandemic trend had continued, this is close to where we’d be. Still, debt accumulation is definitely something to watch over the next couple months, especially when student loan payments resume.

Looking Ahead

We’ll have two posts out on Friday—a jam packed Week in Review for paying subscribers and our monthly post on the jobs report for all subscribers.