Inflation, Debt, & More

Week in Review: Aug. 7-11

This week was mostly about the inflation data released on Thursday, but we also got updates on consumer credit, small business optimism, and consumer sentiment, an executive order on investment in China, and more.

Monday

Consumer Credit

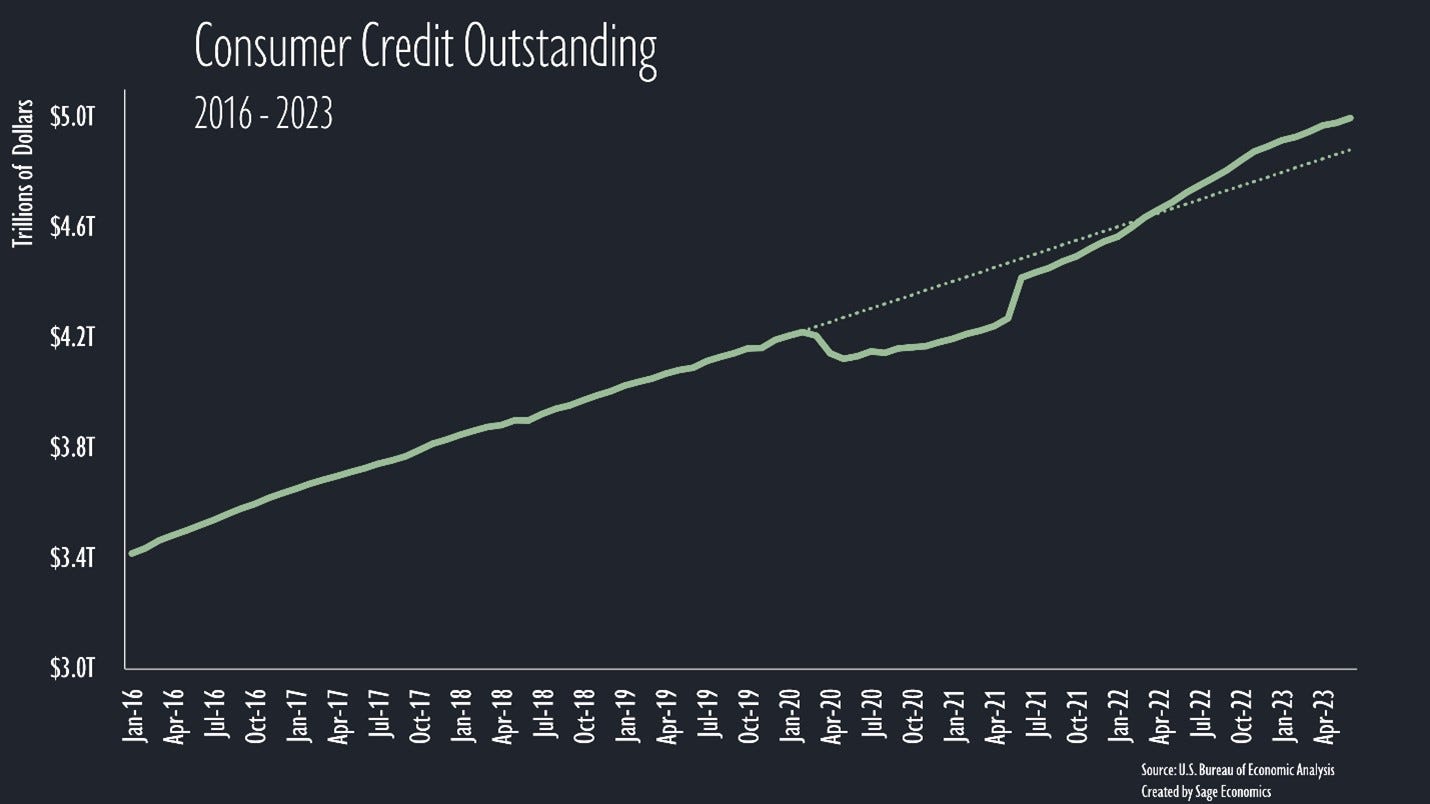

Outstanding consumer credit (i.e., debt) increased at a 4.3% annual rate in June. Revolving debt (think credit cards) actually inched lower for the first time since April 2021, while nonrevolving debt (think cars, student loans, etc.) increased at the fastest rate since October 2022.

What do we take from this? In nominal terms, outstanding consumer credit is well above the pre-pandemic trend. This looks bad, and you might have seen the headlines last week that credit card debt surpassed $1T for the first time ever.

No need to panic (not yet, anyway). When inflation is bad, nominal data overstates increases. After adjusting for inflation, this data looks a lot less worrisome.

Gas Prices

Gas prices increased for the fifth straight week and are now as high as they’ve been since the middle of October 2022.

Diesel Prices

Diesel prices increased for the third straight week, rising to the highest level since mid-March, but are still about $0.90/gallon lower than one year ago.

TSA Checkpoint Travel Numbers

The number of people passing through TSA security during the week ending August 8th stayed about 1% above the same week in 2019 and we’re now in the longest streak of weekly travel volumes staying above 2019 levels. Whatever else is going on in the economy, people are still traveling.

High Earners Fled Major Cities During the Pandemic

The Economic Innovation Group released a report on this topic, and the findings are fairly incredible. Based on an analysis of IRS data, adjustable gross income “in large urban counties fell by more than $68 billion between 2020 and 2021 from net migration alone, a dramatic acceleration of pre-pandemic leakage.”

The high earners that left cities fled to vacation towns, rural counties, and pandemic growth regions (think Florida, North Carolina, Texas, etc.). The interactive maps in the report are incredibly interesting, and poking around on them is highly recommended.

Tuesday

NFIB Small Business Optimism Index

We wrote about how downbeat small business owners are earlier this week, and no surprise, the July reading of NFIB’s SBOI remained below the half-century average for the 19th straight month. The big development is that inflation is being replaced by labor shortages and difficulty hiring as small business owners’ biggest problem.