Inflation heats up, business optimism rises, & more

Week in Review: Dec. 9-13

This week brought us a critical—and frankly disappointing—update on inflation, new information on surging small business optimism, and more.

Monday

TSA Checkpoint Travel Numbers

Travel volumes have fallen off from the Thanksgiving rush, according to TSA data. Despite the decline, air travel is about 4% higher over the past week than in 2023. This will go down as a most excellent year for travel in America, as passenger volumes rose, hotel occupancy expanded, and as airlines and cruise lines fared well. The big question is whether a consumer that has been hit hard by inflation over the past three years can keep spending the way they have.

Gas Prices & Diesel Prices

Gas prices fell to $3.13/gallon this week. That’s (again) the lowest price since mid-2021. Diesel prices fell pretty sharply, down to $3.46/gallon. All of that is great for shopping and shipping costs this holiday season.

Tuesday

NFIB Small Business Optimism Index

Last month, I predicted that small business optimism would surge because of election results. Sure enough, this index rose to its highest level since mid-2021. Small business swings hard to the right.

Softer index components (that is, the ones that don’t involve concrete plans) improved dramatically. The hard components (like cap ex or hiring plans) improved only modestly. While business confidence has surged, election uncertainty has become policy uncertainty.

I think it’s pretty safe to deduce that hard components of this measure reflect actual business expectations, while the soft components reflect who’s in the White House.

Wednesday

Consumer Price Index (INFLATION)

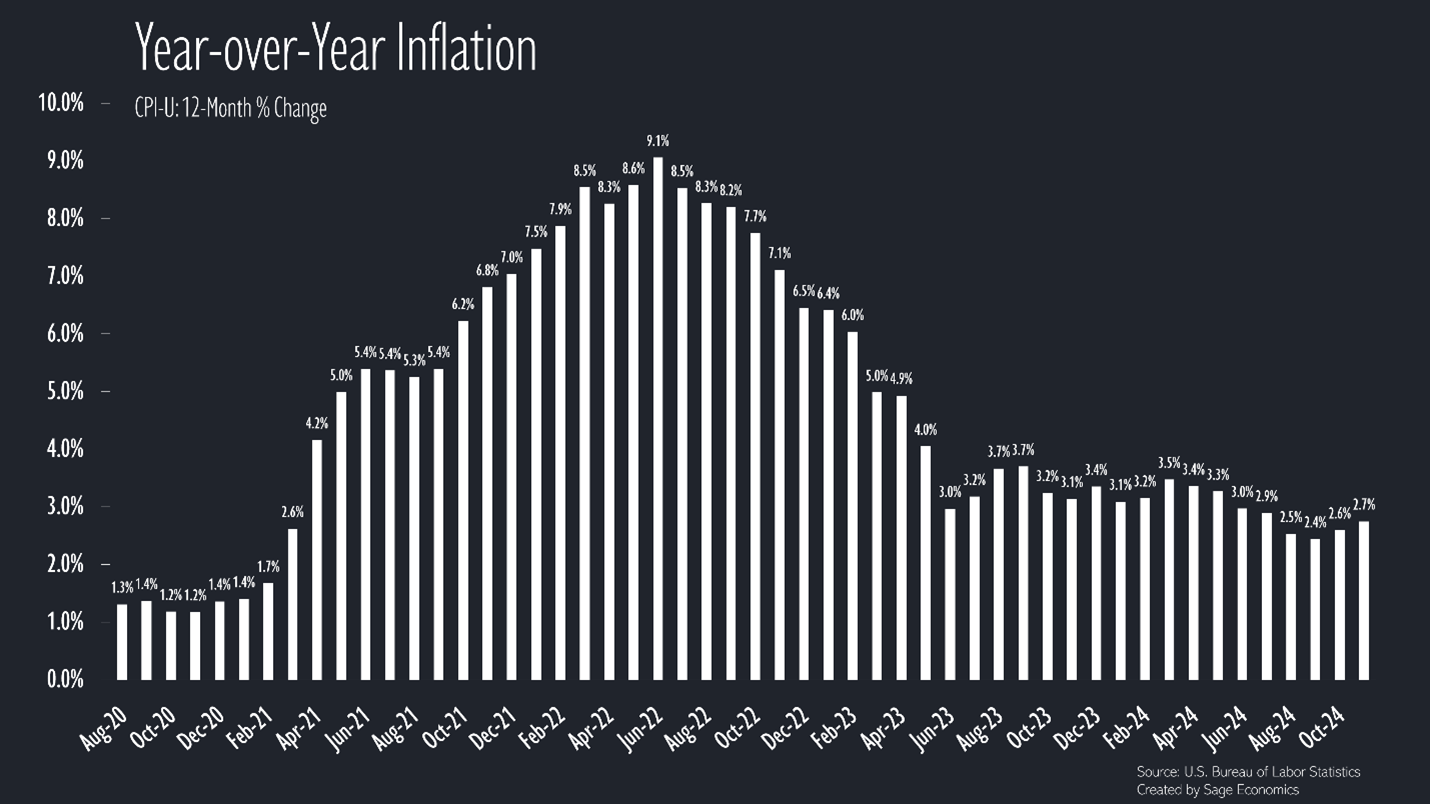

Inflation reaccelerated in November, with prices rising at their fastest pace since April. We need the green bars in this chart to, on average, rise just to the white dotted line to get back to the Fed’s 2.0% target rate. Which is to say, inflation has been too fast the past two months, and hints at the impacts of a still strong labor market (albeit weakening modestly), lingering supply chain issues, and ironically higher borrowing costs, which increase the costs of doing business and therefore can in certain ways actually contribute to price pressures.

Price increases were pretty widespread for the month, with particularly large increases in vehicle, healthcare, and food prices. Prices are up 2.7 percent over the past year and the chase for 2.0 percent annual inflation has become increasingly elusive during recent months.

Mortgage Applications

Mortgage applications increased again last week, but that was due to increased refinance activity. Purchase applications actually fell slightly. Realtors are still waiting for their day in the sun.

Thursday

Producer Price Index

This (less important) measure of inflation (shows change in prices received by U.S. producers) also came in too hot in November. Prices for finished products and services increased 0.4% for the month and are up 3.0% over the past year.

Goods prices increased much faster than services prices (same is in the Consumer Price Index), which represents a big change from the past few years.

Jobless Claims

Initial jobless claims rose to 242,00 last week. While this isn’t a particularly high level by historical standards, it was a large increase by recent standards.

This increase is a mystery, and not a particularly fun one. It could signal a sudden increase in unemployment, which would be very bad. Or it could have to do with seasonal adjustments/reporting issues around the holidays, which would be business as usual. It could also be the lingering effects of recent storms, including the large-scale damage sustained by North Carolina due to Hurricane Helene. We won’t really know until next week.

Continued claims for unemployment insurance increased but are pretty much flat since early October.

Mortgage Rates

Mortgage rates fell again, with the average 30-year fixed down to a still elevated 6.60%. Did I mention that realtors will have to wait . . .?

U.S. Crude Oil Production

U.S. oil production increased to 13.6 million barrels per day last week, setting a new all-time high. To reiterate: it’s been a record-smashing year for domestic oil production. The Treasury Secretary nominee would like to see that tally increase by another 3 million barrels per day. That may prove challenging for all kinds of reasons, including oil price dynamics and the willingness of energy producers to keep pumping if prices fall too sharply.

Friday

Nothing

Enjoy the weekend!

Links of the Week

End the Medicare For All wars (Slow Boring)

How to Stage a Coup (Statecraft)

Insurance companies aren’t the main villain of the U.S. health system (Noahpinion)

Final Thoughts

After this week, my outlook for the economy is: A bit worse

While the recessionary forces I have anticipated over the past two years are simply not there, we are beginning to see a bit of stagflation pervade the economy. Job growth has slowed, unemployment has risen, and inflation has reaccelerated a bit.

Looking Ahead

Next week has a ton of economic news/data, including the Fed’s interest rate decision for December, a bunch of housing stats, retail sales, and more.