Inflation Karate Style

A quick Q&A on inflation with Anirban Basu (who recently watched Cobra Kai)

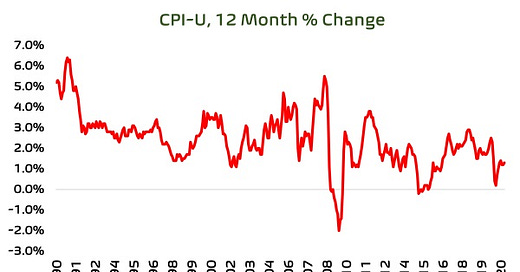

The Consumer Price Index for all Urban Consumers (CPI-U), the go-to index for measuring inflation and one that sounds badass, rose 0.4% in December, an indication that inflationary pressures are creeping higher. Still, the aggregate consumer price level is only up 1.4% from a year ago. So we don’t have an inflation problem today, but the possibility of one going forward exists.

Why is the CPI for all urban consumers the primary measure of inflation?

When this index says, “urban consumers,” it means “anyone living within a metropolitan statistical area or a place with 2,500 inhabitants or more.” This captures nearly 90% of the U.S. population, including those who live in the San Fernando Valley.

Why did prices increase in December?

Gasoline prices—which increased 8.4% for the month—accounted for more than 60% of December’s inflation. Food prices also rose, albeit more modestly, increasing 0.4%. As we enter the post-pandemic world sometime later this year, global economic growth is set to surge, resulting in more commodity price and general price inflation. That could produce higher interest rates, which would karate chop what has been a booming housing market, although not fatally.

Why have prices increased over the past year?

Since December 2019, food prices are up 3.9%, medical care prices are up 2.8%, and new vehicle prices are up 2% (used vehicle prices are up a whopping 10%). In such a damaged and leveraged economic environment, this is not good. This means that people’s incomes don’t stretch as far and that their borrowing costs are likely to increase.

Do I really need to be worried about inflation?

Yup. I know you would rather focus on the ancient struggle between Cobra Kai and Miyagi-Do, but there is more to life that competing dojos. While it is true that 2020 experienced the lowest inflation levels since 2015 (and the third lowest inflation level since 1962), the world is changing quickly. Low prices have helped to truncate supply capacity in many segments, and the global economy is about to rush forward.

BTW, Joe Biden just announced plans for a $1.9 trillion stimulus that would kick buckets of money toward American households and state governments. That has the potential to push inflation higher over the coming months.

Three Key Takeaways

1. Apparel prices fell 3.9% in 2020. Is the pandemic to blame? Partly. You don’t need a suit to work from home. I have a staff populated heavily by those pesky Millennials, who avoid suitable attire under normal circumstances in favor of shorts and leggings. They assure me this trend is universal.

2. Alcoholic beverage prices rose 2.8% in 2020, their largest increase since 2008 (when we were also in the midst of a punishing recession). I could go on, but . . .

3. I need to get a life. Too much Netflix. My daughters are now forcing me to watch Bridgerton.

What to Watch

Vaccine distribution remains underwhelming, but there are indications of improvement. The expectation that the back half of 2021 will be spectacular remains firmly in place.

A second recession has begun. Retail sales began to slip in October, and we lost jobs in December. Oh, when will it end? I just told you—later this year.

Our 2021 Webinars and Presentations

We’re thrilled to announce our 2021 presentation, Anirban Basu and the Chamber of Data. If you’re interested in having me give this wizardly economic forecast to your stakeholders, contact us at webinars@sagepolicy.com.