Inflation, Savings, & More

Week in Review: Aug. 26-30

That Canadian railroad strike we told you about last week—the one that threatened U.S. supply chains—is over for the time being. Crisis (at least temporarily) averted.

This week brought us updates on the Fed’s favorite measure of inflation, which looks good, the personal savings rate, which doesn’t, and a lot more.

Monday

Durable Goods Orders

Orders for durable goods (things that typically last at least three years) increased 9.9% in July, but that was entirely due to a big spike in aircraft orders. Excluding transportation, orders actually fell 0.2% and are up just 1.4% year over year. This continues to be one of the weaker economic indicators.

TSA Checkpoint Travel Numbers

Travel volumes continue to fall as summer comes to an end, according to TSA data, but are still trending about 6% above 2023 levels.

Tuesday

Conference Board Consumer Confidence Index

This measure of consumer confidence improved in August but remains well below the pre-pandemic level. While people still feel pretty bad about the current economic situation, expectations for the future have now been above the level that they say signals recession for two straight months. Which is to say, people are feeling better about the future.

S&P Case-Shiller Home Price Indices

Nationwide home prices increased 0.5% in June and are up 5.4% year over year. No real surprise here.

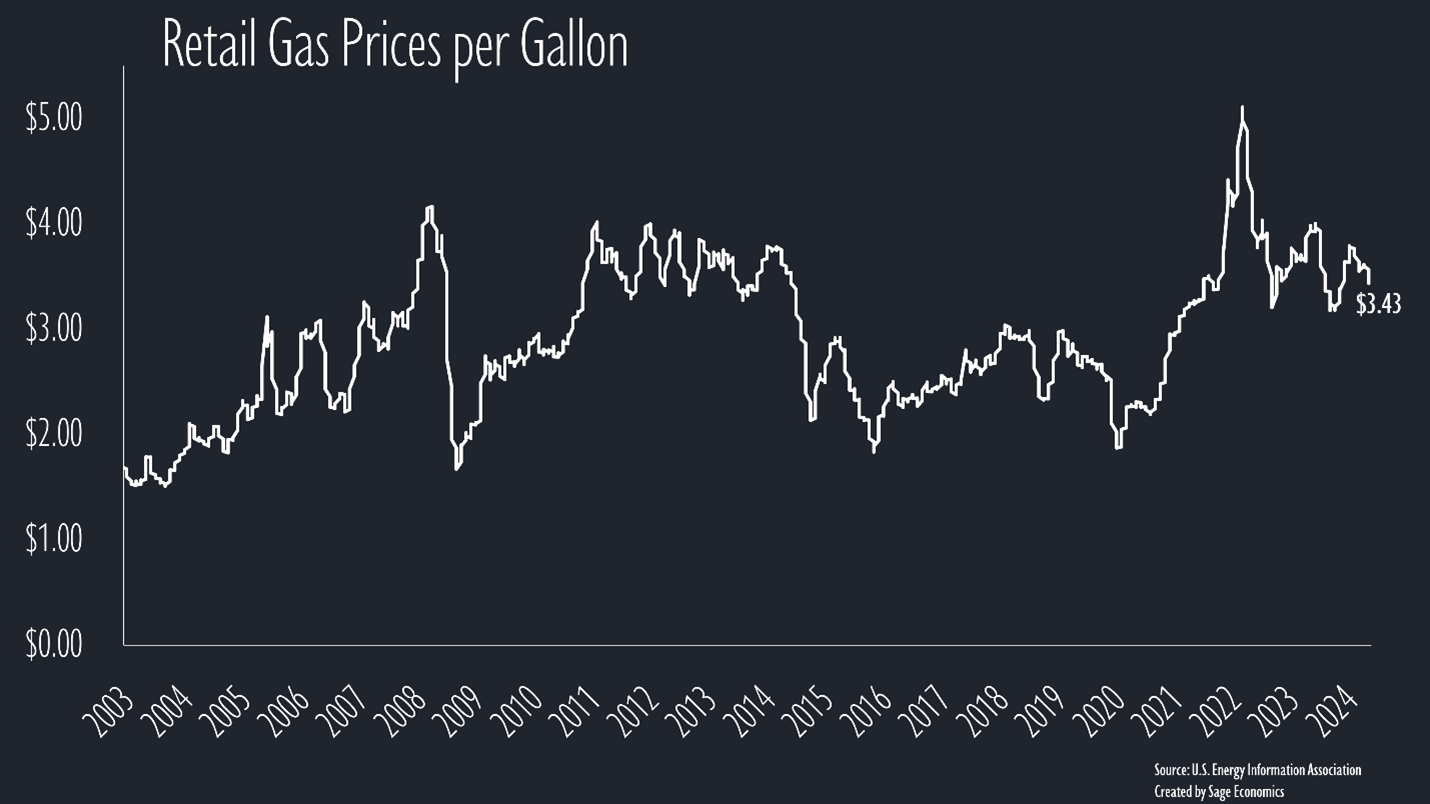

Gas Prices & Diesel Prices

Gas prices fell to an average of $3.43/gallon, the lowest price since February, and should keep trending lower over the next few weeks. Diesel prices fell again and, at $3.65/gallon, are at the lowest level since the first week of January 2022.