Is Data Center Construction Overhyped?

Construction Trend Tuesday (#29)

Data centers have gotten a lot of credit for propping up the construction industry—and the stock market, and the U.S. economy—in 2025.

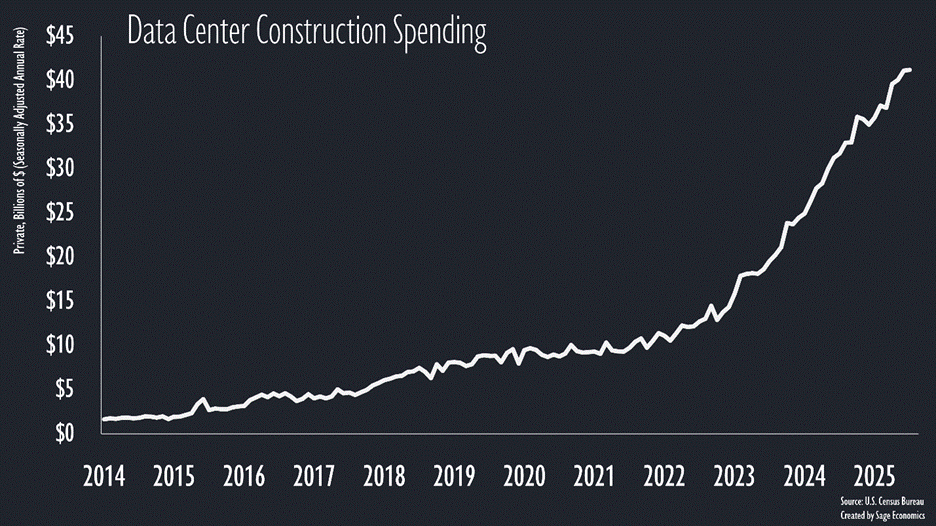

In some ways, the hype is justified. Data center construction spending has blasted off over the past half-decade, surging from less than $10 billion in 2020 to more than $40 billion (and rising rapidly) as of July 2025.

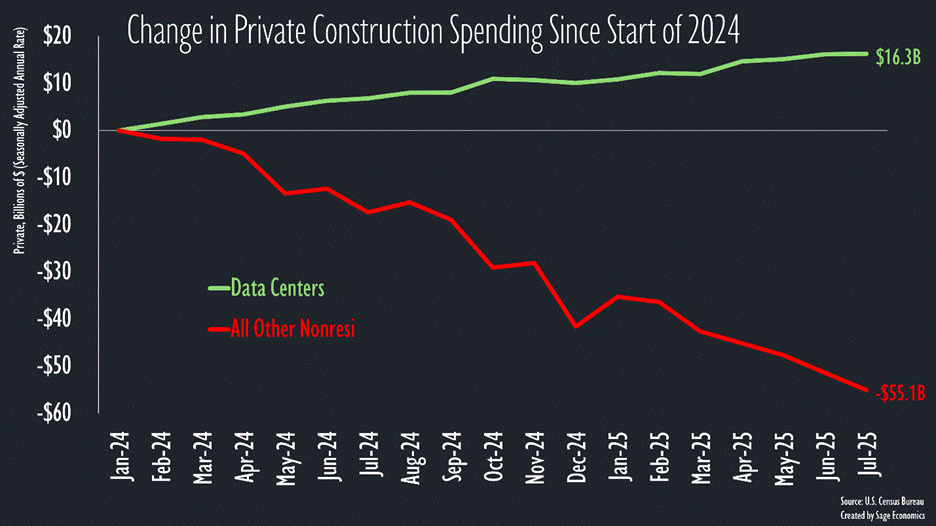

Critically, this has come at a time when virtually every other subsegment is struggling. Since the start of 2024, spending on data centers has risen by $16 billion, while spending on every other private nonresidential segment has fallen by $55 billion.

This has benefited a large swath of the industry. More than 20% of ABC members are currently under contract to work on a data center, according to our recent Construction Backlog Indicator surveys. That’s in stark contrast to the 2022-24 boom in manufacturing construction, where the megaprojects were highly geographically concentrated.

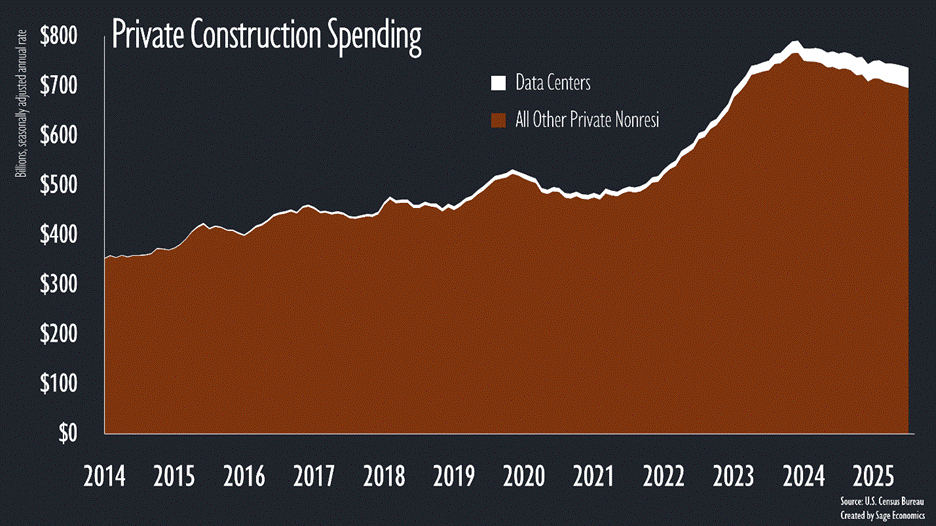

That said, the data center construction hype is slightly overblown. Even with recent astronomical growth, data centers account for just over 5% of private nonresidential construction spending (and less than 2% of total construction spending).

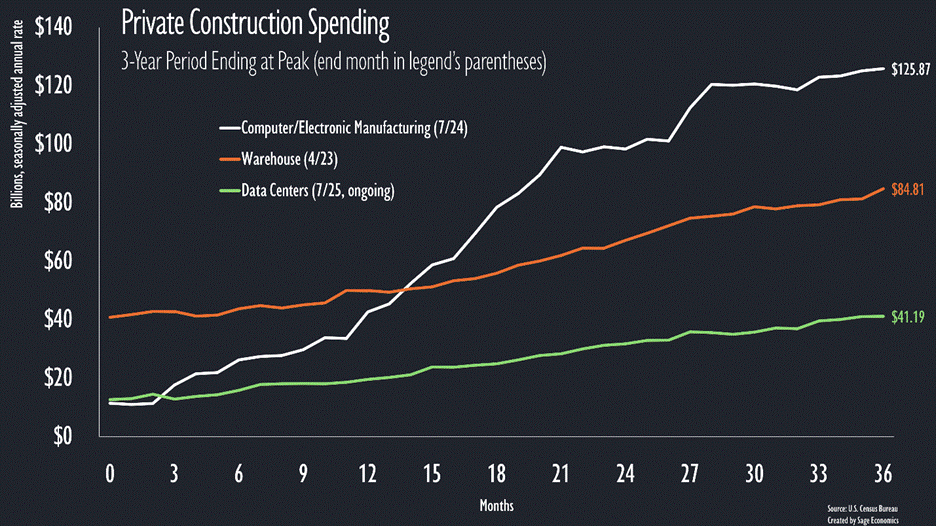

This is—for now, at least—pretty minor compared to some of the other recent subsegment booms. Computer/electronic manufacturing construction surged to nearly 17% of private nonresidential spending in 2024, and warehouse construction peaked at about 11% in August 2023.

This graph shows you the three year’s leading to each of those boom-category’s peak, though you should note that data center spending is still rising.

How is this possible given the unfathomably large capex numbers that get tossed around? Just the largest hyperscalers, for instance, are estimated to have invested more than $250 billion in data centers in 2024. Estimates for 2025 are in the $300 billion+ range.

Here’s the thing: construction of a data center’s powered core and shell—the facility sans any of the equipment that goes inside of it—accounts for just 25% to 30% (roughly speaking) of total data center development costs.

And even that overstates construction’s share of data center capital expenditures, because those gaudy numbers you see in the news include the cost of updating equipment at existing data centers. Servers, for instance, are typically refreshed every three or four years.

One powerful caveat

Data centers’ electricity needs have undoubtedly generated some share of power-related construction activity. Data centers account for just about 3% of U.S. power consumption but are projected to account for anywhere from 20% to 60% of load growth over the next five years.

Which is to say, the data center boom is definitely supporting some construction activity outside of the narrow data center subsegment.

The upshot

Data centers are providing the construction industry with much needed momentum, but the scale of the boom (as it narrowly relates to construction) is overblown due to the astronomically large overall capex figures. In dollar terms and as a share of total construction spending, this is still smaller than the warehouse boom that occurred from 2020 to 2023.

What’s next

This might be another slow week given the ongoing government shutdown, but we still have a good deal of news and privately released data to discuss. Whatever happens, we’ll give you everything you need to know in Week in Review, our every-Friday post that covers all the economic news and data in a breezy, five minute read.

Week in Review is only for paying subscribers. If that’s not you and you want it to be, just click the subscribe button.