Is the Fed Too Late? Dueling Takes

Anirban says no, Zack says yes

Is the Fed too late? Should they have cut rates at their June meeting? The president certainly thinks so, and while Zack thinks he’s right (though maybe for the wrong reasons), Anirban doesn’t.

[If you need a refresher on how/why the Fed moves interest rates, check out our Very Basic Primer]

Anirban’s Take: The Fed is Not Too Late

I admit that the level of the federal funds rate is somewhat arbitrary. After raising rates by 525 basis points from March 2022 through July 2023, the Federal Reserve began reducing rates in September 2024. By December 2023, the upper limit on the Fed Funds rate had been cut from 5.5% to 4.5%.

Let’s say for argument’s sake that the President had been inaugurated six months later. The federal funds rate could easily be around 3-3.5% by now. But he was inaugurated on January 20th of this year, and talk of tariffs intensified at that time. And that’s why the Federal Reserve’s policymaking over the past six months has been spot on despite the partial arbitrariness of the starting point.

I will further admit that the latest data regarding inflation justify rate cuts. The consumer price index has been cooler than expected for four consecutive months. Nonetheless, our Federal Reserve Chair, Jerome Powell, is not too late, and here’s why:

In 1989, the rock group Great White sang a hit song called Once Bitten, Twice Shy. Unlike other rock songs of that era that offered precious little in the form of economic analysis—like Pour Some Sugar on Me by Def Leppard (1987) and Welcome to the Jungle by Guns N’ Roses (also 1987)—Great White’s work was rife with economic content and neatly predicted the conundrum the Federal Reserve presently faces.

You’ll remember that in 2021, the Federal Reserve characterized then raging inflation as transitory. They were wrong and then had to belatedly respond with a dramatic increase in borrowing costs.

Here’s my point. No one, including voting members of the Federal Open Market Committee, knows what impact tariffs will have on inflation. Indeed, no one even knows what tariff rates are going to be next week.

Having been burned in 2021, policymakers are justifiably reluctant to make another inflationary mistake. One bitten, twice shy as they say. Jerome Powell isn’t too late; he lacks basic freedom of movement. These shifting tariffs are paralyzing.

The chart below (from this research) makes another point. Central bank independence is critical. Absent that, elected policymakers will be constantly seeking to stimulate economic activity in pursuit of reelection. That translates into a permanent inflationary state.

Turkey serves as a cautionary tale. Around 2018, President Erdogan began to directly exert pressure on the Central Bank of the Republic of Turkey (CBRT) to lower interest rates despite then rising inflation. In 2021, the CBRT experienced the dismissal of several governors while cutting interest rates.

Turkish inflation, predictably, surged above 80%. And then, even as global inflation declined in late-2022, Turkey experienced another wave of inflation in 2023. The nation’s currency, the lira, has depreciated significantly against the US dollar, diminishing Turkish spending power.

Which is to say, it’s important that the Fed operates independently, both in practice and appearance. (The President said as much himself last week, explaining, “I fully understand that my strong criticism of him makes it more difficult for him to do what he should be doing, lowering rates…”)

Finally, I understand that these “higher for longer rates” are wreaking havoc on U.S. real estate and construction markets. I’m tempted to say to my friends in construction that these higher rates are set to Rock You Like a Hurricane (Scorpions, 1984), but that would be a bit much.

Zack’s Take: The Fed is Too Late

Anirban and I agree on three important points here. First, rates are too high. Second, cutting right now would send a bad signal by bending to political pressure. And third, in a perfect world, the Fed would have cut more in late 2024 and wouldn’t need to do so now.

It’s not a perfect world.

The Fed needs to choose between holding rates steady in hopes of suppressing inflation or lowering rates to keep the labor market from crumbling and growth from slowing.

I’m more worried about the labor market and the housing market than I am about inflation (which I’m also worried about, to be fair), and that’s why I think the Fed is too late.

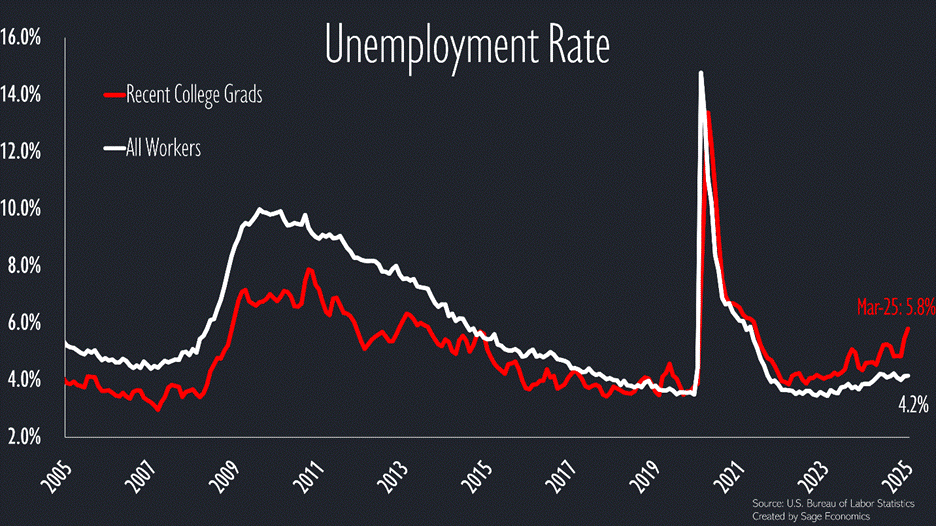

Starting with the labor market: the unemployment rate has crept higher over the past year. It’s not at a particularly concerning level yet, but the trend isn’t great. Continuing unemployment insurance claims are trending up, and labor market sentiment has plunged to the lowest level since the pandemic.

At the same time, businesses have been reluctant to hire or fire, and workers have been hesitant to quit. Put another way: it’s a great time to have a job but a brutal time to need one.

This has been particularly rough for those just entering the job market. The unemployment rate for recent college graduates surged from 4.8% to 5.8% during the first three months of 2025 (this data is only available through March), rising to 1.6 percentage points above the economywide rate.

While job-seeker struggles have yet to harm aggregate employment gains, the composition of job growth over the past few years sucks. The private education and healthcare segment, which is largely unaffected by cyclical factors, has added more jobs since the start of 2023 than all other segments combined (2.428 million vs. 2.353 million).

So the unemployment rate is creeping higher, job seekers are having a bad time, and job growth is dominated by a noncyclical sector. None of this is great, but it’s also not that bad, at least not yet.

It’s the labor market vibes—for lack of a better word—that have me really worried. I just don’t see any sectors outside of healthcare and leisure/hospitality hiring right now. White collar businesses are locked down in wait-and-see mode, with many trying to figure out how AI can limit headcount growth. Manufacturers, scrambling to keep up with ever-changing tariffs, aren’t expanding their staffs. The federal workforce isn’t growing, and many state and local governments are scrambling to make their budgets work as COVID relief funds expire.

And then there’s construction. The nonresidential segment is weakening as manufacturing megaprojects wind down and would-be project owners wait for a little bit of economic certainty (or, you know, lower interest rates).

Residential construction is even worse. Spending in the segment is on pace to fall 11% this year, and homebuilder sentiment just dropped to the lowest level since 2012 (excluding April 2020). While would-be homebuyers might be getting acclimated to higher mortgage rates, the same economic uncertainty that’s keeping them in their jobs is keeping them out of the housing market.

I don’t envy the Fed. Cut rates, and they risk making inflation even worse in the second half of 2025. Hold rates steady, and they risk the labor market falling apart. I’d rather have stable unemployment and a bounce in inflation, which is likely to be more of a one-time acceleration due to the nature of tariffs.

What’s Next

This week brings us updates on consumer sentiment, inflation, and some housing stats. We’ll cover that and a whole lot more in Week in Review, our every-Friday post that covers all the economic news and data in a breezy, five minute read.

Week in Review is only for paying subscribers. If that’s not you and you want it to be, just click the subscribe button.

Zack, nice job describing the labor market stimulus needed, but the Fed also had mandate to manage inflation and you didn't speak to risk of tariff impact. Anirban wins.