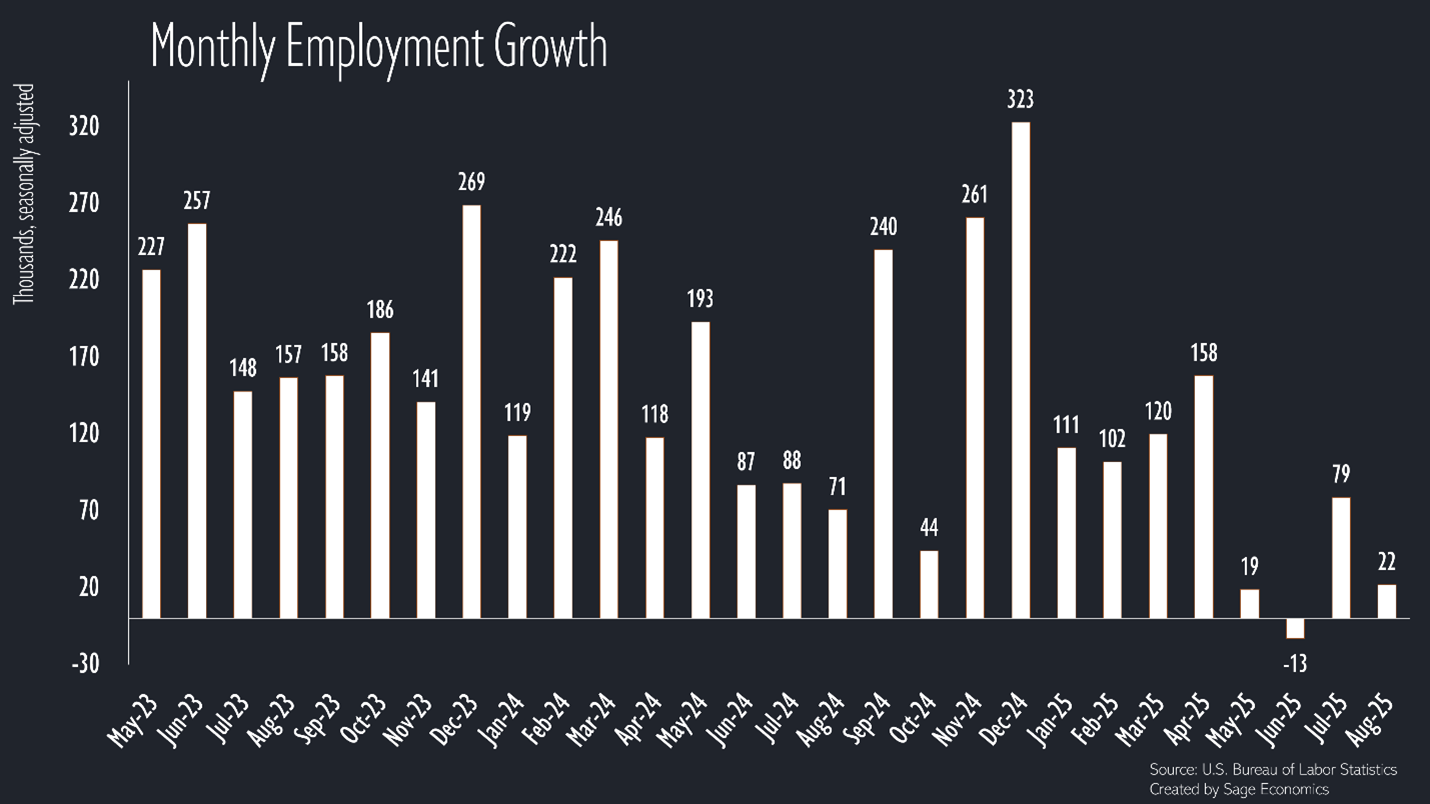

Job growth has stalled out

Another stinker of a jobs report in August

This post is sponsored by KODIAK – Proven Workforce Solutions. I wouldn’t accept a sponsor for this newsletter unless they were 1) a company I trust and 2) addressing critical issues like skilled labor shortages in construction. KODIAK, which recently merged with Pivot, checks both those boxes. Their mission is to help construction companies find experienced talent, including engineers and project managers for Direct Hire, as well as skilled craft professionals like welders and electricians for contingent staffing. With over three decades of experience, I encourage contractors struggling to find workers to consider KODIAK.

New BLS Commissioner, same disappointing jobs report; U.S. employers added just 22,000 jobs in August, and the unemployment rate ticked up to 4.3%.

With revisions (yes, those again), we now lost 13,000 jobs in June. That ends a streak of 53 consecutive monthly employment gains—the second longest ever—that spanned from January 2021 to May 2025.

The labor market is in an absolute state of paralysis. Layoffs remain low, but no one is hiring, and who can blame them? The outlook is deeply uncertain, inflation is reaccelerating, and tariff policy is, well, you know.

This is particularly rough for new entrants to the labor market. The unemployment rate for young adults (20-24) rose to its highest level since early 2021 (more thoughts on that here).

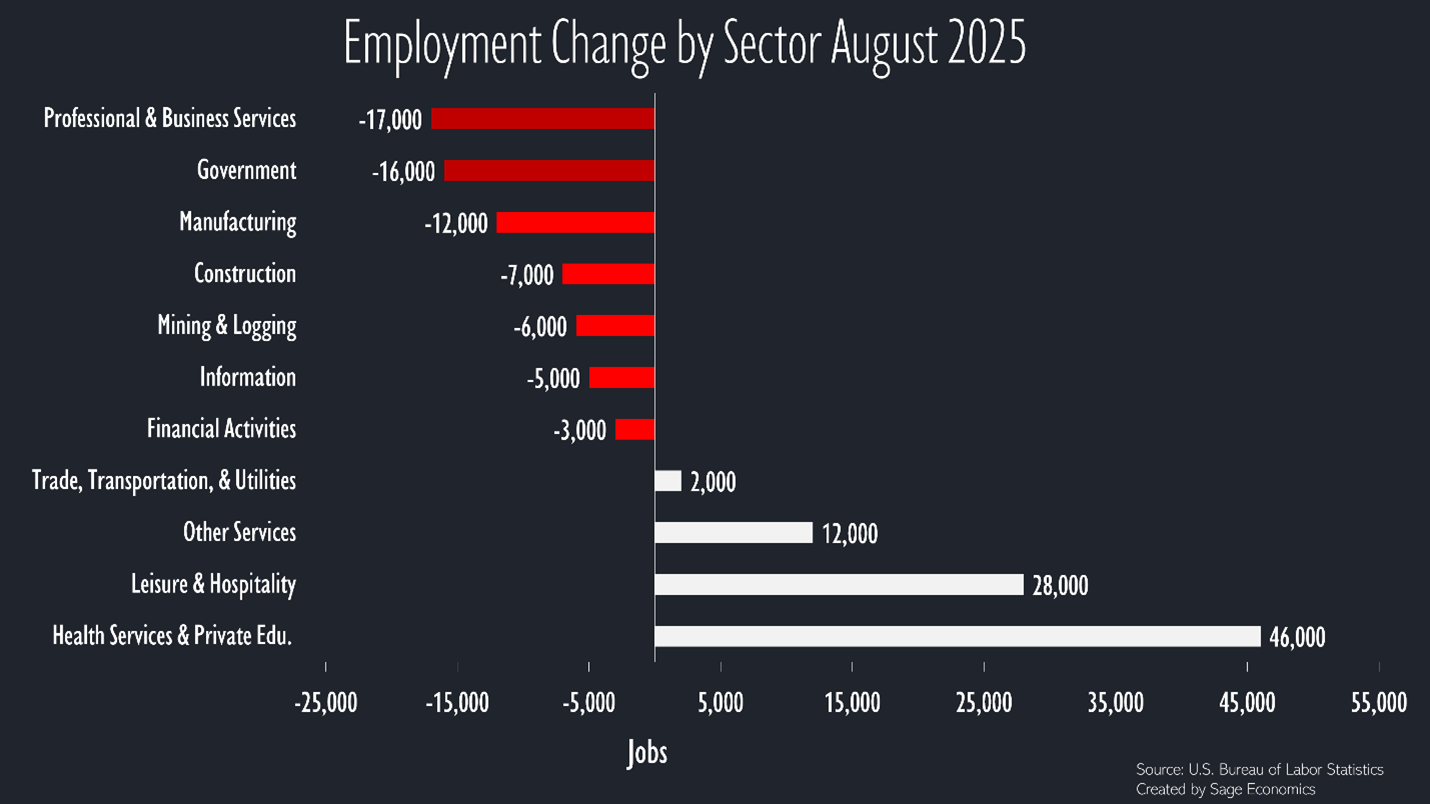

Job growth (well, mostly losses) by industry

7 of the 11 major industry groups lost jobs in August. Manufacturing, which is supposed to be the primary beneficiary of tariffs, has now lost 42,000 jobs since April.

And don’t be fooled by the loss of professional and business services jobs. This is less about white collar job losses and more about administrative and support services like staffing firms, landscapers, etc.

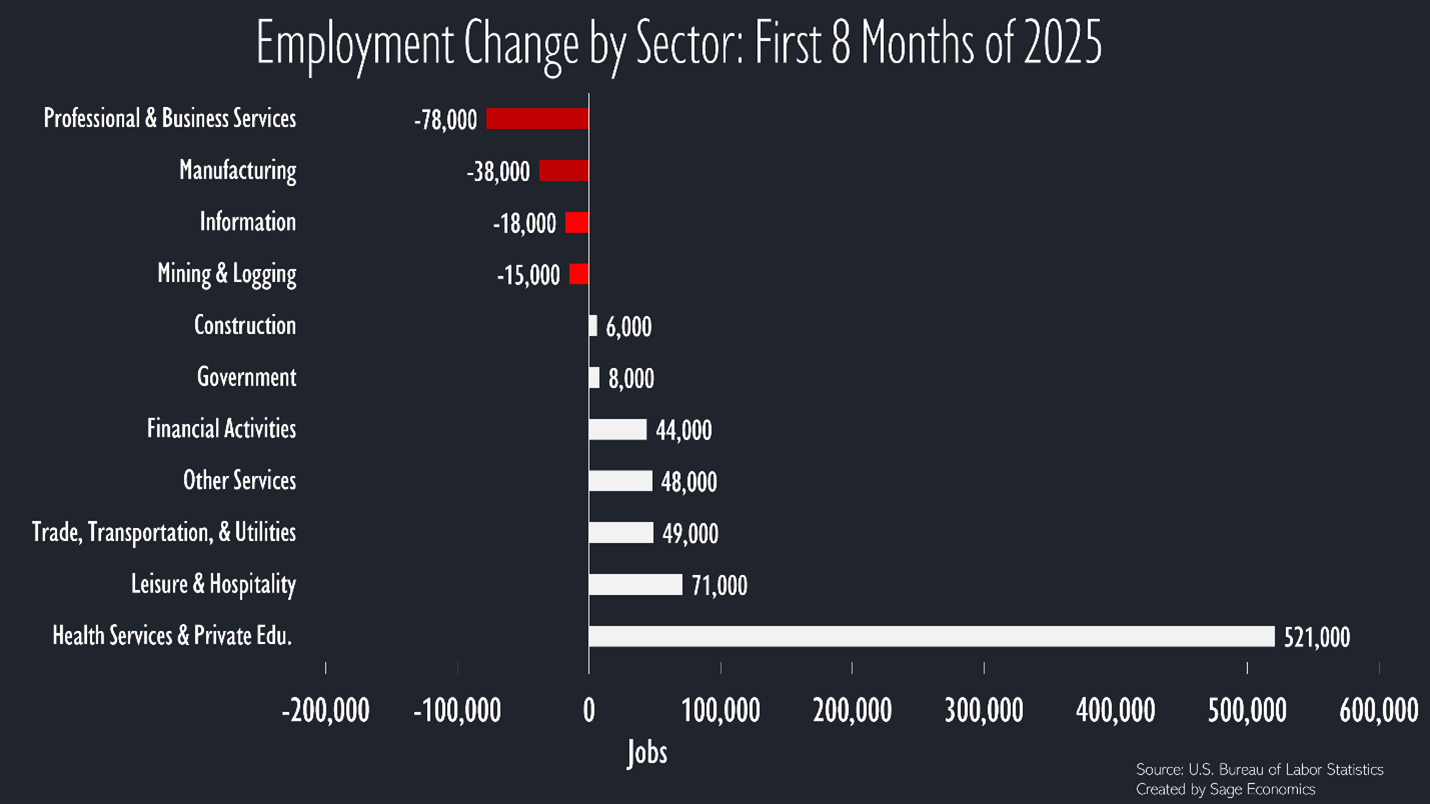

The healthcare segment must have a sore back, because it’s been carrying the rest of the economy for several months now. Notably, healthcare is a noncyclical segment that isn’t effected by broader macroeconomic cycles.

Looking at year-to-date employment change, the healthcare outperformance is even more glaring.

Silver linings?

If we really squint, we might see a few. The labor force participation rate ticked back up to 62.3%. That’s still low, but at least it’s not falling. More importantly, the prime age (25-54) labor force participation rate rose to the highest rate this year.

Average hourly earnings growth has also slowed down a bit, rising by just $0.10 in August. That’s good for inflation, though less good for workers trying to keep up with inflation.

And then there’s the Fed, which will definitely cut rates at their next meeting given the string of dismal jobs data. Markets have responded accordingly, with stocks up and bond yields down as of this writing.

The Upshot

Job growth has slowed, inflation is reaccelerating, and there’s just not much to like about the economy right now, even if recession doesn’t appear particularly imminent.

Anirban is currently working on Week in Review, our every-Friday post that covers everything you need to know about the economy in a breezy, five minute read. That’s just for paying subscribers. If that’s not you and you want it to be, just click the button below: