Job Growth Strong in August

But with a few concerning details

This post is sponsored by Pivot Workforce. I wouldn’t accept a sponsor for this newsletter unless they were 1) a company I know and trust and 2) tackling an important problem like the construction industry's skilled labor shortages. Pivot checks both those boxes. Their goal is to help construction companies get the high-quality talent they need, and they have over three decades of experience staffing difficult-to-fill positions for some of the most recognized names in the construction industry. I urge any contractors struggling to find workers to give Pivot a look.

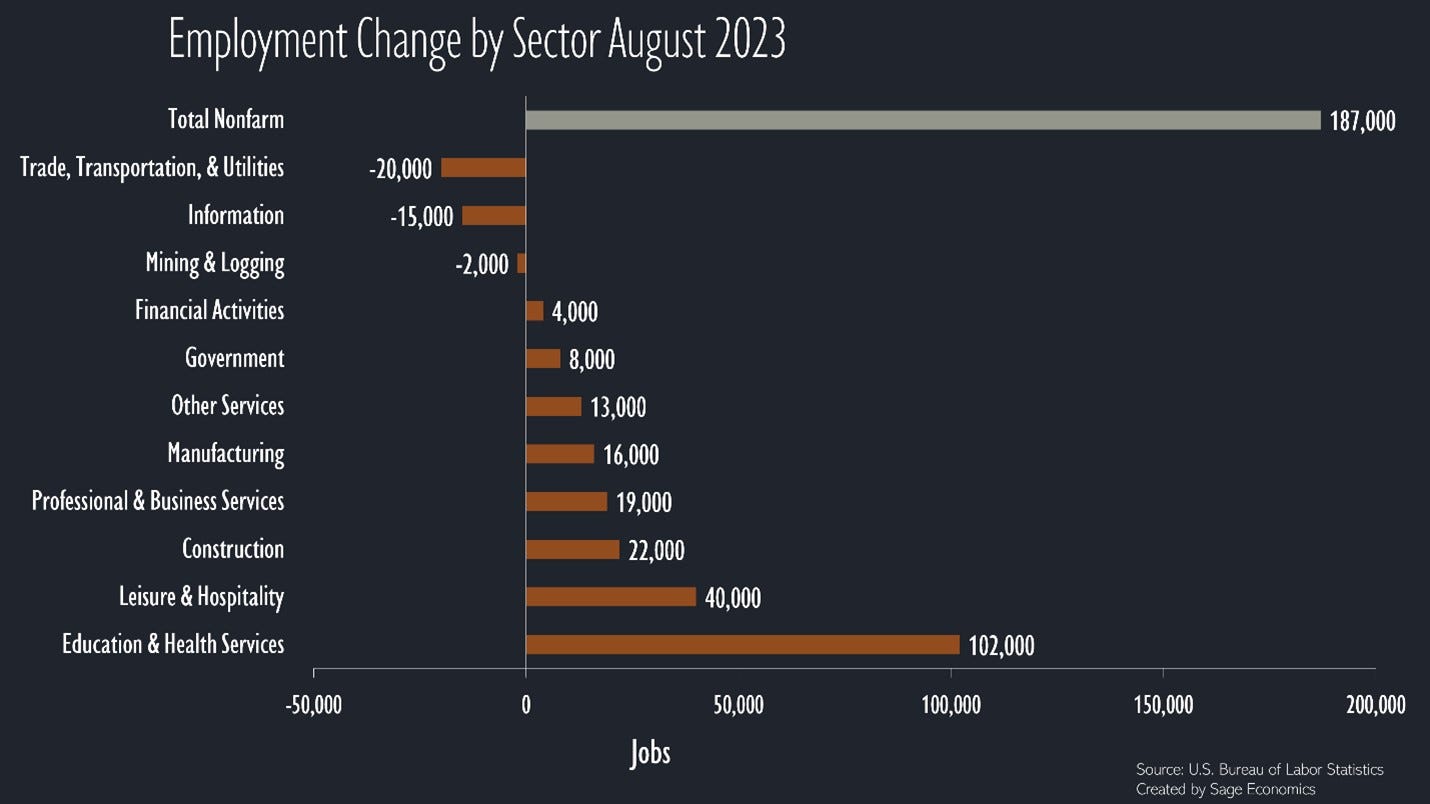

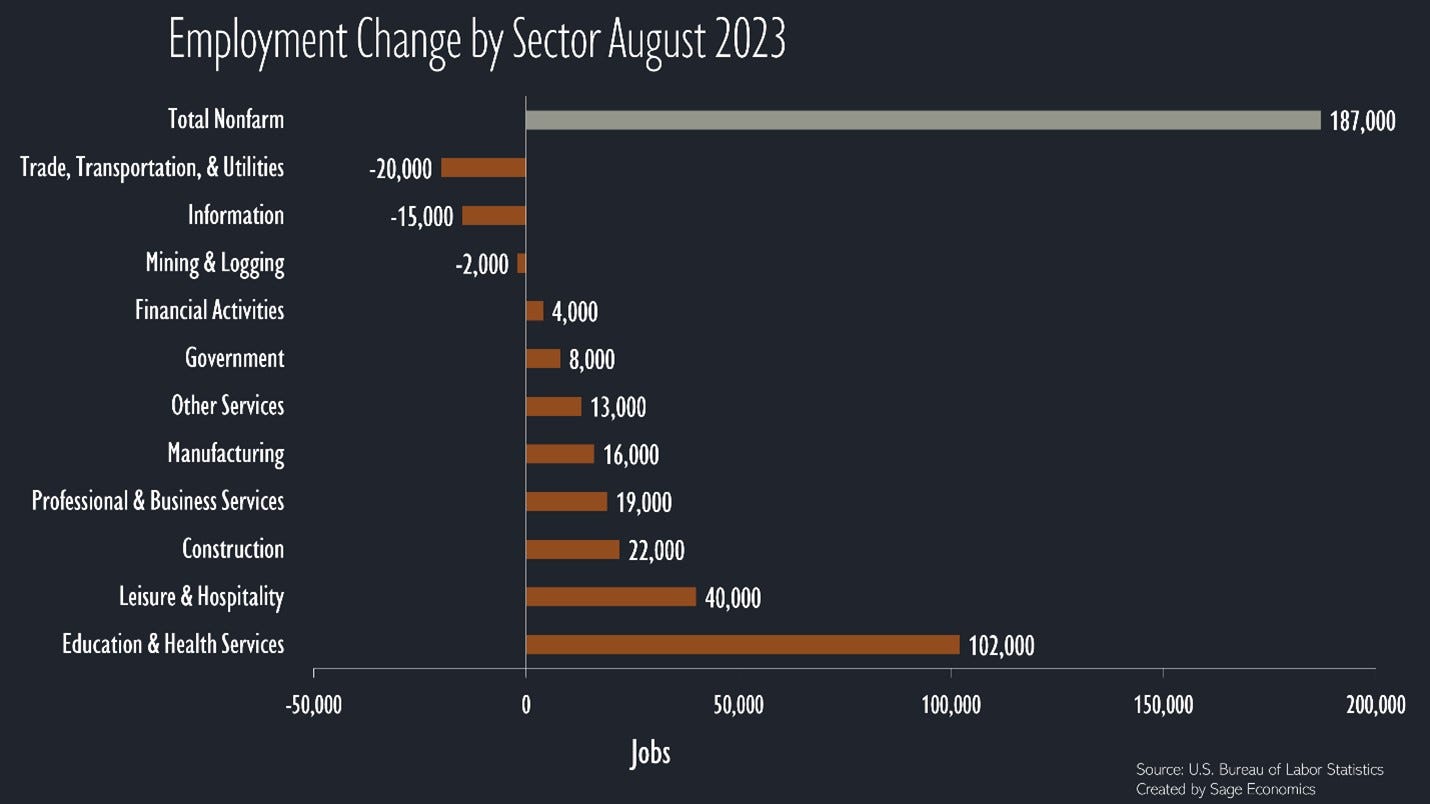

At first glance, today’s jobs data looks just about perfect. U.S. payroll employment increased by 187,000 in August, about 15,000 more than expected, and the unemployment rate jumped to 3.8%, which is still extremely low by historical standards but also the highest rate since February 2022.

If you want a reason to be downbeat, there were pretty chunky downward revisions to the previous months’ job growth numbers; June’s went from +185,000 to +105,000, and July went from +187,000 to +157,000. Collectively, that means we added 110,000 fewer jobs over that two month span than we initially thought.

Taking those revisions into account, job growth has averaged just +150,000 per month this summer, and that’s slightly slower than the pre-pandemic rate of hiring. We knew the economy would eventually slow due to the effects of higher interest rates, and that’s exactly what we’re starting to see.

But we needed job growth to cool down to get inflation under control. The pace of hiring over the past three years has been unsustainable, and that’s led to 1) labor shortages and 2) rapid wage gains that are great for workers but less great for taming inflation. August’s data suggests that both of those problems are improving.

The rise in the unemployment rate was due to a massive 736,000 person increase in the labor force, and that pushed the labor force participation rate up to 62.8%, the highest level since the start of the pandemic.

As a result, average hourly wages increased by just $0.08 in August, the smallest monthly rise over the past year and a half. This will please the Fed and, pending some very surprising developments over the next few weeks, makes another rate hike at their September meeting unlikely.

There were also some unusual circumstances that pushed job growth lower for the month. The bankruptcy of Yellow caused the truck transportation category to lose 37,000 jobs, at least some of which will be regained over the next couple months, and the motion picture and sound recording sector lost 16,800 jobs for the month due to the actors’ and writers’ strikes.

If those sectors had instead remained unchanged for the month, payroll employment would have risen by a robust 240,000 in August.

You can read what Anirban had to say about construction hiring over at ABC.

Final Thoughts

Today’s jobs report had lots of reasons for optimism. The unemployment rate increased because a lot more people are looking for work, wage gains slowed to a pretty ideal level, and job growth came in at what might just be a not-too-hot, not-too-cold, Goldilocks level.

But (and does anything before the “but” really matter?) the pace of hiring has slowed over the past year, and if it continues to trend downward at this rate over the next several months, it’s not out of the question that the economy dips into a shallow recession.

What’s Next

We’ll have Anirban’s Week in Review out for paying subscribers later today. If that’s not you and you want it to be, just click the button below.