Jobs, Manufacturing Data, & Firework Injuries

Week in Review: July 3-7

This week was all about the jobs report (covered at length in our post earlier today), but we also review a Frankenstein veto in Wisconsin, firework stats, and new data on manufacturing, job openings, and more.

Monday

Construction Spending

Construction spending increased in May, up about 1% on a monthly basis and 2.4% year over year. That’s not adjusted for inflation, so on a yearly basis, construction spending is down in real terms.

Residential construction spending posted the largest monthly increase since January 2022 but is still 11% lower than it was one year ago. Over the past year single family construction spending is down 25% while multifamily construction spending is up 20%.

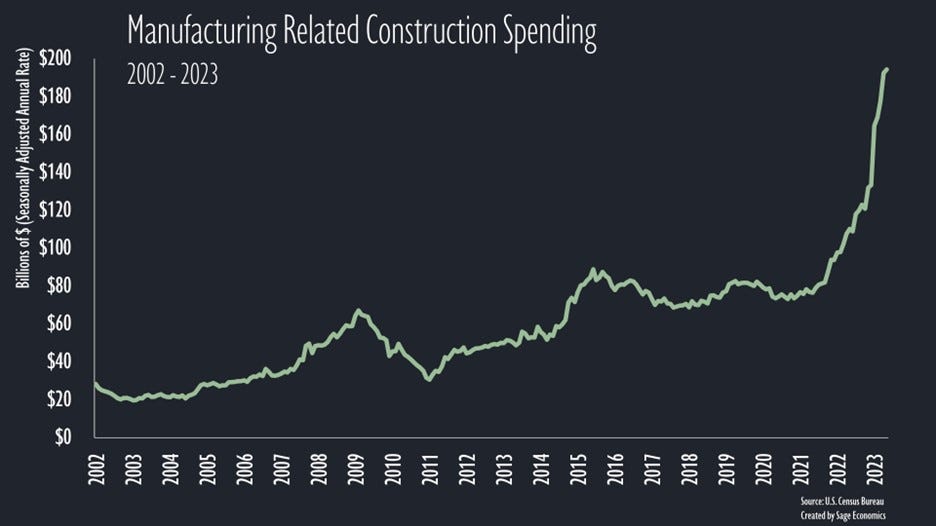

Nonresidential spending was essentially flat for the month and is up 17% year over year. That has everything to do with manufacturing-related construction, which has absolutely exploded, up 154% over the past two years. The CHIPS Act, the (not so accurately named) Inflation Reduction Act, and the movement to bring manufacturing capacity back to the U.S. are working out as well as anyone could have hoped.

But even excluding the ascendant manufacturing sector, nonresidential spending is still up about 9% over the past year. That has a lot to do with infrastructure-related categories, but healthcare and a couple other privately financed categories have also picked up. Again, that’s not accounting for inflation, but even in real terms we’ve seen a modest increase in nonresidential spending. Given interest rates and credit conditions, a modest increase is just fine.

You can read more of what Anirban had to say about this data over at Associated Builders and Contractors.

ISM Manufacturing PMI

The manufacturing sector shrank in June at a faster rate than it did in May and has now contracted in each of the past eight months, according to ISM’s manufacturing survey. That’s the longest contractionary streak since the Great Recession.

This was a pretty downbeat release. Production, employment, inventories, and backlog all decreased for the month. There was one piece of good news: manufacturers input prices decreased for the second straight month, and nearly 90% of panelists said prices were the same or lower than in May.

Gas Prices

Gas prices fell for the third straight week and are $1.24 cheaper per gallon than one year ago.

TSA Checkpoint Travel Numbers

The number of people passing through TSA security during the week ending July 4th was 2.0% higher than during the same week in 2019. On average, more than 2.5 million people have flown each day over the past week.

Tuesday

Independence Day and Fireworks

Last year set a record for fireworks spending, with $400 million in display fireworks revenues and $2.3 billion in consumer fireworks revenues, according to the American Pyrotechnics Association. After adjusting for inflation, though, consumer firework spending was actually lower in 2022 than in 2021, and by pounds, consumer firework purchases have declined in each of the past three years.

That likely explains why firework-related emergency room visits also fell in 2022, down 11% from 2021 and 35% from 2020. Leaving the pyrotechnics to the professionals apparently reduces injuries. Who would have thought?

Finally, the chart of fireworks-related hospital visits by month looks exactly how you’d expect.