Jobs, OPEC, & Ouching Like Hell

Week in Review: Apr. 3-7

Happy Good Friday, to those who celebrate. It was a good week for economic news/data releases (at least in quantity), starting with a surprise OPEC announcement and ending with a solid jobs report.

Monday

OPEC+ Cuts Output

Back in September 2020, Saudi’s energy minister swore that anyone shorting oil prices would be “ouching like hell.” That’s my new favorite curse to wish upon my enemies, and also exactly what happened this week.

On Sunday, OPEC+ announced it’s going to cut production by roughly 100 million barrels per day over the rest of 2023, which amounts to about a 1.0% cut. This had the intended effect (intended by OPEC+, anyway), and oil prices jumped about 7.5% in response to the announcement.

A few things to note here. First, this wasn’t expected. When Biden and the Saudi Crown Prince fist bumped back in July 2022, I thought it meant we were cool. Apparently not.

Second, this sends a message that OPEC isn’t going to let oil prices fall below the $80/barrel mark. It also suggests they’re expecting an economic downturn, which typically causes oil prices to crater, and the recent banking situation might have spooked them.

This probably won’t have that big of an impact on the prices you pay at the pump. OPEC accounts for about 40% of the world’s crude oil and about 60% of total oil exports. A 1.0% cut will put some upward pressure on gas prices, but not a ton.

Back to ouching like hell. That’s what the Biden admin should be doing after dragging their feet on refilling the strategic petroleum reserve, which is currently at its lowest level since 1983. You can read more about that here.

Manufacturing PMIs

We got two different purchasing mangers indices of manufacturing activity, and they both show the industry is contracting. The more popular ISM measure indicates that the economy contracted for the fourth straight month, a pretty sharp reversal after 30 straight months of expansion. The overall reading is now at its lowest level since May 2020 which, if you’ll recall, was not a great month, economically or otherwise. The new orders index posted a particularly sharp decline.

The somewhat less popular S&P measure also shows the manufacturing sector is contracting, but at a slower rate than in February. Supply chain pressures eased, which led to an increase in output, but new orders were still down pretty sharply.

Big picture, the state of the manufacturing sector suggests the economy is slowing down pretty quickly.

Dallas Fed Banking Conditions Survey

This survey of financial institutions in the Dallas fed region (which covers TX and parts of LA and NM) shows that loan values fell pretty sharply and for the fifth period in a row in March (this survey happens twice a quarter).

We usually don’t include banking conditions surveys in our weeks in review, but the loan volume index for this region, which is one of the best performing in the country, is now at levels not seen since early 2020.

Gas Prices

Gas prices increased by about $0.07 during the week ending April 3. That’s the first increase in three weeks and also the largest increase since the last week of January. This doesn’t really reflect the OPEC cuts. Big picture, gas prices are about $0.67 lower than at this time last year.

TSA Checkpoint Travel Numbers

Travel numbers for the week ending 4/4/2023 climbed above 2019 levels, and that hasn’t happened for a couple months. While 2023 traveler numbers have been climbing higher in recent weeks, I’m not convinced this isn’t the result of the timing of spring break.

Construction Spending

Construction spending inched 0.1% lower in February. Residential spending fell 0.6% and continues to trend lower (down 5.5% year over year), while nonresidential spending moved 0.4% higher and is up 16.8% year over year.

Don’t let the aggregate nonresidential numbers fool you; the increased spending is almost entirely because of manufacturing-related construction (if the nonresidential segment was a women’s basketball team, manufacturing would be Caitlin Clark). If we exclude manufacturing, nonresidential spending actually declined in February.

This time last year, the residential sector accounted for 52% of all construction spending. Now, that share has fallen to below 47%. Unsurprisingly, it looks like a 3 percentage point increase in average mortgage rates is not great for the housing industry.

You can read what Anirban had to say about construction spending over at Associated Builders and Contractors.

Tuesday

Job Opening & Labor Turnover Survey (JOLTS)

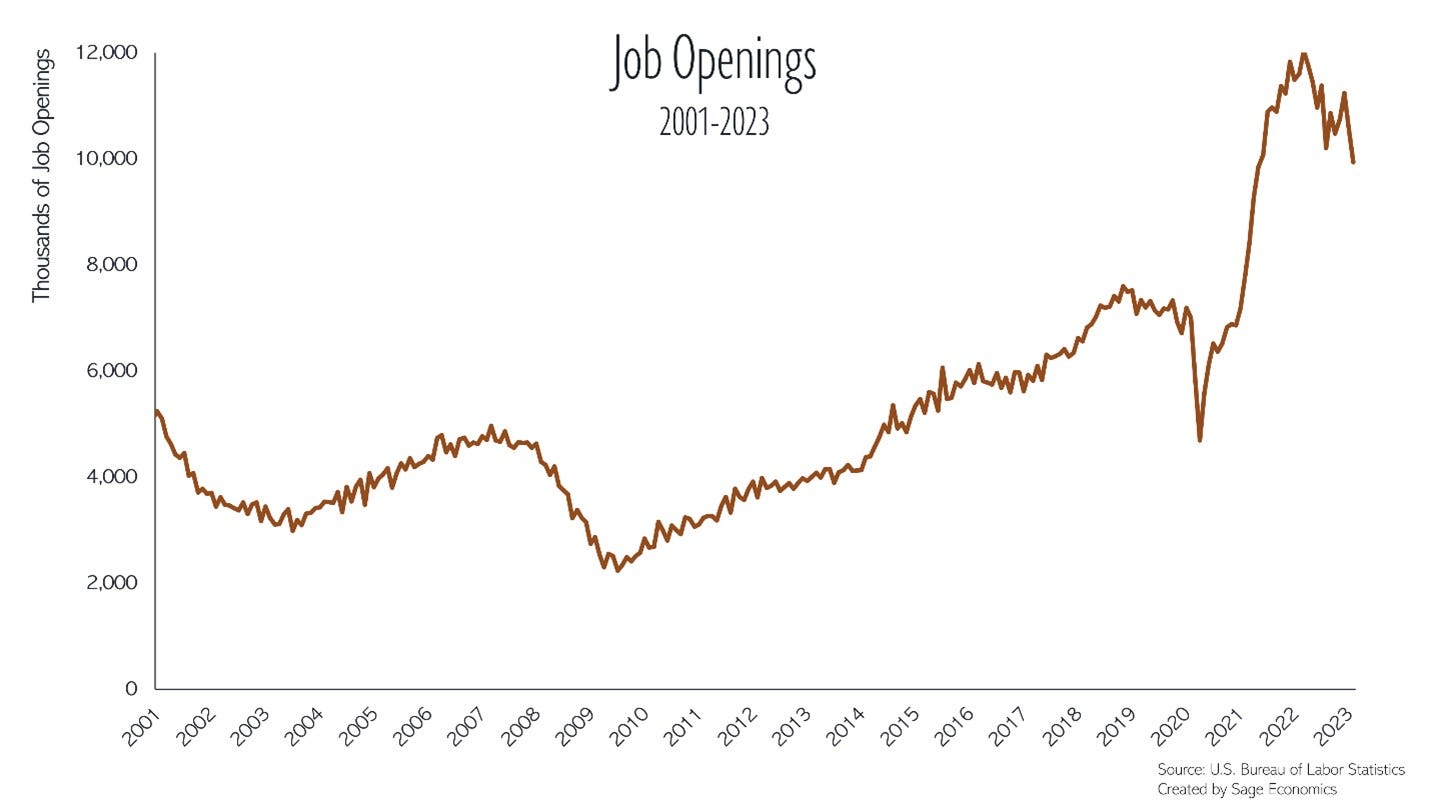

Job openings fell by 632,000 in February and are now at their lowest level since May 2021. Sure, the total number of job openings is still at 9.9 million, well above the 7.0 million in February 2020, but we’re trending in the right direction. Taken alone, this definitely looks like a sign that demand for labor is declining.

The details of this data release are a little less straightforward. First, workers are still quitting their jobs at a really elevated rate, and that only happens in a tight labor market. The quit rate increased to 2.6% in February, higher than at any point between the start of the series in 2000 and March 2021.

Employers are also still really hesitant to lay off workers. The layoff/discharge rate fell to 1.0% in February, lower than at any point before March 2021. Note this graph cuts off the spike in layoffs that happened in March 2020 (when 13 million people were laid off).

The last reason these data are tricky is that they seem to have become increasingly volatile since the start of the pandemic, and the reason for that volatility is probably falling response rates. In February 2020, JOLTS had a response rate of 56.4%. As of December 2022, that’s down to 31.1%.

I’m not saying these are meaningless, but each monthly data point is less important than the trend. The good news here is that the trend is showing a steady decrease in job openings.