This post is sponsored by Pivot Workforce. I wouldn’t accept a sponsor for this newsletter unless they were 1) a company I know and trust and 2) tackling an important problem like the construction industry's skilled labor shortages. Pivot checks both those boxes. Their goal is to help construction companies get the high-quality talent they need, and they have over three decades of experience staffing difficult-to-fill positions for some of the most recognized names in the construction industry. I urge any contractors struggling to find workers to give Pivot a look.

If you’re interested in sponsoring a post on Sage Economics, just shoot Zack an email at Zfritz@sagepolicy.com

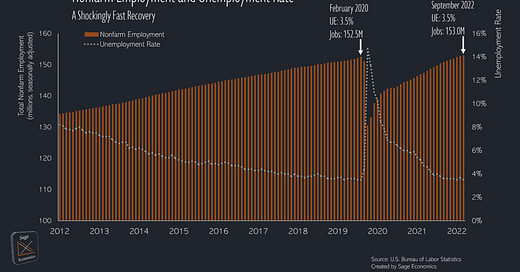

For about a year, we’ve been waiting for labor market momentum to stall. Well, folks, we’re still waiting, because payroll employment increased by 263,000 jobs in September, slightly higher than the consensus estimate of 250,000, according to today’s jobs report.

The unemployment rate fell to 3.5%, matching its lowest level since the late 1960s. The labor force declined by 57,000 people for the month and remains just barely above February 2020 levels, and the number of unemployed Americans fell by 261,000 for the month. That’s great news, right? We love it when people don’t suffer joblessness. But right now, we’re rooting for bad news so we can get out of this wage-price spiral and back to 2% inflation.

The labor market is still way too hot, with demand for labor too high and the labor supply too low. Oh, I know what you’re thinking. The number of available, unfilled jobs fell to 10.1 million in August, down about a million from July. But 10 million job openings is still way more than what we observed pre-pandemic. At that time, the economy was fabulous, and job openings totaled a modest 7 million.

What’s that? Oh, you have more to say? Well let’s hear it. The 263,000 net new jobs added in September represented the smallest tally since April 2021? Ok, that’s true, but it’s still an impressive monthly total. From early-2015 to February 2020, U.S. payrolls averaged 196,000 new jobs/month, and that was a pretty strong period of job growth by historical standards.

The upshot: this all but ensures a 75-basis point rate hike in November, and rates will keep rising until economic momentum falters. Here we are waiting for the economy to collapse and for millions of people to lose their jobs. Alas, it can be a nasty and brutish world.

The best news in this report is that average hourly earnings only increased 0.3% in September. The 5.0% year-over-year increase is the smallest since December 2021. At an annualized rate, wages grew 4.4% during 2022’s third quarter, meaningfully slower that during the prior three quarters.

There are also some signs of waning consumer demand. The retail sector lost 1,100 jobs for the month. Employment in the transportation and warehousing sector declined by 7,900 jobs. Attention Walmart shoppers, we have excess inventory on aisle 3. The deconstruction of the pandemic-era recovery has begun, but we’re only seeing the tip of the proverbial iceberg.

As always, you can read my in-depth thoughts regarding the construction industry’s labor market at Associated Builders and Contractors.

Three (somewhat) Key Takeaways

Total employment is 514,000 higher than in February 2020. We’re back baby! But will employment decline during the year to come?

Women now account for 49.9% of all nonfarm jobs, up from 49.8% in August. This is still below the pre-pandemic level of exactly 50%.

The Leisure and Hospitality sector added 83,000 jobs in September, but still supports 1.1 million fewer jobs than in February 2020.

What to Watch

Inflation, obviously. Next week we get updated Producer Price Index and Consumer Price Index data.

Want to Hear Me Speak Live?

Of course you do. My 2022 presentation is called No Time to Buy, and yes, the theme is James Bond. If you want to book a presentation (in person or virtual), please contact my assistant Julia (jcomer@sagepolicy.com).

This whole thought that more unemployed people will help curb inflation is mind-boggling. Why do we want to reduce the number of people who are participating in the workforce? Wouldn't it be better to concentrate on making our workforce more productive to reduce inflation? If we are more productive, wouldn't that reduce the cost of things?

What do people do when they become unemployed? Do they stop buying things?

Anirban-- so if we fast tracked some LEGAL immigrants to help out with childcare/service industry jobs, what effect would that have on inflation? the economy in general?