Labor Force Grows Heading into Labor Day Weekend

August 2022 Jobs Report

This post is sponsored by Pivot Workforce. I wouldn’t accept a sponsor for this newsletter unless they were 1) a company I know and trust and 2) tackling an important problem like the construction industry's skilled labor shortages. Pivot checks both those boxes. Their goal is to help construction companies get the high-quality talent they need, and they have over three decades of experience staffing difficult-to-fill positions for some of the most recognized names in the construction industry. I urge any contractors struggling to find workers to give Pivot a look.

So this is when Gen X cynicism meets Millennial optimism. From Zack’s perspective, today’s jobs report is “about as good as it gets. Job growth remained strong, but not too strong, with 315,000 new positions added in August. More importantly, there are signs that labor market tightness eased in August; the unemployment rate rose to 3.7% (a higher unemployment rate is good when labor is scarce), the labor force grew by nearly 800,000 people, and the labor force participation rate (62.4%) climbed to its highest level since March 2022. Jerome Powell will be pleased.”

I, Gen X economist Anirban Basu, view things a bit differently. I actually don’t disagree much with Zack about the headline numbers, I just have a tendency to consider a broad context. First of all, never make too much out of one month’s data. I say this for statistical reasons, but also because this jobs report was for August. While it is true that overall labor force participation expanded, a meaningful fraction of that growth transpired among those of college-age and those over the age of 65. That could easily reverse itself as some of these people go back to school and some of those seasonal summer jobs disappear.

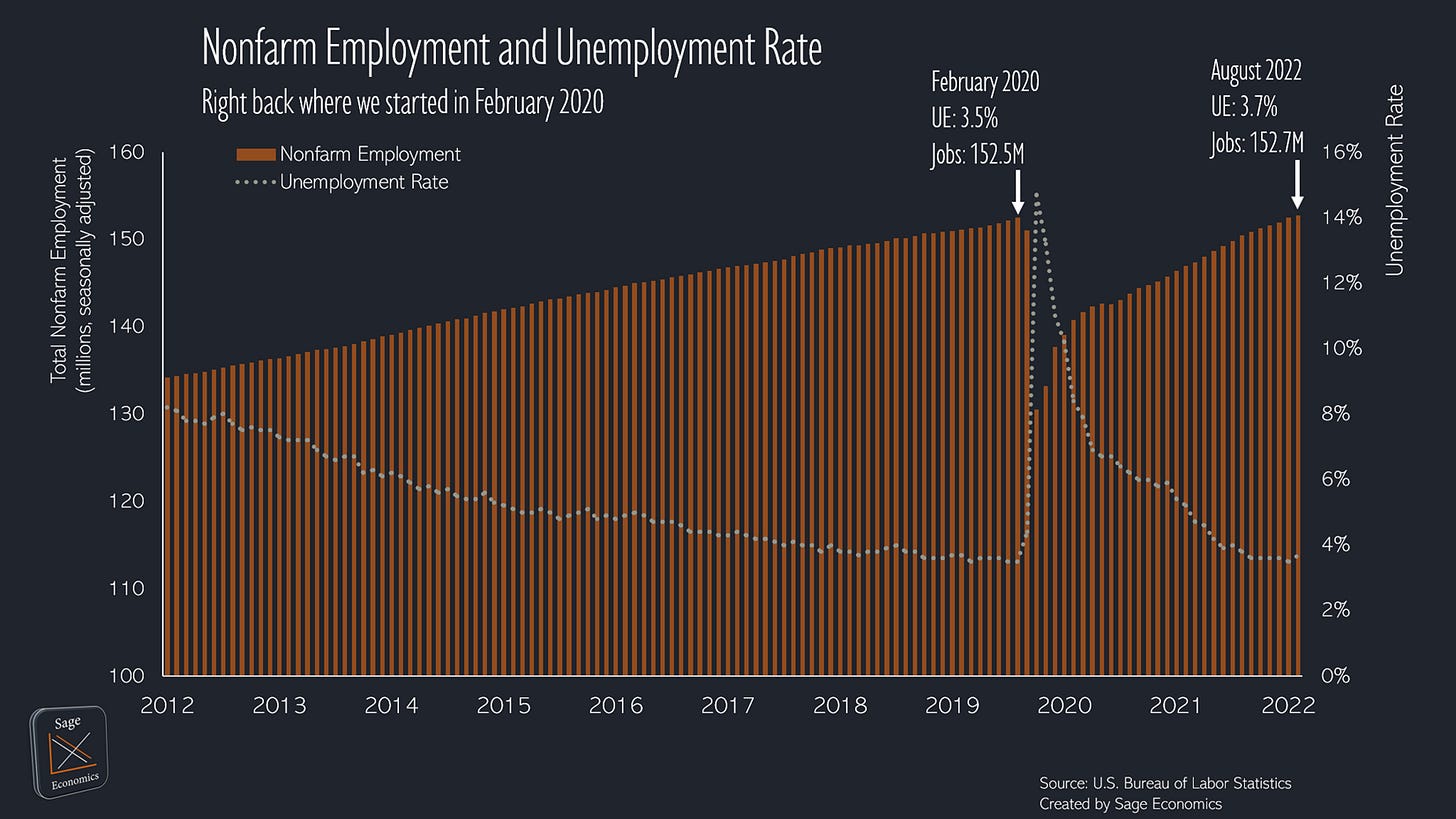

Second, today’s labor force participation numbers simply reverse some of my earlier disappointment. With inflation elevated for the last year and a half, I had thought that more people would have joined to labor market not for love of work (see quiet quitting, the latest fad) but because they had bigger bills to pay. Indeed, labor force participation has climbed from 61.7% in April 2021 to 62.4% in August. But it hasn’t expanded by nearly as much as I thought it would, and in absolute numbers, America’s labor force is barely larger than it was at the start of the pandemic. And let’s keep in mind that productivity (output per hour worked) is down this year.

Third, I don’t care much for or about Jerome Powell. He helped get us into this mess in the first place.

What’s more, there was some bad news coming out of the report. Here’s what Zack says: “If you really want something to feel bad about, June and July’s job growth estimates were revised down by a combined 107,000 positions. But really, that’s nitpicking, because we’re still averaging 380,000 new jobs per month since June and 440,000 new jobs per month in 2022. There are reasons to gripe about the economy at the moment, but job growth isn’t one of them.”

So despite employers raising wages massively (especially at entry levels) and posting job openings in the millions, we just reached full employment recovery in August. We thought we already did that in July, but we get to say it again because of the downward revisions to job estimates for earlier months.

In many ways, the job market is right back where it started in February 2020. The unemployment rate is 0.2 pp higher (3.7% v. 3.5%), about 240,000 more people have jobs, and about 165,000 more people are in the labor force.

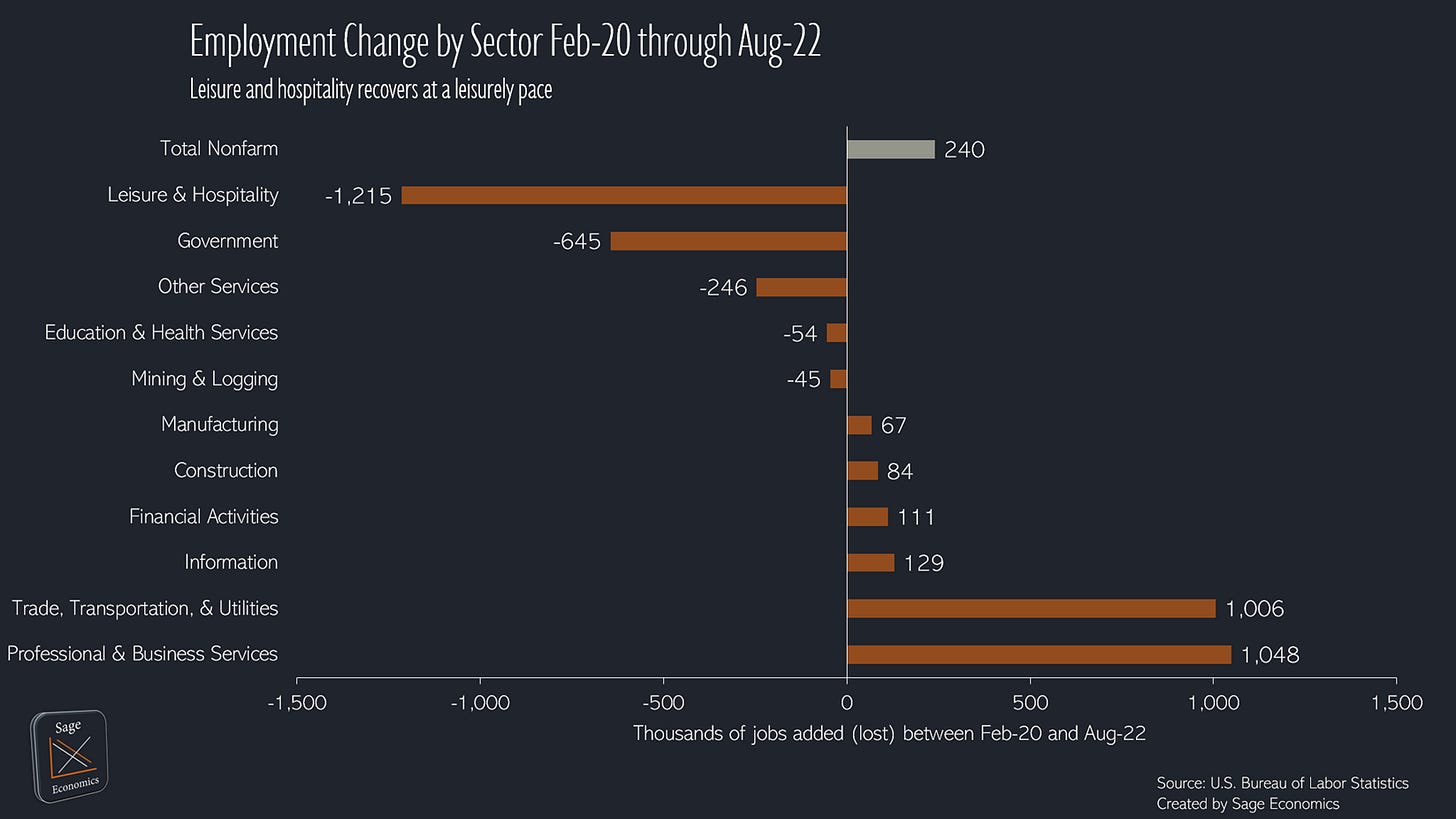

What’s different between now and February 2020? The sectoral composition of the economy. The leisure and hospitality segment (think restaurants and hotels) is still down about 1.2 million jobs from February 2020, and government employment is down about 650,000 (we’ll make that up with IRS agents—fantastic). The professional and business services (think remote work) and the trade, transportation, and utilities (think supply chain) segments, on the other hand, have each added more than 1 million jobs since the start of the pandemic.

As a final note, wage growth moderated slightly in August, with average hourly earnings up $0.10. In percentage terms, the 0.3% monthly wage growth is the same as the average monthly wage growth for August from 2013 to 2019.

Overall, this report doesn’t change the Fed’s stance on rate increases, but it’s a move in the right direction. The perfect scenario is job growth moderates to some semblance of its pre-pandemic level, the unemployment rate ticks up but stays low by historical norms, the labor force keeps expanding, and the demand for workers falls back to early-2020 levels.

As always, you can read my in-depth thoughts regarding the construction industry’s labor market at Associated Builders and Contractors.

Three (somewhat) Key Takeaways

Foreign born men (78.2%) participate in the labor force at a much higher rate than native born men (66.0%), while native born women (57.4%) participate in the labor force at a slightly higher rate than foreign born women (55.4%).

The number of Americans in the labor force aged 25+ with less than a high school diploma declined by approximately 280,000 in August. All other education levels experienced increasing labor force participation.

From August 2021 to August 2022, the number of unemployed veterans has fallen by 31.7%.

What to Watch

Inflation, but also retail spending. So far, consumers have kept spending despite higher prices and incredibly dour economic sentiment. How long will that persist?

We’ll send out our Week in Review column later today. That’s just for paid subscribers. If you want that to be you, click the button below. If you don’t, no worries! You’ll still get a free preview.

Sounds like native born men are being lazy compared to the foreign born men. Let's get some more LEGAL foreign born men into our country. More work visas.