Labor market weakens, not quite weak

August 2024 Jobs Report

This post is sponsored by Pivot Workforce. I wouldn’t accept a sponsor for this newsletter unless they were 1) a company I know and trust and 2) tackling an important problem like the construction industry's skilled labor shortages. Pivot checks both those boxes. Their goal is to help construction companies get the high-quality talent they need, and they have over three decades of experience staffing difficult-to-fill positions for some of the most recognized names in the construction industry. I urge any contractors struggling to find workers to give Pivot a look.

U.S. employers added 142,000 jobs in August, which is slightly fewer than expected. Perhaps more importantly, the previous two months’ estimates were revised down by a total of 86,000 jobs.

We’ve added just 116,000 new jobs per month since June, the lowest 3-month average since June 2020 (a particularly bad time for the economy, if you’ll recall).

As you can see below, hiring has slowed considerably since the end of March.

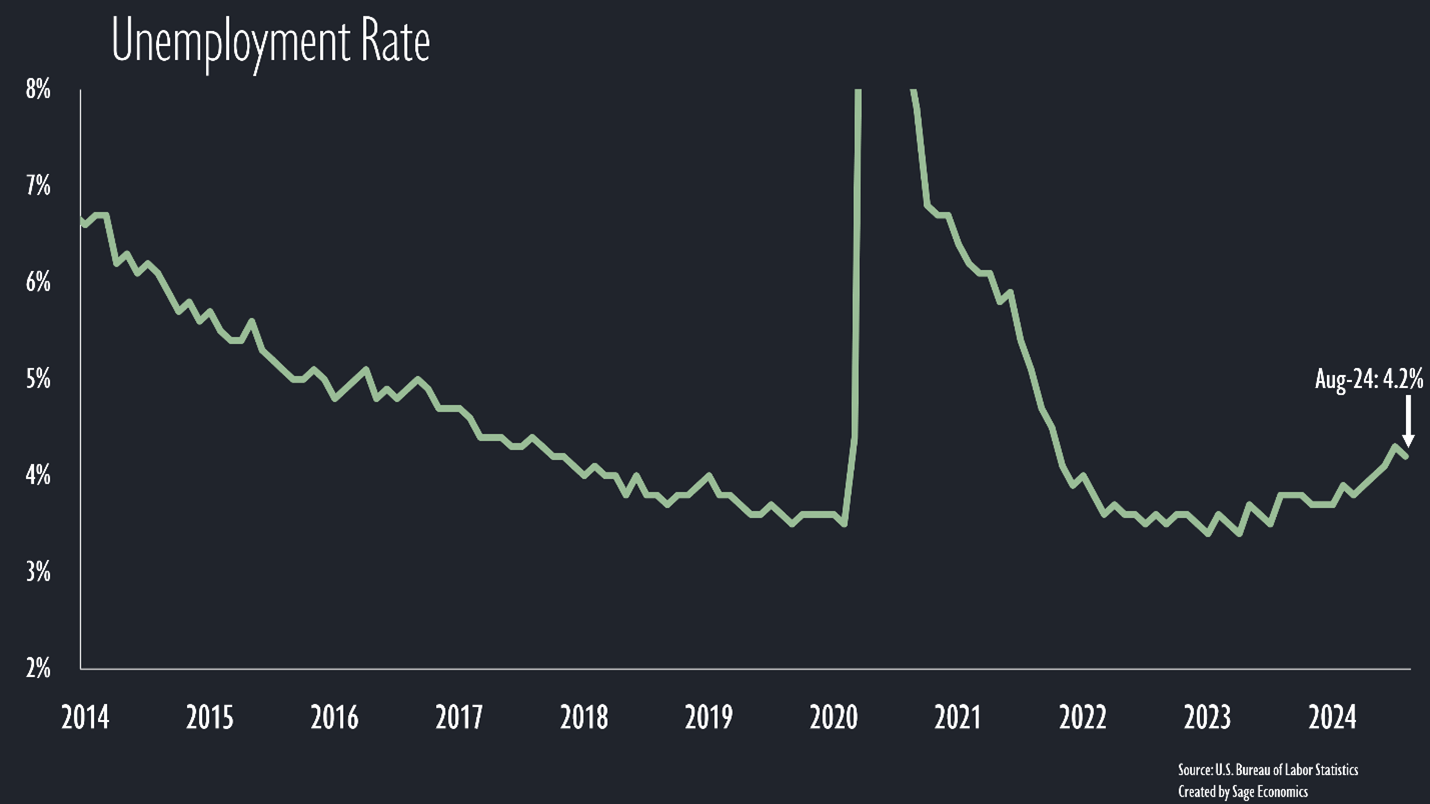

The unemployment rate inched down from 4.3% in July to 4.2% in August, and it fell for the right reasons; unemployment declined, employment increased.

Without rounding, though, it was a pretty small drop—from 4.25% to 4.22%. Even with the monthly decline, the unemployment rate has clearly trended higher over the past year or so.

The labor force expanded for the third straight month, though only modestly, and the labor force participation rate was unchanged at 62.7%. That matches a post-pandemic high but is still about half a percentage point above the late 2019 level.

The best news in this otherwise pretty downbeat report is that the prime age (25-54) employment to population ratio stayed put at 80.9%. That matches the highest level since 2001. People want and have jobs right now.

By Sector

August was a tough month for the manufacturing sector. The transportation manufacturing segment accounted for about half of the 24,000 decrease in employment, and I assume some of that was related to automakers temporarily ceasing operations as they retool plants. Even so, it’s just not a good time for the goods producing side of the economy.

The information sector (think media and tech) also shed jobs for the month, with the entirety of those losses in two subsegments: motion picture and sound recording and broadcasting and content providers.

Health services and leisure and hospitality continue to lead the way in terms of job growth. Construction employment also posted a strong increase in August, and you can read Anirban’s thoughts on that over at Associated Builders and Contractors.

What Do we Take From This?

The labor market isn’t weak, but it has clearly weakened over the past couple of months. Job growth has slowed. The unemployment rate has risen.

There’s no question that the Fed is going to cut rates at their September meeting. There is a question about whether it will be a 0.25 or 0.50 percentage point cut, and I think this jobs report pushes the needle slightly toward 0.50.

What’s next?

Anirban is currently working on Week in Review, our every Friday post where we concisely cover everything you need to know about the economy. We’ll have that out in the next couple hours. That’s just for paying subscribers. If that’s not you and you want it to be, just click the button below: