Litigated Week in Review

Tariffs take to the courts, CEO confidence, & more

This week introduced us to the newest character in the ongoing tariff saga: the U.S. Court System. On the economic data front, we got updates on inflation, consumer and CEO confidence, a few housing stats, durable goods orders, and more.

Monday

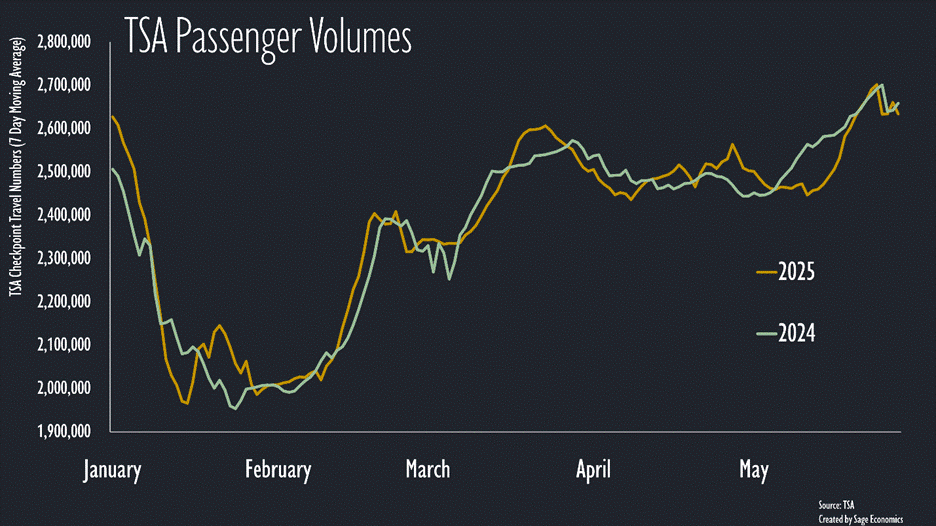

TSA Checkpoint Travel Numbers

Air travel continues to trend right about in line with 2024 levels, according to TSA data, with a strong surge in Memorial Day travel. While I’d prefer to see air travel trending above year-ago levels, there’s nothing here that makes me think consumers are running out of steam.

Tuesday

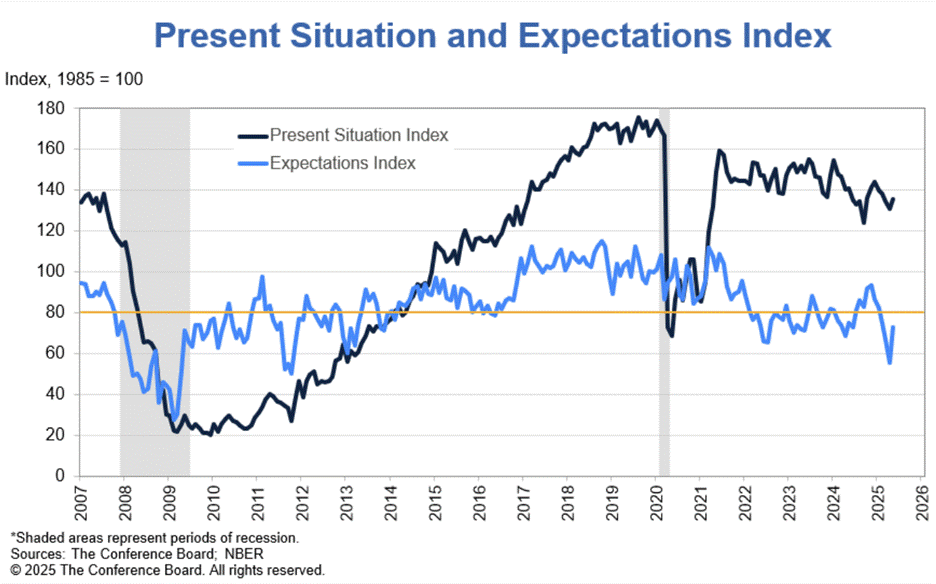

Conference Board Consumer Confidence Index

This measure of consumer sentiment rebounded in May but remains well below late 2024 levels. The decline over the past few months is due to bad expectations for the future rather than a bad assessment of the current situation. If the court ruling banning most of the “reciprocal” tariffs remains in place, I expect this will increase rapidly in June.

Durable Goods Orders

New orders for durable goods (things that last at least three years) fell sharply in April after surging in March, when buyers raced to beat tariffs. Durable goods sales will likely remain volatile over the next couple of months (or longer, if we don’t get clarity on trade policy).

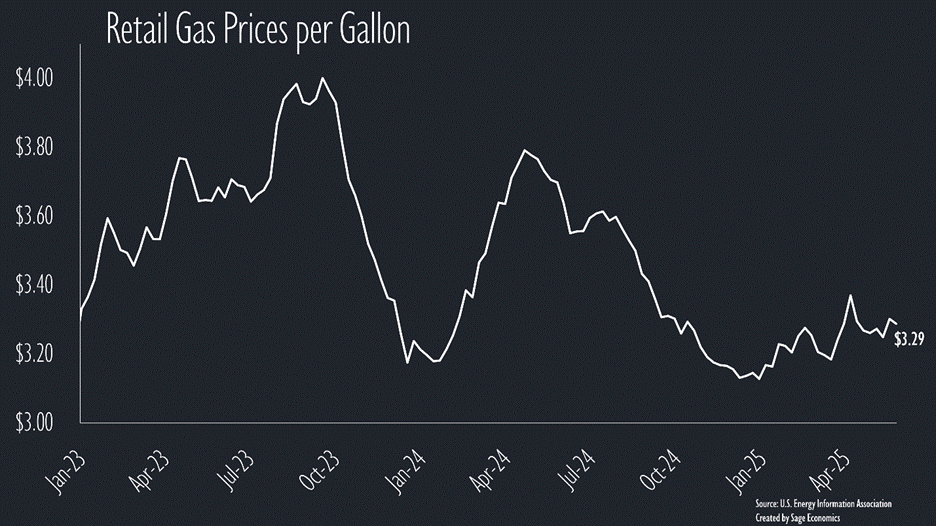

Gas Prices & Diesel Prices

Gas prices inched down to $3.29/gallon this week. That’s $0.41/gallon cheaper than at the same time last year. Low oil prices might be bad for domestic production, but they’re great for domestic drivers.

Diesel prices fell to a pretty low $3.49/gallon.